ROBS: Using Retirement Funds To Start a Business — Benefits, Risks, and Key Considerations

We may earn from vendors via affiliate links or sponsorships. This might affect product placement on our site, but not the content of our reviews. See our Terms of Use for details.

Rollovers as Business Startups, also known as rollovers for business startups or ROBS, is an arrangement that lets you use your retirement savings to launch or purchase a business without taking on debt. While it provides access to capital without loan repayments, it comes with strict compliance requirements and potential risks. We’ll explore how ROBS works, its benefits, drawbacks, and costs, and whether it’s right for you.

Key takeaways:

|

How a ROBS structure works

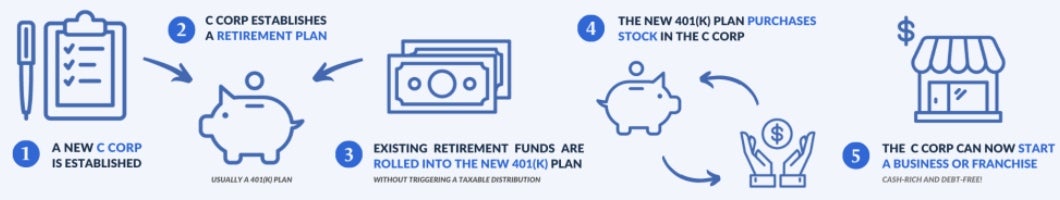

ROBS works by rolling funds from your personal retirement account into a newly created C-corp’s retirement plan, which then purchases stock in the company. This provides your business with capital, similar to how publicly traded companies raise funds through stock sales.

To successfully utilize a ROBS arrangement, you must follow a structured process to ensure compliance with IRS and DOL regulations. While it can be a powerful financing tool, it requires careful execution to avoid legal and tax complications.

Here is how to set up and use a ROBS transaction.

- Step 1: Establish a C-corp. A new C-corp must be created because ROBS relies on the sale of QES, which only a C-corp can issue. Other business structures — such as LLCs, S-corps, and sole proprietorships — do not qualify.

- Step 2: Create a retirement plan under the C-corp. The C-corp must establish a retirement plan, typically a 401(k), though options like defined benefit or profit-sharing plans may be available. This plan will be used to facilitate the rollover of funds.

- Step 3: Choose a custodian and rollover funds from personal retirement accounts to the C-corp’s plan. A plan custodian, such as Guidant Financial, must be selected to manage investments and handle administrative tasks, including tax reporting and participant account management.

You, as the business owner, will then transfer funds from an existing eligible retirement account (e.g., a 401(k) or traditional IRA) into the newly created C-corp retirement plan. This step is tax and penalty-free because it is a rollover, not a withdrawal.

- Step 4: Use the C-corp’s plan to purchase stock in the company. The newly funded retirement plan purchases stock in the C-corp through a QES transaction. This allows your business to access the rolled-over retirement funds as working capital.

- Step 5: Use the available funds for business purposes. Once the QES transaction is complete, the business can use the funds for operational expenses, such as purchasing equipment, leasing office space, paying franchise fees, and hiring employees. To remain compliant with IRS and DOL regulations, the funds must be used strictly for business-related expenses.

ROBS compliance requirements

Establishing and maintaining a ROBS arrangement requires strict adherence to several compliance requirements to meet IRS and DOL regulations. Key obligations include:

- C-corp structure: The business must be established as a C-corp, as only this structure permits the issuance of QES necessary for ROBS.

- 401(k) plan establishment and maintenance: A new 401(k) retirement plan must be created within the C-corp. This plan should be compliant with ERISA? and the Internal Revenue Code, ensuring all eligible employees can participate.

- Annual filing of IRS Form 5500: The C-corp must file Form 5500 annually, detailing the plan’s financial condition, investments, and operations. This includes reporting the valuation of the 401(k) plan’s assets, notably the company’s stock held by the plan.

- Annual business valuation: An independent annual valuation of the C-corp’s stock is necessary to determine the fair market value (FMV) of the shares held by the retirement plan. This valuation supports accurate reporting on Form 5500 and ensures compliance with IRS regulations.

- Fidelity bond acquisition: As the plan trustee, the business owner must obtain an ERISA fidelity bond. This bond protects the retirement plan against losses caused by acts of fraud or dishonesty.

- Payroll and compensation compliance: The business owner must be an active employee of the C-corp, receiving reasonable compensation through the company’s payroll system. This includes making regular payroll tax payments and ensuring that 401(k) plan contributions are properly managed.

- Offering benefits to eligible employees: The 401(k) plan must be nondiscriminatory, offering benefits to all eligible employees who meet the plan’s criteria, typically those working over 1,000 hours per year. This may involve making employer contributions, such as safe harbor matching, to ensure compliance with ERISA guidelines.

- Corporate tax filings: As a C-corp, the business is required to file federal and state corporate tax returns annually, adhering to all applicable tax laws and deadlines.

| Maintaining strict compliance with these requirements is essential to preserve the tax-deferred status of the retirement funds and to avoid potential legal issues. Due to the complexity of ROBS arrangements, it is advisable to consult with financial and legal professionals experienced in this area to ensure all obligations are met appropriately. |

Pros and cons of a ROBS structure

| Pros | Cons |

|---|---|

| Has no debt or interest payments. Unlike traditional loans, ROBS allows you to fund your business without taking on debt or making monthly loan payments. | Comes with a risk to retirement savings. If the business fails, you risk losing the retirement funds invested, potentially jeopardizing your financial future. |

| Lets you avoid early withdrawal penalties. Since ROBS is a rollover, not a withdrawal, you can access retirement funds without paying the usual 10% early withdrawal penalty or income taxes. | Requires you to operate as a C-corp. This may lead to double taxation on profits and dividends and having to hold annual shareholder meetings and adhere to specific tax filing requirements, often necessitating professional legal and accounting assistance. |

| Has a potential for higher returns. If the business is successful, the value of the company’s stock in the retirement plan can grow, potentially increasing your retirement savings over time. | Means complex legal and tax compliance. ROBS transactions are heavily regulated by the IRS and DOL, requiring strict compliance to avoid penalties or disqualification. |

| Enables you to retain full ownership. Unlike equity financing, ROBS allows you to maintain complete control over your business without giving up shares to investors. | Has high setup and maintenance costs. Establishing ROBS typically costs anywhere from $3,000 to $5,000 upfront, with ongoing administrative fees of $100 to $200 per month. |

| Offers flexible use of funds. Once the funds are rolled over, they can be used for nearly any business-related expense, such as payroll, equipment, real estate, and operating costs. | Is an ongoing administrative burden. It requires continuous oversight, including annual filings, compliance with ERISA regulations, and potential audits from the IRS or DOL. |

When ROBS is right for your business

ROBS can offer accessible and flexible financing, especially if you are in the early stages of business development. By leveraging personal retirement funds, you can infuse capital into your ventures without incurring debt or affecting your credit score.

It is particularly advantageous if you do not qualify for traditional business loans due to limited credit history or insufficient collateral. However, it’s essential to assess your financial situation carefully, as ROBS requires a significant amount of retirement savings and involves specific compliance obligations.

| Consulting with a financial advisor or a ROBS specialist can help determine if this financing method aligns with your business goals and personal financial plans. |

Prohibited uses of ROBS

Strict compliance with IRS and DOL regulations is essential to avoid prohibited transactions that could lead to severe tax consequences.

- Personal use of business assets: Business assets acquired through ROBS funding must be used exclusively for business purposes. Personal use by the owner or their family members is strictly prohibited. For instance, leasing or renting business property to disqualified persons, such as immediate family members, can trigger prohibited transaction rules.

- Engaging with disqualified persons: Transactions between the business and disqualified persons — including the owner, their spouse, lineal descendants, and entities they control — are not allowed. This includes leasing, lending, or renting corporate assets to or from these individuals or entities.

- Noncorporate business structures: ROBS arrangements require the establishment of a C-corp. Using ROBS funds in business structures like LLCs, S-corps, or sole proprietorships is prohibited, as these entities cannot issue the qualifying employer securities necessary for the ROBS structure.

- Failure to operate the business: The business funded through ROBS must be an active, operating company. Passive investments, such as purchasing rental properties without active involvement in management, do not meet the operational requirements and are prohibited.

- Discriminatory employee benefits: The retirement plan established under ROBS must offer benefits to all eligible employees and cannot favor highly compensated individuals or the business owner. Failing to provide equal investment opportunities within the retirement plan can lead to disqualification.

| To ensure compliance and avoid prohibited transactions, it’s advisable to consult with financial and legal professionals experienced in ROBS arrangements. Proper guidance can help you navigate the complexities and maintain your retirement funds’ tax-advantaged status. |

Common mistakes to avoid with ROBS

When utilizing ROBS to fund your business, it’s crucial to avoid common mistakes that could lead to legal complications or financial losses. By being mindful of these and adhering to ROBS guidelines, you can better ensure the legality and success of your business venture.

| Mistake | Solution |

|---|---|

| Neglecting proper plan structure | Ensure your business is established as a C-corp, as ROBS arrangements require this structure to issue QES. Operating under a different entity type, such as an S-corp or LLC, can result in noncompliance. |

| Getting excessive personal compensation | As a business owner, you have a fiduciary duty to the retirement plan. Paying yourself an unreasonably high salary or getting unreasonable benefits from the ROBS-funded corporation can violate this responsibility and attract scrutiny from the IRS. |

| Misusing ROBS funds for personal expenses | Funds obtained through ROBS must be used exclusively for legitimate business purposes. Utilizing funds for personal expenses is prohibited and can lead to severe penalties. |

| Failing to offer plan participation to employees | ROBS regulations mandate that the company’s retirement plan be available to all eligible employees. Preventing or discouraging employee participation can result in discriminatory practices, jeopardizing the plan’s qualified status. |

| Not maintaining an active operating business | The business funded through ROBS must remain an active, operational company. Transitioning to a passive investment model, such as owning rental properties without active management, can violate ROBS requirements. |

Selecting a ROBS provider

Choosing the right ROBS provider is crucial for ensuring a smooth and compliant transition of your retirement funds into your new business venture. Here are key factors to consider when making your choice:

- Experience and expertise: Opt for a provider with extensive experience facilitating ROBS transactions. A seasoned one will have a deep understanding of the complexities involved and can guide you through the process efficiently.

- Transparent pricing: Evaluate the fee structure. Be cautious of hidden fees, and ensure the costs are transparent and justifiable. Some may offer lower initial fees but charge higher ongoing maintenance fees.

- Compliance support: Given the strict IRS regulations surrounding ROBS, choosing a provider that offers robust compliance support, including ongoing monitoring and assistance with required filings, is essential.

- Client education: A reputable provider should prioritize educating clients about the ROBS process, ensuring they understand each step, the associated responsibilities, and the long-term implications for their businesses and retirement funds.

- Customer service: Assess the quality of customer support. A provider that allows direct access to compliance officers or attorneys can offer more reliable and informed assistance compared with those relying solely on sales representatives.

- Audit protection: Inquire whether the provider offers audit support or guarantees. This can be invaluable in the event of an IRS audit, providing peace of mind that you have expert assistance to navigate potential challenges.

A provider I recommend is Guidant Financial. It specializes in ROBS transactions and has a dedicated team to guide you through the entire process.

ROBS alternatives

If ROBS isn’t the right fit, several alternative financing options are available for funding a new business.

- Traditional small business loans, such as those offered by the Small Business Administration (SBA), provide access to capital with manageable repayment terms.

- Business lines of credit and term loans from banks or online lenders can also be viable options, offering flexibility in funding without the complexities of a ROBS structure.

- Personal financing methods — like using savings, home equity loans, or credit cards — may be suitable for some entrepreneurs, though they come with varying degrees of risk.

- Equity financing is great for those seeking funding without taking on debt. Investors, venture capital firms, and crowdfunding platforms can provide capital in exchange for partial ownership in the business.

- Grants and economic development programs may also be available, particularly for businesses in specific industries or those owned by minorities, women, or veterans.

Choosing the right financing method depends on factors such as risk tolerance, business goals, and financial qualifications.

Frequently asked questions (FAQs)

Can ROBS be used for LLCs?

No, ROBS cannot be used to fund an LLC. The arrangement requires the business to be structured as a C-corp, as this is the only entity type permitted to issue QES, which are essential for the ROBS process.

How much does it cost to set up a ROBS?

Establishing a ROBS arrangement typically involves an initial setup fee ranging from $3,000 to $5,000, depending on the provider. This fee generally covers the formation of a C-corp, the creation of a qualified retirement plan, and guidance through the rollover process.

How do you pay back a ROBS loan?

ROBS is not a loan, so there are no payments to make or interest to repay. Since the funds come from your retirement savings through a rollover, they are invested in your business in exchange for company stock, and repayment is not required.