QuickBooks Payroll’s fast facts [3.6 stars out of 5]Pricing: Starts at $45/month + $5/employee Features:

|

Business payroll isn’t as simple as it was back in the days of punch cards and physical checks. Today’s compliance standards, competitive benefits packages, dispersed teams and tax penalties are just some of the many factors that go into running payroll for a business while maintaining accuracy throughout.

SEE: Choosing a payroll service? Here’s a handy guide for business leaders.

Fortunately, services like QuickBooks Payroll can streamline and simplify several areas of the payroll process while providing HR and taxation features. Learn more about QuickBooks Online Payroll to determine whether it is an ideal solution for your business.

Jump to:

What is QuickBooks Payroll?

Intuit QuickBooks is a business accounting software company that provides bookkeeping software and other accounting and finance solutions, including payroll. QuickBooks Payroll enables businesses to run payroll, file state and federal income taxes, and manage employee direct deposit. QuickBooks Payroll also has some human resource tools, such as healthcare insurance and benefits administration.

QuickBooks Payroll has both a cloud-based and desktop version. For this piece, we’re focusing on the cloud-based QuickBooks Online Payroll, which syncs with the cloud-based accounting solution QuickBooks Online (not with QuickBooks Desktop). For the time being, Intuit QuickBooks continues to offer desktop-based payroll and accounting software, but the company’s strong marketing push for QuickBooks Online suggests desktop programs won’t remain its main focus.

QuickBooks Payroll pricing

Intuit QuickBooks Online Payroll buyers can choose from several service plans that are fine-tuned to support their users’ needs:

- The Core plan costs $45 per month plus $5 per employee paid per month.

- The Premium plan costs $75 per month plus $8 per employee paid per month.

- The Elite plan costs $125 per month plus $10 per employee paid per month.

New customers can choose between a 30-day free trial or a 50%-off discount for three months of service. Choosing the latter lowers your monthly base price to $22.50 for Core, $37.50 for Premium and $62.50 for Elite.

Be aware that choosing the free plan waives the 50% discount and vice versa. You can’t secure both the free trial and the discount.

While Intuit QuickBooks Payroll’s monthly base price is higher than that of most competitors, its per-employee fee is lower than average. Depending on how many employees you have, QuickBooks Payroll will actually save you money over time compared to Gusto Payroll and OnPay, which charge $40 a month plus $6 per employee.

QuickBooks Payroll’s key features

QuickBooks Payroll has many standout payroll features that support businesses in their employee payments, tax filing, human resources processes and benefits administration.

Next-day and same-day direct deposit

Businesses can show their teams they care by providing employees with fast direct deposits. Businesses with the QuickBooks Online Payroll Core plan can use next-day direct deposit and submit payroll up to 5:00 p.m. PT the day before payday. The QuickBooks Payroll Online Premium and Elite plans provide same-day direct deposit.

Auto Payroll

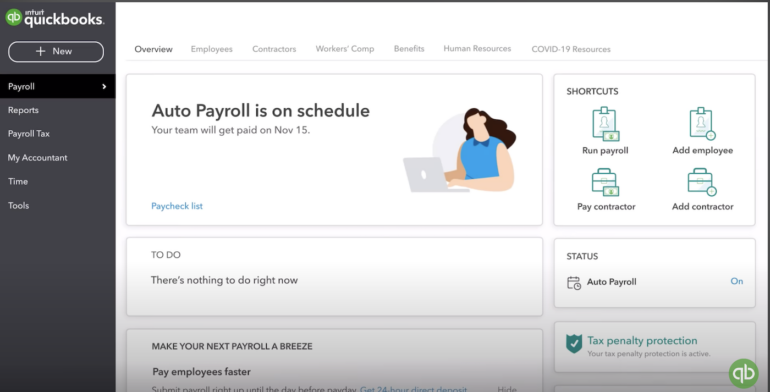

With QuickBooks’ Auto Payroll feature, businesses can set up payroll for salaried employees on direct deposit just once, then schedule automatic payroll runs from that point forward. Employers can still check for paycheck accuracy before approving the pre-scheduled payroll run, but the autopilot feature makes payroll runs as hands-off as possible.

Tax features

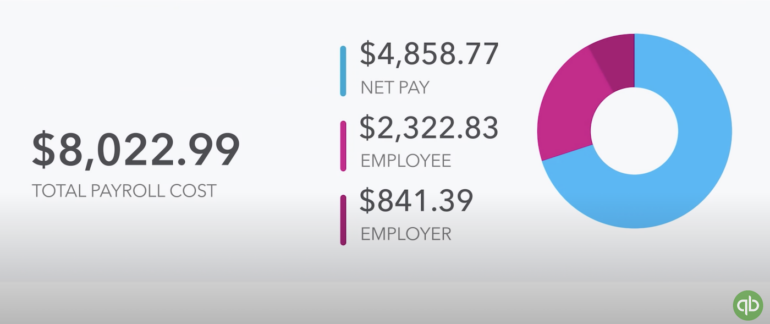

As a full-service payroll provider, QuickBooks Online Payroll automatically calculates paychecks, deducts payroll taxes (which include state and federal income, Social Security and Medicare taxes), and remits those taxes on your behalf. QuickBooks’ payroll service also prepares end-of-year tax filings, draws up W-2 and 1099 payroll tax forms, and submits those forms to the IRS on your behalf. Note that 1099 e-filing costs extra and applies to federal taxes only.

QuickBooks Payroll Core doesn’t support local tax filing, but the QuickBooks Premium and Elite plans both do. Filing state taxes in more than one state costs $12 per extra state per month unless you’re enrolled in the most expensive QuickBooks Payroll plan, Elite, which includes multi-state payroll in the base cost.

Time tracking

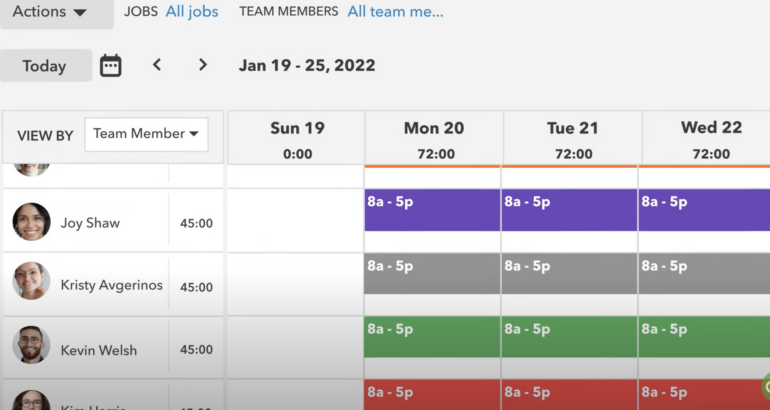

QuickBooks Payroll’s time-tracking tools make reporting on payroll subjects a breeze. Businesses can manage and control multiple timesheets wherever and whenever they please with the QuickBooks Time mobile app, and access is included with the QuickBooks Online Payroll Premium and Elite subscription at no additional cost.

The QuickBooks Time mobile app works with iPhone, iPad and Android phones and tablets. It enables users to track time, submit and approve timesheets and create invoices on the go. The online timesheet tracker even has geofencing and GPS capabilities for easier employee management.

Robust reporting

All QuickBooks plans include the ability to generate and download payroll reports for factors like payroll history, paid time off, tax payments and bank transactions. Payroll reports and timecard reports can gather data from the payroll solution to reveal insights on many areas of business expenditures for things like labor and project costs.

Expert support features

All QuickBooks Payroll plans come with expert product support, which lets users get step-by-step help and troubleshooting assistance via phone and chat. While chat support is available 24/7, U.S.-based phone support is available only during limited hours.

The Premium and Elite plans can access additional support perks like the workers’ comp administration feature, which can help businesses find quotes and connect their policies to QuickBooks to simplify their audits.

SEE: The best payroll software for your small business in 2022 (TechRepublic)

Further benefits for QuickBooks Online Payroll Premium and Elite plan users include the Expert Review feature, which grants them access to experts that will review their payroll setup to ensure everything is correct. This can be especially beneficial for users switching from other providers.

In addition, Payroll Premium and Elite plan users can access the QuickBooks HR support center for HR questions and concerns; this can be helpful for ensuring compliance with state and federal wages and learning the best practices for HR operations. Elite plan users even get a personal certified HR advisor to provide professional guidance on HR tasks and topics.

Workers’ compensation administration

The QuickBooks Online Premium and Elite plans include workers’ compensation insurance administration at no extra cost. QuickBooks uses AP Intego to help businesses find workers’ compensation insurance quotes and connect their policies to QuickBooks to simplify their audits.

QuickBooks Core users can add workers’ comp administration for an additional $5 per month. Workers’ comp plans through QuickBooks are available in every U.S. state except for Ohio, North Dakota, Wyoming and Washington.

Tax accuracy guarantee and penalty protection

Every QuickBooks Online Payroll plan includes a QuickBooks accuracy guarantee, which means QuickBooks promises to file payroll taxes accurately and on time. If QuickBooks introduces an error when filing your taxes, it will pay the resulting IRS fine and deal with any tax penalties you incur. This guarantee doesn’t apply to any tax errors that occur because you entered payroll data incorrectly or have insufficient funds available to cover tax payments.

Full tax-penalty protection is limited to QuickBooks Online Payroll Elite users. With this feature, qualified users who receive a tax notice and send it to QuickBooks within 15 days of the notice will have their tax penalty fees and interest covered for up to $25,000.

Additionally, the QuickBooks Tax Resolution team will represent them and help resolve any payroll tax or filing issues with the IRS. This feature brings extra peace of mind to covered businesses regarding their potential tax penalties.

HR and employee benefits

QuickBooks Payroll lets employees support their teams with its HR and health benefits. Workers can quickly set up retirement plans with experts that handle the 401(k) administration, compliance and recordkeeping at no extra cost to businesses.

Businesses can also compare and select health plans to provide affordable coverage to their workers. All benefits processes are managed with the centralized online system, which shows instant quotes on plans and a fast three-step application process.

QuickBooks Payroll’s pros

Ease of use

The QuickBooks Payroll platform is extremely user-friendly. Its streamlined dashboard simplifies payroll processes both for employers using the software to run payroll and employees using QuickBooks’ time-tracking app to clock in and out. The automatic payroll features take the effort and confusion out of normal payroll processing.

Comprehensive payroll features

QuickBooks Payroll simplifies the payroll process for businesses through its helpful full-service payroll features and capabilities. It supports unlimited payroll runs with an easy-to-use user interface that lets users take charge of many aspects of their payroll processes. The software performs payroll in all 50 U.S. states, and the direct deposit payments save users time and money on producing physical checks.

Thorough automation

The automated features of QuickBooks Payroll can save users time and effort. The payroll solution can perform accurate automated calculations for tax withholdings and paychecks and helps businesses stay compliant with tax laws.

QuickBooks Online accounting integration

QuickBooks Online Payroll integrates seamlessly with the QuickBooks Online accounting service, so users can perform all of their finance and payroll processes in one system. If you sync the two Intuit QuickBooks solutions, your QuickBooks Online general ledger and expense accounts will update automatically whenever you process payroll on QuickBooks Payroll, ensuring your business finances are always up to date and accurate.

Expert customer support

Another benefit of QuickBooks Payroll is its support for business administrators and employees. QuickBooks Payroll provides various customer service and support options for businesses, like free guided setup and expert product support on its higher-tier plans.

QuickBooks Payroll’s cons

High monthly base price

While QuickBooks Payroll is helpful for businesses, the software service does have drawbacks — most notably, its pricing. QuickBooks Payroll comes in three pricing tiers, but some users may find the pricing to be too high, especially in terms of what features are offered.

Limited HR features

Plus, some users may want more capabilities for their payroll processing that the software does not support. For example, even higher-tier plans like QuickBooks Online Payroll Premium’s HR features are basic when compared to payroll solutions offered by other providers, especially Paychex and ADP.

Key features limited to higher-cost plans

Additionally, several features like time-tracking are only available through higher-cost plans. The HR support center is limited to only QuickBooks Premium and Elite subscriptions, and the HR advisor support is only provided for QuickBooks Payroll Elite plan users. Its most basic plan lacks local tax filings, and Core and Premium plan users also must pay additional filing fees for employees in other states.

Alternatives to QuickBooks Payroll

There are a number of alternatives to QuickBooks Payroll — we’ll focus on Gusto, ADP and Papaya Global.

Gusto

Gusto is another popular payroll provider option; its online payroll service allows businesses to automate their payroll calculations, tax filing and contractor payments. It contains helpful tools for employee onboarding and automating several areas of HR processes. Gusto’s scalability, flexible scheduling and new hire reporting make it a capable choice for growing businesses.

Pricing

- Simple: $40 per month plus $6 per person paid

- Plus: $80 per month plus $12 per person paid

- Premium: Custom

RUN Powered byADP

ADP is another payroll software option that shines through its HR services. Its comprehensive online payroll solution, RUN Powered by ADP, is popular among businesses of all sizes and provides HR compliance checkups, support from HR professionals and legal services. Its payroll-specific features include payroll tax filing, payroll processing and state new-hire reporting.

Pricing

- Essential: Custom

- Enhanced: Custom

- Complete: Custom

- HR Pro: Custom

Papaya Global

Papaya Global offers international payroll services in 160+ countries, making it a great option for dispersed teams. It has a vast array of integration options and uses synced payroll information to provide helpful features on one unified platform, like real-time data analytics, an employee self-service portal and international tax compliance tools.

Pricing

Papaya Global’s international payroll service starts at $12 per employee per month. You can tack on other features for an additional cost:

- Global Expertise Services: $250 per employee per month

- International Contractor Management: $25 per contractor per month

- Employer of Record: $770 per employee per month

Is QuickBooks Payroll right for your business?

Businesses should always carefully consider their needs and budget when deciding on a software service. For QuickBooks Payroll, important deciding factors include the software’s feature limitations, scalability and business size.

QuickBooks Payroll offers excellent support features businesses can use to ensure they carry out accurate payroll and tax processes. Still, many of the QuickBooks Payroll standout features are only offered through the high-tier plans, meaning buyers will have to pay more to access them. Therefore, businesses should consider the budget they are willing to spend and whether these features are essential to their practices.

Like any software, QuickBooks Online Payroll has pros and cons. For the most part, though, QuickBooks Online Payroll is a good choice for business owners who want a supportive and easy-to-use payroll solution. However, while QuickBooks Payroll is one of the best payroll software for businesses, it isn’t the only option. If you’re shopping for a new payroll solution, we recommend reviewing the features and pricing for multiple payroll solutions to ensure you select the best option for your business.

Methodology

To write our comprehensive review, we thoroughly researched QuickBooks Payroll’s features and services. We watched Intuit QuickBooks’ extensive how-to videos, including those for setting up payroll and integrating it with QuickBooks’ time-tracking and accounting software. We read extensive user reviews, watched user reviews and how-tos on YouTube, and looked at aggregate ratings on sites like Trustpilot, the BBB, Apple’s App Store and Google Play.

Trending accounting software

1

Wrike

Wrike is a team collaboration platform used by more than two million people across 140 countries. Manage your finances and keep your organization profitable with Wrike´s powerful software. Create a project budget, set preferred currencies, add default hourly rates, and control user access – all in one place. Use time tracking tools to log employee hours and allocate resources. Get detailed reports and build analytics dashboards for a full project portfolio overview.

2

Multiview ERP

Multiview Financials’ ERP provides a single point of truth within your organization, enabling visibility across divisional, regional, or product line silos. It goes beyond traditional finance and accounting to add the sophisticated capabilities that today’s complex organizations demand.

3

Oracle NetSuite

NetSuite cloud financials and accounting software helps finance leaders design, transform and streamline their processes and operations. NetSuite seamlessly couples core finance and accounting functions, which improves business performance while reducing back-office costs. With real-time access to live financial data, you can quickly drill into details to quickly resolve delays and generate statements and disclosures that comply multiple regulatory financial compliance requirements.