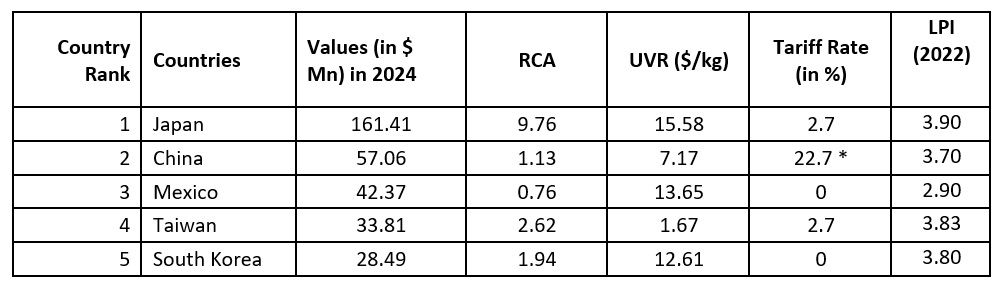

Table 1: Key Exporting Countries to the US and Trade Statistics– HS 590320- Polyurethane-Coated Fabrics in CY 2024

Japan leads the US polyurethane-coated fabric market with $161.41 million exports in 2024, focusing on premium products.

China, the second-largest supplier, faces a 22.7 per cent tariff in the US market, raising costs and reducing competitiveness.

South Korea benefits from zero tariff.

Future growth will depend on eco-friendly innovations and advanced manufacturing amid shifting trade policies.

Source: TradeMap and F2F Analysis *Effective from 4th March

Note: RCA – Revealed Comparative Advantage; UVR – Unit Value Realisation; LPI – Logistic Performance Index.

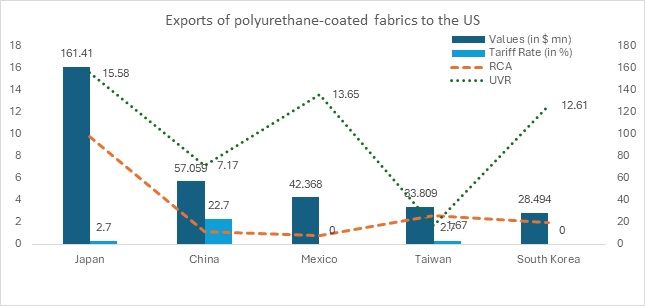

Figure 1: Key Exporters of polyurethane-coated fabric to the US and trade statistics in CY 2024

Japan

Japan dominates the polyurethane-coated fabric in the US market, exporting $161.41 million worth of products in 2024, backed by superior quality and advanced technology. With a high RCA of 9.76 and the highest LPI of 3.9, Japan remains the leading supplier to the U.S. Its UVR of $15.58/kg reflects its focus on high-value, premium-grade products.

China

China ranks second in polyurethane-coated fabric exports to the US, with $57.06 million in 2024 trade, benefiting from cost-efficient mass production. However, its RCA of 1.13 indicates weaker competitiveness compared to Japan. With a UVR of $7.17/kg, China remains among the lower-value suppliers, second only to Taiwan in terms of pricing.

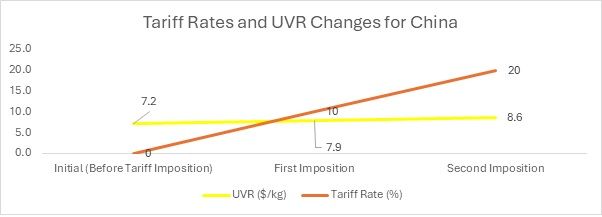

Tariff Impact: With the first tariff imposition on February 4th, 2025, the tariff rate increased by 10 per cent. This rise in the tariff has led to an increase in the UVR as production and export costs escalate. As a result, the UVR would likely increase to around $7.9/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive for price-sensitive consumers.

In the second tariff imposition, effective from March 4th, 2025, the tariff rate rose to 22.7 per cent. This substantial increase would push the UVR to approximately $8.6/kg or higher. The higher tariff burden will continue to raise costs, further diminishing the cost-effectiveness of the products. However, with the rising tariff on competing products, exporters in countries like India could potentially benefit, as their polyurethane-coated fabrics may remain more competitively priced compared to those affected by higher tariffs, securing their position in the global market.

Mexico

Mexico benefits from zero tariffs under its trade agreements with the US under the USMCA, which, along with its geographical proximity, enhances its export competitiveness. With a UVR of $13.65/kg, Mexico positions itself as a supplier of relatively high-value polyurethane-coated fabrics. However, its RCA of 0.76 indicates a weakening comparative advantage, suggesting that its market strength is gradually eroding. This decline may be due to increased competition from technologically advanced players like Japan or tariff-free competitors like South Korea.

Taiwan and South Korea

These two countries maintain a stable presence in the exports of polyurethane-coated fabrics to the US market. Taiwan’s RCA of 2.62 reflects a moderate competitive position, supported by its low UVR of $1.67/kg, which indicates a focus on cost-sensitive markets. South Korea, with a UVR of $12.61/kg, benefits from zero tariffs, giving it a pricing advantage in key markets, particularly the US. This tariff-free access allows South Korea to enhance its US market reach despite facing competition from larger exporters like Japan and China.

Trade strategy and future outlook

Japan, China (now 22.7 per cent), and Taiwan face a 2.7 per cent tariff, affecting their price competitiveness, while Mexico and South Korea benefit from zero tariffs from the US, giving them an edge in the US market, which currently relies on the cost-effectiveness of the product. Japan maintains its dominance with high-value, technologically advanced products, while China relies on large-scale manufacturing and lower production costs to stay competitive.

However, the recent imposition of 20 per cent additional tariff on China is expected to significantly erode its market share in the US, creating opportunities for Japan and South Korea to strengthen their foothold.

Future growth will be driven by investments in eco-friendly polyurethane fabrics and advanced manufacturing technologies, aligning with evolving market demands and sustainability trends.

Fibre2Fashion News Desk (NS)