British firms remained generally positive amid robust demand projections, forthcoming technology investment and hopes of supportive monetary policy, but concerns over domestic and international political uncertainty and increasing employment costs weighed on expectations.

UK businesses were less optimistic about their future activity levels in October, an S&P Global survey found.

These remained generally positive amid robust demand projections, forthcoming technology investment and hopes of supportive monetary policy.

There were concerns that business cost hikes, linked to higher wages and payroll costs, could limit the rate of expansion and dampen profits.

The net balance of surveyed UK private sector firms projecting an expansion in business activity over the next 12 months slipped to 41 per cent in October, down from 44 per cent in June and the lowest in exactly one year.

This was also slightly weaker than the average recorded over the survey’s history (44 per cent). However, the reading was still consistent with a robust level of confidence in the near-term outlook.

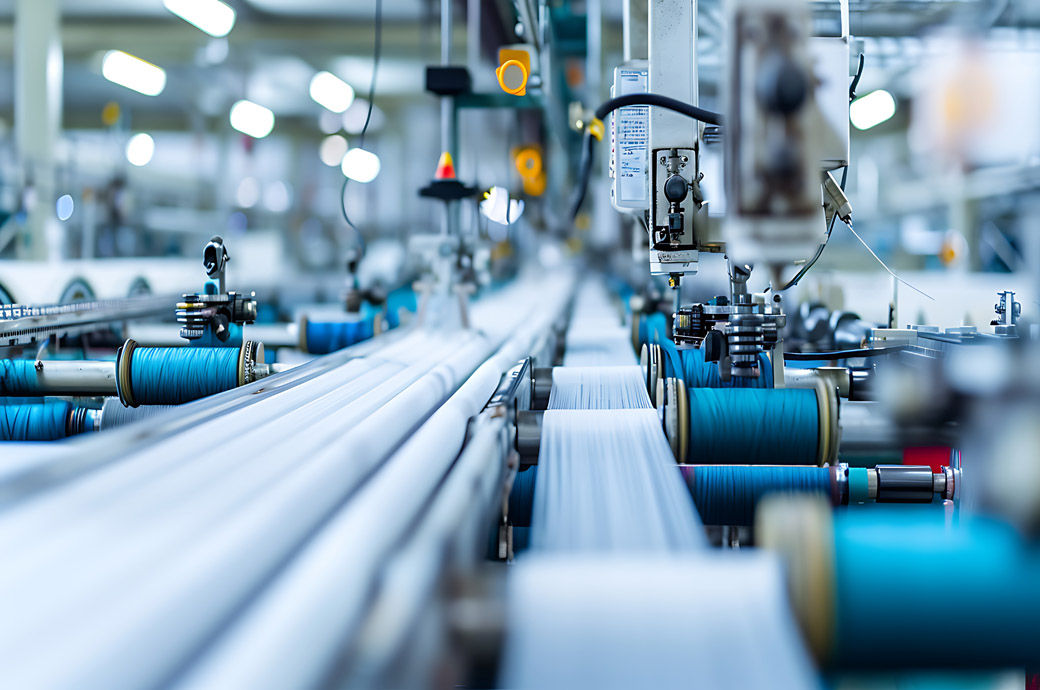

A slide in output expectations was especially observed in the manufacturing sector during October, where net sentiment dropped from 56 per cent in June to 43 per cent.

According to surveyed firms, growth opportunities revolved around stronger domestic economic conditions, new product development, technology investment and growth of exports. Firms also expect a loosening of monetary policy to propel activity, while some anticipate a boost to demand from rising government spending.

At the same time, there were concerns that increases in business costs, linked to higher wages and payroll costs, could limit the rate of expansion and dampen profits.

Supplier-related inflationary pressures, geopolitical uncertainty, staff shortages and foreign competition were also noted as economic headwinds.

The decline in activity growth expectations in the United Kingdom led to less upbeat predictions towards employment and capital expenditure in October.

A net balance of 18 per cent of UK businesses expects to increase staffing levels over the forthcoming year, the lowest since October 2022. This was wholly driven by the manufacturing sector, where the net balance fell sharply from 25 per cent to 12 per cent.

Capital expenditure forecasts remained positive but only slightly, with net optimism a third of the level recorded in the previous survey, S&P Global said in a release.

Output price inflation forecast to quicken UK businesses were generally of the view that prices charged for goods will rise at a sharper pace over the next 12 months, compared with predictions made in the June survey.

Fibre2Fashion News Desk (DS)