Taiwan Semiconductor Manufacturing Company has offered a share in its proposed acquisition of Intel’s chip foundries to NVIDIA, Broadcom, and AMD, sources told Reuters. The Taiwanese chipmaker intends to oversee the operations of Intel’s fab division, but aims to retain less than 50% ownership and is seeking multiple partners for the deal.

Intel’s reluctance and internal divisions

According to the anonymous sources, Intel does not want to sell its chip design house separately from the foundry division, which manufactures custom chips for its customers. Intel executives are also divided on whether striking any deal is a good idea.

Last month, it was reported that TSMC and Broadcom were considering splitting the U.S. company’s manufacturing and design arms between them. Intel’s factories already operate somewhat independently; since 2022, they have taken orders from outside customers and in-house at equal priority.

Challenges in potential TSMC-Intel partnership

TSMC has its own demands when it comes to the joint venture, as it wants any potential investors to also be Intel advanced-manufacturing customers. It did pitch to Qualcomm in the early stages, but the company has since exited discussions, sources said.

SEE: Qualcomm, Intel, and Others Form Ambient IoT Coalition

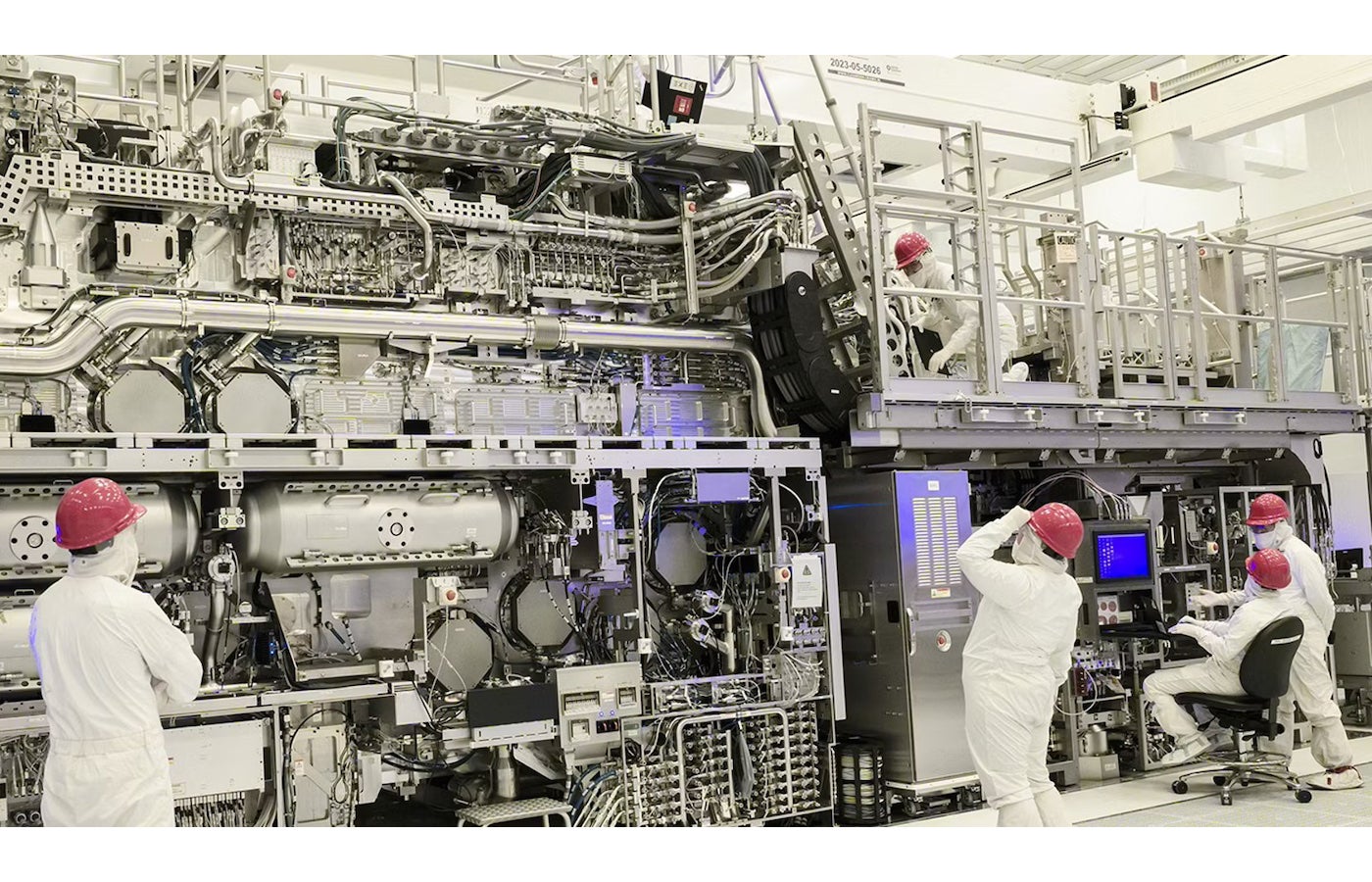

The sources added that any manufacturing partnership between TSMC and Intel would be difficult and costly in practice, as they use very different processes, materials, and tool setups when making their chips. Managing trade secrets between the two companies would pose another significant hurdle.

Intel, TSMC, Nvidia, AMD, and Qualcomm declined Reuters’ requests for comment, while the White House and Broadcom did not respond.

The pitch to NVIDIA, Broadcom, and AMD was reportedly made before TSMC announced earlier this month that it would invest an additional $100 billion building data centres in the U.S., bringing total spending to $160 billion. It dubbed this the “largest single foreign direct investment in U.S. history.”

Trump is at the helm of the joint venture

U.S. President Donald Trump encouraged TSMC to assist in pulling Intel out of its slump, according to the Reuters sources, by taking over some of Intel’s U.S. chipmaking factories. He is keen to revive the former U.S. manufacturing icon while strengthening domestic production, so he does not want any part of Intel to be fully foreign-owned, the sources added.

SEE: Trump Calls for CHIPS Act Repeal, Slams ‘Horrible’ Subsidies

Intel’s decline amid industry shift

Intel used to be a giant in the CPU industry, but the AI boom and a failure to strategize in a way that benefits from current trends have led to struggles. Intel is unusual among its rivals in that it has not focused solely on either manufacturing or designing chips; as a result, it has seen its chip-making endeavors eclipsed by TSMC.

The U.S. manufacturing icon also had some struggles with quality in 2024, leading to it reporting its first net loss since 1986 and dropping from first to second on Gartner’s list of top global semiconductor vendors by revenue growth.