Kate_sept2004 | E+ | Getty Images

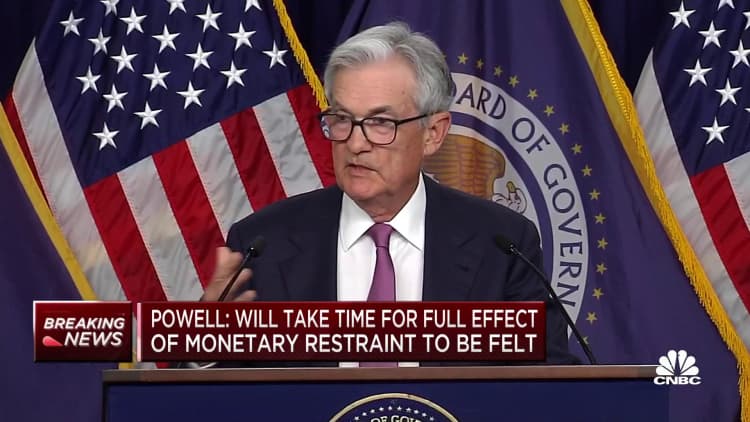

After the Federal Reserve’s interest rate pause on Wednesday, a fixed income expert covers what to know about bond allocations amid economic uncertainty.

“This is an attractive time to start looking at investment-grade credit,” which may provide “good income,” said Sonal Desai, executive vice president and chief investment officer for Franklin Templeton Fixed Income.

“It has been a decade and a half that people like your mother or my father, frankly, have had no income from their fixed income,” said Desai, speaking at CNBC’s Financial Advisor Summit. “They’ve taken the volatility and it hasn’t delivered income.”

Experts are weighing longer bond duration

It’s also time to consider adding bond duration, she said, going from “very short” to “extending duration somewhat.”

As interest rates change, advisors weigh so-called duration, which measures a bond’s sensitivity to interest rate changes. Duration factors in the coupon, time to maturity and yield paid through the term.

Many advisors have shifted to shorter-duration bonds to shield portfolios from interest rate risk. But allocations may move to longer-duration bonds as Fed policy changes.

Consider high-yield bonds

Investors with more appetite for risk may also consider high-yield bonds, Desai said, which typically pay a larger coupon, but have a higher default risk.

“If you can take volatility over the next 18 months or so, high-yield is offering 8.5%, sometimes close to 9%,” she said.

While these assets are riskier amid economic uncertainty, Desai believes a possible U.S. recession may be “pretty mild.”

“Default probably will pick up which is why you don’t buy the index,” she said. But investors may lock in “pretty interesting yields” by picking individual corporate bonds.