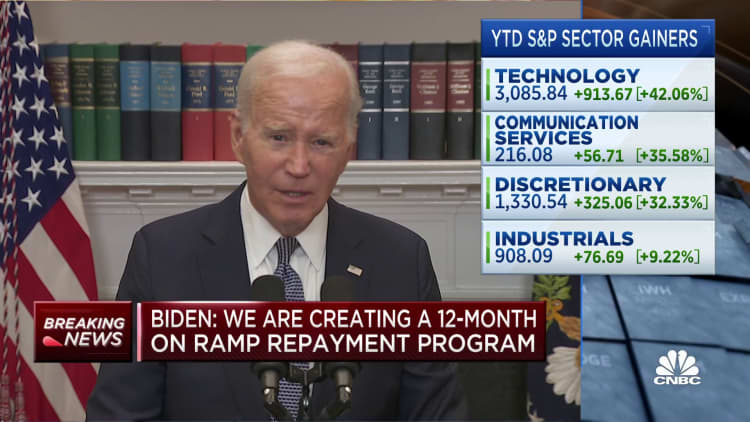

President Joe Biden speaks at the White House on June 30, 2023.

Bloomberg | Bloomberg | Getty Images

After the Supreme Court struck down President Joe Biden’s original student loan forgiveness plan, Biden said he would pursue a new path to deliver relief to holders of federal educational debt.

This second attempt may leave more people out.

“Borrowers should avoid getting their hopes up for forgiveness,” said higher education expert Mark Kantrowitz.

At the end of June, the high court justices ruled that the executive branch didn’t have the authority to widely cancel people’s debts.

More from Personal Finance:

New, used EV prices have dropped, but don’t rush to buy

Long Covid has led to financial hardship for patients

Don’t keep your job loss a secret — here’s how to talk about it

As a result, the Biden administration may now try to narrow the reach of the aid, experts say.

“That would be easier to justify in front of a court that is skeptical of broad authority,” said Luke Herrine, assistant professor of law at the University of Alabama.

Abdullah Hasan, a White House spokesman, said it was premature to speculate who will or won’t benefit from the president’s program, which “still has to go through an entire regulatory process.”

“As the president said, he’ll be fighting to get relief to as many borrowers as possible, as quickly as possible,” Hasan said.

First plan excluded a small share of borrowers

At an estimated cost of about $400 billion, Biden’s first student loan forgiveness plan would have been among the most expensive executive actions in history. Around 37 million people were slated to benefit.

Just a small share of borrowers were excluded.

In terms of income, only those who earned more than $125,000 per year, or married couples making over $250,000, were left out. The vast majority of people with student debt fall under those thresholds.

Biden officials were also looking at earning years 2020 and 2021, when many people saw their income take a hit because of the coronavirus pandemic.

In the end, the Supreme Court rejected the Biden administration’s argument that its sweeping aid was a necessary measure amid a national emergency.

″’Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?'” wrote Chief Justice John Roberts in the majority opinion for Biden v. Nebraska, referring to U.S. Secretary of Education Miguel Cardona. “We can’t believe the answer would be yes.”

Only those struggling the most may be eligible

In an effort to avoid another failure at the Supreme Court, Biden may look to cancel debt only for people in distressed financial situations, according to Herrine.

“Not sort of broadly for everyone under a certain income level, but for those who’ve been paying for too long, or with a repeated default,” he said.

A quarter of federal student loan borrowers — or more than 10 million people — were in delinquency or default before the pandemic, noted Kantrowitz.

And there is another reason fewer people may qualify this round.

Unlike Biden’s first attempt to forgive student debt quickly through an executive order, this time he’s turning to the rulemaking process. That route can come with more limitations, Kantrowitz said.

“Biden’s plan for student loan forgiveness may need to be scaled back to comply with statutory restrictions,” he said.

For example, it may turn out that only borrowers who can demonstrate they won’t be able to repay their student debt in a reasonable amount of time will be eligible.

“It remains to be seen what approach they take and whether it will survive the court challenges,” Kantrowitz said.