People shop at Lincoln Market on June 12, 2023 in the Prospect Lefferts Gardens neighborhood in the Brooklyn borough of New York City.

Michael M. Santiago | Getty Images News | Getty Images

Inflation slowed in May to the lowest rate in two years, largely on the back of declining prices for energy such as gasoline and electricity, the U.S. Bureau of Labor Statistics said Tuesday. But some areas of household budgets haven’t seen much improvement in recent months, a potential concern.

Inflation measures how quickly prices are changing across the U.S. economy.

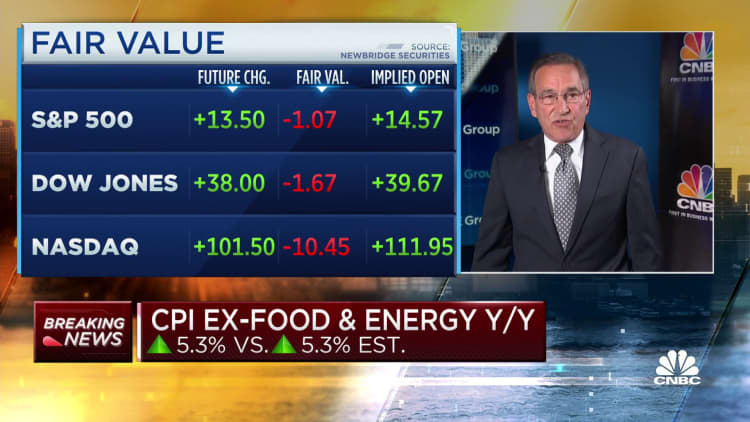

The consumer price index increased 4% in May relative to a year earlier, a slowdown from 4.9% in April.

The CPI is a key barometer of inflation, measuring prices of anything from fruits and vegetables to haircuts and concert tickets.

Where consumers saw inflation, deflation in May

Consumers saw gasoline prices decline 5.6% between April and May, according to the CPI report.

Prices have fallen dramatically from a spike in the first half of 2022 that was a result of Russia’s invasion of Ukraine. Prices at the pump are down 20% in the past year.

“Energy prices at this time last year were just absurd,” Leer said.

Grocery prices rose slightly from April to May after declining during the two months prior. The “food at home” index is up 6% in the past year.

But food and energy prices can be volatile. That’s why economists use a measure that strips out such categories to get a better sense of inflation’s trajectory going forward. The measure — so-called “core CPI” — has somewhat plateaued since the fall.

“The progress on core inflation has stalled out in recent months,” said Greg McBride, chief financial analyst at Bankrate.

Housing is the biggest expense for the average consumer. Shelter costs were the largest contributor to core CPI in May, according to the Bureau of Labor Statistics.

Shelter prices rose 0.6% in May, up from 0.4% in April. They’re up 8% in the past year. However, economists expect housing prices to start falling in the second half of the year.

Monthly prices for used cars and trucks, motor vehicle insurance, apparel, personal care and education also increased notably in May, the BLS said.

When measuring increases over the past year, notable categories include motor vehicle insurance, which saw prices jump by 17.1%, recreation (4.5%), household furnishings and operations (4.2%), and new vehicles (4.7%).

Aside from energy, many consumer categories also deflated from April to May, including airline fares, communication, new vehicles and recreation, according to the BLS. The monthly 0.6% decline in household furnishings and operations was the category’s first decline since June 2021 and the largest since August 2009.

Over the past year, there was deflation in categories such as airline fares, car and truck rentals, citrus fruits, fresh whole milk, and used cars and trucks.

Why inflation surged in the pandemic era

Inflation during the pandemic era has been a “complicated phenomenon” stemming from “multiple sources and complex dynamic interactions,” according to a recent paper co-authored by Ben Bernanke, former chair of the U.S. Federal Reserve, and Olivier Blanchard, senior fellow at the Peterson Institute for International Economics.

Consumer prices began rising rapidly in early 2021 as the U.S. economy reopened after its Covid-induced shutdown. Americans unleashed a flurry of pent-up demand for dining out, entertainment and vacations, aided by savings amassed from government relief, months of curbed spending and rock-bottom borrowing costs.

Meanwhile, the rapid economic restart snarled global supply chains. That dynamic was exacerbated by Russia’s invasion of Ukraine, which also fueled higher prices for food, energy and other commodities.

Fed policy acts with a lag, one that impacts different sectors of the economy in different ways and at different times.

Greg McBride

chief financial analyst at Bankrate

In other words, supply couldn’t keep up with consumers’ willingness to spend.

Inflation, which increased in economies around the world during the Covid-19 pandemic era, was initially siloed in categories of physical goods such as used cars and trucks.

But the dynamic has somewhat changed. Now, the labor market appears to be playing a bigger role than a shortage of physical goods, economists said.

As the economy reopened after the pandemic, businesses rushed to hire workers, and job openings surged to record highs. That demand tilted the job market in favor of workers, who had ample opportunities. They saw wages grow at their fastest pace in decades as employers competed to hire them.

That strong wage growth has nudged employers, especially labor-intensive service businesses, to raise prices to help compensate for higher labor costs, economists said.

There are signs that labor dynamic is easing, though — which should put downward pressure on overall inflation.

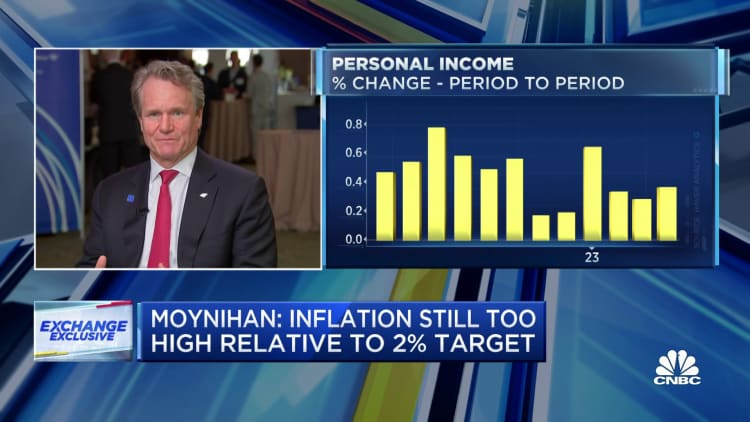

The Federal Reserve has been raising borrowing costs aggressively since early 2022 to rein in demand among consumers and businesses, and ultimately bring inflation back to its 2% annual target. Fed officials are meeting this week and are expected to announce a pause in their campaign to raise interest rates, at least for the time being.

“Fed policy acts with a lag, one that impacts different sectors of the economy in different ways and at different times,” said McBride.

Leaving interest rates unchanged would allow officials to evaluate the cumulative effect of policy so far and “see if it is having the desired impact,” he added.