No matter how big or small your business is, the right payroll software can make managing tasks related to payroll, HR and benefits much easier. Gusto and Paychex are two well-established, convenient payroll services targeted toward small and midsize businesses, but which one is better for your unique organization?

Generally speaking, Gusto is perfect for small and midsize businesses that want full-service payroll and HR tools bundled with employee benefits options and limited extra fees. Paychex isn’t as fully featured as Gusto and charges more extra fees for services Gusto includes with its base price, but its higher-tier plans work better for midsize and large businesses that need extra HR support as they hire more workers.

Jump to:

Gusto vs. Paychex: Comparison table

Gusto and Paychex are full-service payroll providers, meaning both providers will calculate, deduct and remit state and local payroll taxes on your behalf. Both providers also file end-of-year tax forms for you, though Paychex charges an additional fee for this service.

| Feature | Gusto | Paychex |

|---|---|---|

| Starting price per month | $40 + $6/payee | $39 +$5/payee |

| International payroll | International contractor payments only | No |

| Health benefits availability | 37 states | 50 states |

| Benefits administration | Yes | Yes (extra fee) |

| Primary accounting integrations | QuickBooks Online, Xero, Sage, FreshBooks | QuickBooks Online, Xero, Sage Intacct |

| Hiring and onboarding tools | Yes | Yes |

1

Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Gusto vs. Paychex: Pricing

Gusto’s pricing

Gusto is payroll management software that puts various employee management tools, such as pay, time off and benefits, in one place. Gusto offers reporting tools with customizable reports, compliance reports and team survey capabilities as well. This payroll management software is best for small organizations that don’t foresee a lot of growth.

Gusto is payroll management software that puts various employee management tools, such as pay, time off and benefits, in one place. Gusto offers reporting tools with customizable reports, compliance reports and team survey capabilities as well. This payroll management software is best for small organizations that don’t foresee a lot of growth.

Gusto has three payroll plans that share the same basic payroll features with varying degrees of HR tools and support:

- Gusto Simple costs $40 per month plus $6 per employee or contractor paid per month.

- Gusto Plus costs $80 per month plus $12 per employee or contractor paid per month.

- Gusto Premium is a custom plan that requires interest parties to request a custom quote.

Gusto also has a contractor-only plan that charges $6 per contractor paid per month. The plan has no base fee for the first six months. After the first six months, the price increases to $35 a month along with the employee fee.

Other Gusto plans and products include the following:

- International contractor payments (available in 120 countries).

- New-state tax registration.

- R&D tax credit optimization.

Paychex’s pricing

Paychex is a payroll processing and human resources software service. It provides online services such as geolocation and geofencing for organizations whose employees are often on the move. Paychex’s core capabilities are payroll, invoicing, insurance administration and compliance, workers’ compensation and benefits.

Paychex Flex is the company’s most popular HR platform. While Paychex offers a variety of other services, this all-in-one solution provides a good introduction to Paychex’s portfolio.

While both Gusto and Paychex have three main payroll plans, Paychex’s pricing isn’t as transparent as Gusto’s. Typically, the company only lists its cheapest plan’s starting price online.

However, Paychex is currently running a 65% off sale for its two higher-tier plans. New clients who sign up during the promotional period (which ends August 31, 2023) can lock in the 65% off price for a full 12 months:

- Paychex Flex Essentials starts at $39 per month + $5 per employee.

- Paychex Flex Select starts at $47 per month + $3 per employee (with the current promotion).

- Paychex Flex Pro starts at $95 per month + $3 per employee (with the current promotion).

Paychex also charges additional fees for services included in Gusto’s base price, such as accounting software integration, employee benefits administration, time and attendance tracking, workers’ compensation insurance and more.

Gusto vs. Paychex: Feature comparison

Full-service payroll

Winner: Gusto

Gusto and Paychex are among the best full-service payroll software for small businesses. Both payroll software tools will automatically calculate paycheck amounts, remit payroll taxes on your behalf, deposit employee paychecks and file end-of-year taxes.

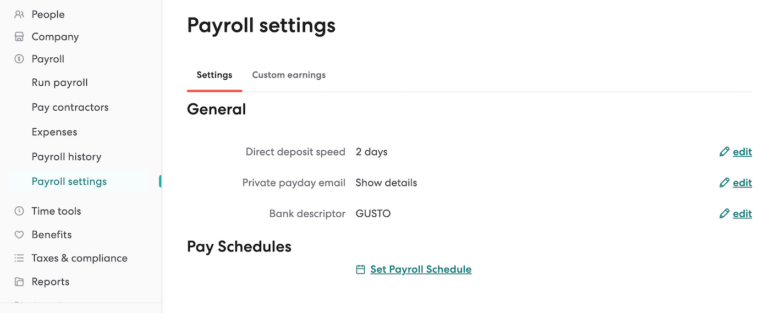

But although both providers have fairly thorough features, Gusto ultimately offers more payroll tools for a better price. With its cheapest plan, Gusto includes features like the following:

- Fee-free integration with Gusto-brokered health insurance plans.

- Hiring and onboarding tools like offer-letter templates and onboarding checklists.

- Free integration with third-party time-tracking, accounting and expense-management tools.

- Free workers’ compensation insurance integration.

- End-of-year W-2 and 1099 tax form filing.

Figure A

While Paychex also offers most of these tools, it often does so either with its higher-tier plans only or at an additional fee.

HR features

Winner: Paychex

Both Gusto and Paychex blend payroll and HR tools into one handy software package. While Gusto includes basic onboarding and hiring features with its cheapest plan, it doesn’t include HR essentials like compliance audits in any plan except its most expensive.

In contrast, even though it charges extra for many of its HR features, Paychex has more human resource support than Gusto does. Its features include the following:

- Learning management system.

- Employee handbook builder.

- Recruiting and applicant tracking.

Dashboard

Winner: Tie

Both payroll software services offer a typical dashboard with a main menu on the left side and other displays appearing in the middle as needed. However, Gusto and Paychex break down information differently in a way that may be more or less suitable for smaller or larger businesses.

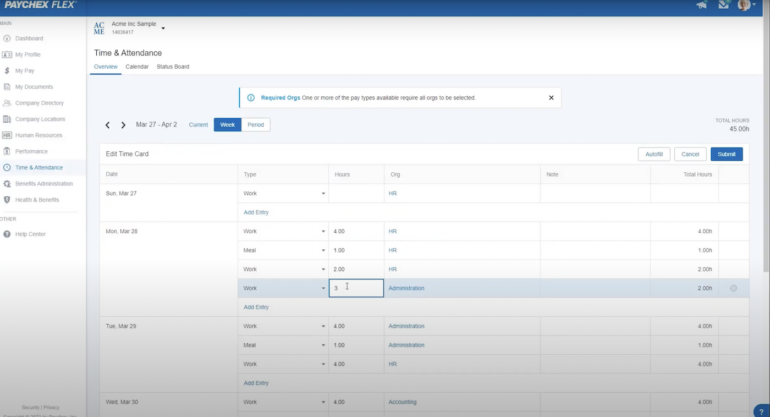

Paychex’s dashboard (Figure B) follows the classic Windows philosophy, offering insight into what the software is doing and providing the ability to play with a lot of settings.

Figure B

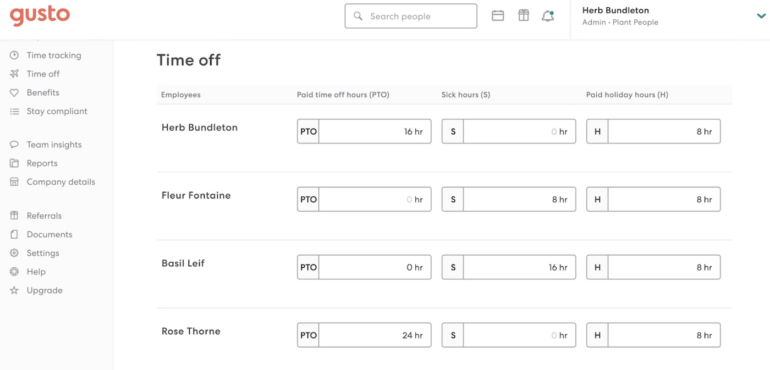

By comparison, Gusto’s dashboard (Figure C) is similar to Apple, hiding more information initially to promote an easier-to-use approach. In Gusto, instructions flow in a chronological fashion, whereas Paychex lets the user look at more information at one time in general.

Figure C

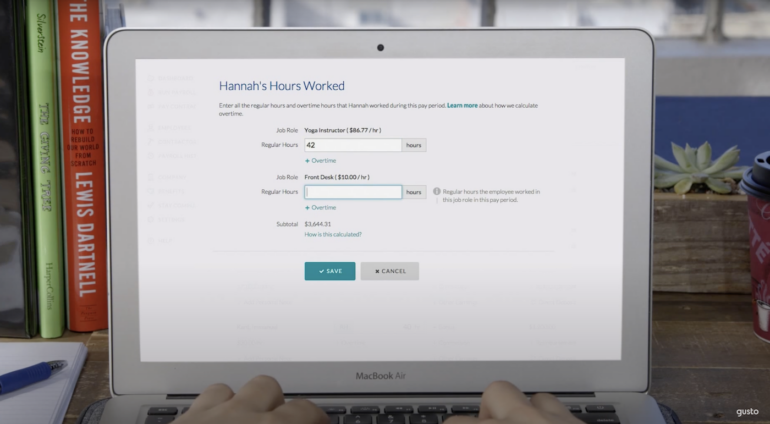

Employee portals

Winner: Gusto

Employees can log in to Paychex or Gusto (Figure D) to log their work time if they’re hourly and to check the status of payments. Gusto’s app walks employees through onboarding, while Paychex integrates with several proprietary hardware tools including a face recognition “clock-in” device called the Iris or similar retina scanning. Gusto does not offer hardware add-ons.

Figure D

Benefits administration

Winner: Gusto

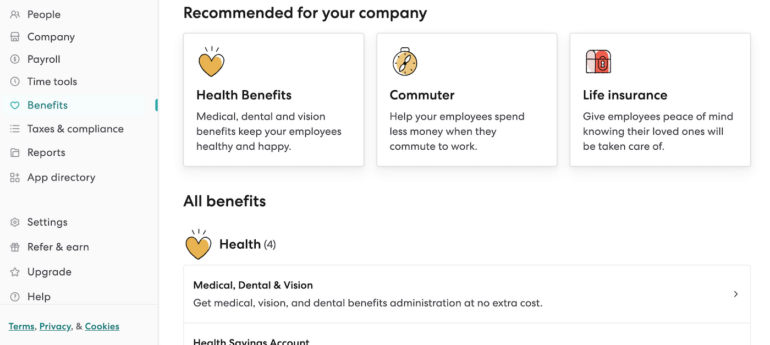

Both Gusto and Paychex offer benefits administration. While Paychex is able to offer better benefits in all 50 states, it costs users an extra fee to administer benefits. In contrast, Gusto’s in-house brokerage helps you find healthcare coverage that you can integrate with Gusto’s software at no additional fee. Users can also use Gusto to administer third-party health benefits for a low monthly fee. (Figure E)

Figure E

However, it’s worth noting that Gusto’s health benefits are only available in 37 states and Washington, D.C. Plus, Paychex offers professional employer organization benefits beyond the ones you can get with Gusto, including a variety of options for 401(k) management, which is fitting since it’s most suitable for larger and more geographically dispersed organizations.

Gusto pros and cons

Pros

- Wide variety of payroll services, including state tax registration, contractor payments, W-2s and 1099s.

- Easy to switch between salaried and hourly employee reporting.

- Streamlined and easy to use.

Cons

- Some reviews note poor customer service.

- Some reviews note delayed payroll.

- Compliance features limited to most expensive plan only.

Paychex Flex’s pros and cons

Pros

- Scalable for large organizations.

- Paychex Flex combines several types of reporting in one easy-to-use dashboard.

- Reliable customer support.

- Large number of customization options.

- Handles larger teams well.

Cons

- Expensive plans with extra fees for essential services.

- Some reviews note nested menus can be convoluted.

- Accessing custom reporting over more than a two-year period is not automated.

- PDF reports can be cumbersome.

Our methodology

To compare Gusto and Paychex, we set up an account with Gusto so we could experience its dashboard and functionality for ourselves. We viewed multiple demos of Paychex’s software and watched reviews and how-to videos. We also considered verified user reviews on third-party sites like Gartner Peer Insights.

Should your organization use Gusto or Paychex?

Larger organizations with more complicated payroll needs might want to choose Paychex for the greater number of customization options and display made to show a lot more information. Growing companies might want to choose Paychex for its ease of handling larger teams.

Gusto is a good choice for organizations that want an easy-to-use payroll system. Gusto is designed to hold a small business owner’s hand through the process of doing taxes according to state and federal regulations, so there’s less chance of running into unexpected payroll problems.

1

Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).