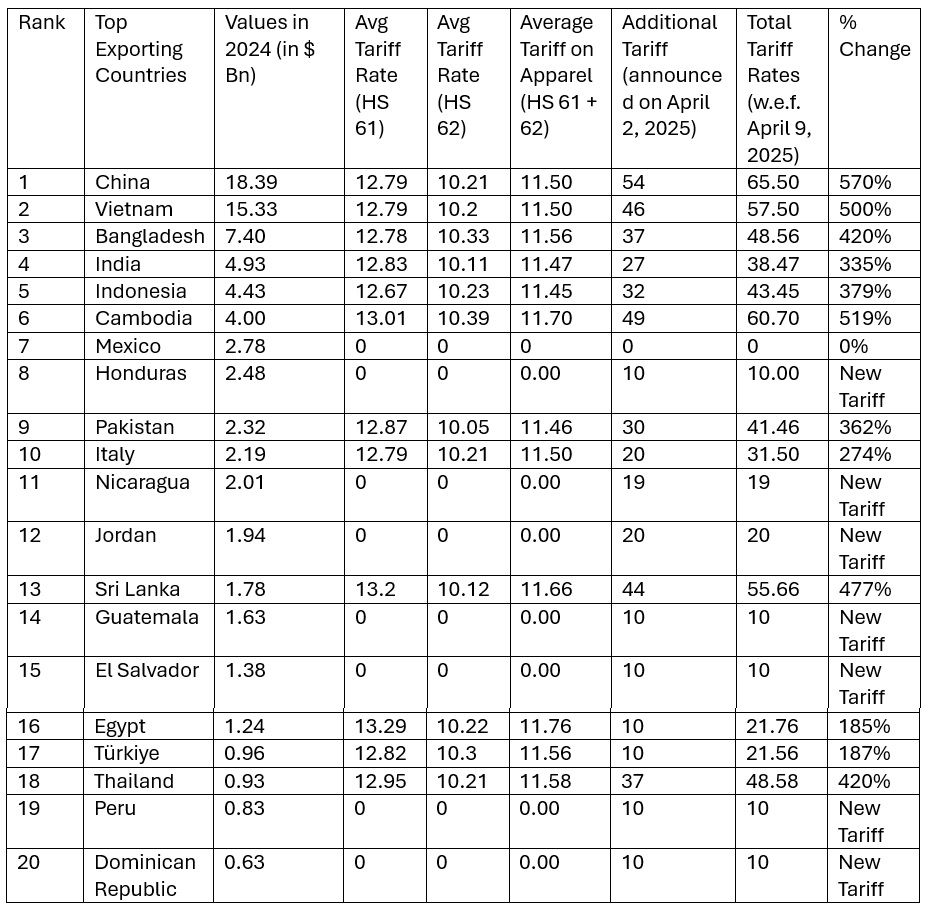

Table 1: Top 20 apparel exporting countries to the US, their new tariff rates, and % change in tariffs

Source: TexPro

Steep Tariff Increases for Top Asian Suppliers

China

New Average Tariff Rate: 65.5%

Previous Rate: ~11–12%

Increase: Approx. 54 percentage points, or nearly 6 times higher

Impact: As the largest apparel exporter to the US, China faces the most severe impact. This escalation likely aims to further decouple US reliance on Chinese manufacturing amid ongoing trade tensions.

Vietnam

New Average Tariff: 57.5%

Previous: ~11–12%

Increase: ~46 percentage points

Impact: Vietnam, once a top alternative to China due to its cost-efficiency, now finds itself similarly penalised, which may push US importers to seek new sourcing options.

Bangladesh

New Average Tariff: 48.6%

Previous: ~12%

Impact: While slightly lower than China and Vietnam, this still represents a four-fold increase, undermining one of the world’s key suppliers of low-cost garments.

Other Major Asian Exporters Hit Hard

India:

New Average Tariff: 38.5%

Previous: ~12%

Impact: While slightly lower than China, Bangladesh and Vietnam, this still represents a 27-percentage-point increase, a two-and-a-half times increase, undermining one of the world’s key suppliers of garments.

Indonesia:

New Average Tariff: 43.5%

Previous: ~12%

Impact: While slightly lower than China, Bangladesh and Vietnam, the present tariff has been increased by 32 percentage points, more than three-and-a-half times increase, undermining one of the world’s key suppliers of garments.

Cambodia:

Tariff jumps from 11.7% to 60.7%

This 49-point increase mirrors the sharp trend, signalling uniform targeting of Southeast Asian producers.

These countries, heavily reliant on apparel exports for economic growth and employment, now face significant barriers to one of their largest markets.

Free Trade Partners Also Affected (With Exceptions)

New Tariffs for Some Formerly Duty-Free Countries

Central American nations (e.g., Honduras, El Salvador, Nicaragua): Now face around 10% tariffs.

Jordan: Tariffs up to 20%, despite previously enjoying duty-free access under trade deals like the US-Jordan FTA.

This change signals a potential rollback or re-evaluation of long-standing preferential trade agreements.

Mexico – The Lone Exception

Tariff Rate: 0%

Status: Unaffected

Reason: Likely due to the USMCA (United States-Mexico-Canada Agreement), which solidifies Mexico’s trade relationship and preserves its competitive edge as a nearby, stable supplier.

Implications for US Importers and Global Supply Chains

Rising Costs: Retailers in the US may pass higher import costs onto consumers, increasing apparel prices.

Supply Chain Diversification: Pressure to shift sourcing towards tariff-exempt regions like Mexico or explore nearshoring options.

Reshaping Trade Routes: These policy changes could spark regional alliances, trade tensions, or a move towards domestic production in certain segments.

Source: TexPro

Fibre2Fashion News Desk (NS)