Below are the excerpts from Finance Minister Nirmala Sitharaman’s Budget presented in the Parliament today:

The Union Budget 2025-26 has announced a Mission for Cotton Productivity to boost yield and sustainability.

MSME investment and turnover limits are raised, with enhanced credit access and ₹5 lakh credit cards for micro enterprises.

Customs duty on knitted fabrics is revised to 20 per cent or ₹115/kg.

Leather sector to benefit from duty exemption on Wet Blue leather and crust leather.

Mission for Cotton Productivity

For the benefit of lakhs of cotton growing farmers, I am pleased to announce a ‘Mission for Cotton Productivity’. This 5-year mission will facilitate significant improvements in productivity and sustainability of cotton farming, and promote extra-long staple cotton varieties. The best of science & technology support will be provided to farmers. Aligned with our integrated 5F vision for the textile sector, this will help in increasing incomes of the farmers, and ensure a steady supply of quality cotton for rejuvenating India’s traditional textile sector.

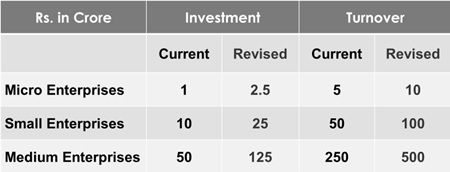

Revision in classification criteria for MSMEs

Currently, over 1 crore registered MSMEs, employing 7.5 crore people, and generating 36 per cent of our manufacturing, have come together to position India as a global manufacturing hub. With their quality products, these MSMEs are responsible for 45 per cent of our exports. To help them achieve higher efficiencies of scale, technological upgradation and better access to capital, the investment and turnover limits for classification of all MSMEs will be enhanced to 2.5 and 2 times respectively. This will give them the confidence to grow and generate employment for our youth. The details are in Annexure D.

Annexure D

Significant enhancement of credit availability with guarantee cover

To improve access to credit, the credit guarantee cover will be enhanced:

- For Micro and Small Enterprises, from ₹5 crore to ₹10 crore, leading to additional credit of ₹1.5 lakh crore in the next 5 years;

- For Startups, from ₹10 crore to ₹20 crore, with the guarantee fee being moderated to 1 per cent for loans in 27 focus sectors important for Atmanirbhar Bharat; and

- For well-run exporter MSMEs, for term loans up to ₹20 crore.

Credit Cards for Micro Enterprises

We will introduce customized Credit Cards with a ₹5 lakh limit for micro enterprises registered on Udyam portal. In the first year, 10 lakh such cards will be issued.

Focus Product Scheme for Footwear & Leather Sectors

To enhance the productivity, quality and competitiveness of India’s footwear and leather sector, a focus product scheme will be implemented. The scheme will support design capacity, component manufacturing, and machinery required for production of non-leather quality footwear, besides the support for leather footwear and products. The scheme is expected to facilitate employment for 22 lakh persons, generate turnover of ₹4 lakh crore and exports of over ₹1.1 lakh crore.

Manufacturing Mission – Furthering “Make in India”

Our Government will set up a National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” by providing policy support, execution roadmaps, governance and monitoring framework for central ministries and states. Details are in Annexure E.

Annexure E

Manufacturing Mission – Furthering “Make in India

The Mission’s mandate will include 5 focus areas:

- ease and cost of doing business;

- future ready workforce for in-demand jobs;

- a vibrant and dynamic MSME sector;

- availability of technology; and

- quality products.

National Centres of Excellence for Skilling

Building on the initiative announced in the July 2024 Budget, five National Centres of Excellence for skilling will be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing. The partnerships will cover curriculum design, training of trainers, a skills certification framework, and periodic reviews.

Support to Domestic Manufacturing and Value addition

Textiles

To promote domestic production of technical textile products such as agro-textiles, medical textiles and geo textiles at competitive prices, I propose to add two more types of shuttle-less looms to the list of fully exempted textile machinery. I also propose to revise the BCD rate on knitted fabrics covered by nine tariff lines from “10% or 20%” to “20% or ₹115 per kg, whichever is higher”.

CUSTOMS DUTY RATE CHANGES

1. Reduction in customs duty to reduce input costs, deepen value addition, promote export competitiveness, correct inverted duty structure, boost domestic manufacturing etc [with effect from 2.2.2025]

S. No. | Commodity | From (per cent) | To (per cent) |

|---|---|---|---|

VI. | Textile, Handicraft and Leather Sector | ||

1. | Wet blue leather | 10 | Nil |

2. | Shuttle less loom Rapier Looms (below 650 meters per minute) and Shuttle less loom Air jet Looms (below 1000 meters per minute) for use in textile industry | 7.5 | Nil |

3. | Certain additional items for duty free import by bonafide exporters for manufacture of handicrafts | As applicable | Nil |

2. Increase in Customs duty [with effect from 02.02.2025]

S. No. | Commodity

| Rate of duties | |

|---|---|---|---|

From (per cent) | To (per cent) | ||

I. | Textiles | ||

1. | Knitted Fabrics covered under tariff items 6004 10 00, 6004 90 00, 6006 22 00, 6006 31 00, 6006 32 00, 6006 33 00, 6006 34 00, 6006 42 00 and 6006 90 00 | 10/20 | 20 or Rs 115 per kg, whichever is higher |

Export Promotion

Leather sector

I propose to fully exempt BCD on Wet Blue leather to facilitate imports for domestic value addition and employment. I also propose to exempt crust leather from 20% export duty to facilitate exports by small tanners.

Export duty on Leather [with effect from 2.2.2025]

S. No. | Commodity

| Rate of duties | |

|---|---|---|---|

From (per cent) | To (per cent) | ||

1 | Crust Leather (hides and skins) | 20 | 0 |

Fibre2Fashion News Desk (RKS)