Wave and FreshBooks are two of the most noteworthy accounting software options for small businesses. Wave Accounting’s completely free software lets small-business owners — especially self-employed freelancers — track their finances, send invoices and get paid at no cost. FreshBooks, which starts at $17 a month, has more expansive invoicing features and multiple plans that scale up to support growing and midsize businesses.

However, FreshBooks can work well for some self-employed freelancers, and Wave Accounting’s features could be ideal for some small and midsize businesses. In our FreshBooks vs. Wave review below, we compare each software’s pros, cons, pricing and features to help you hone in on the right option for your needs.

Jump to:

FreshBooks vs. Wave Accounting: Comparison table

Wave and FreshBooks handle the same basic bookkeeping tasks, from invoicing and billing to expense tracking and beyond. Although they were built for different types of business owners (Wave for freelancers, FreshBooks for other small businesses), both accounting tools go out of their way to cater to non-accountant business owners.

However, the two tools differ in terms of how much they cost, how many automations they offer and which third-party apps they sync with for crucial tasks like payroll and time tracking.

| Feature | FreshBooks | Wave Accounting |

|---|---|---|

| Starting price | $17 per month | Free forever |

| Time and project tracking | Yes | No |

| Inventory tracking | Limited | No |

| User limits | Unlimited (extra fee) | Unlimited |

| Payroll integration | Gusto, SurePayroll | Wave Payroll |

| Other third-party integrations | 100+ | Through Zapier only |

| Learn more |

Plan and pricing data verified as of 6/9/2023.

Featured Partners

FreshBooks vs. Wave Accounting: Pricing

FreshBooks pricing and plans

Starting price: $17/mo. paid month-to-month or $183.60/yr. paid annually

FreshBooks’ four plans have fairly industry-standard pricing. Their features range from basic invoicing and accounting to enterprise-level financial reporting:

- FreshBooks Lite costs $17 per month and includes unlimited expense, income and sales tax tracking.

- FreshBooks Plus costs $30 per month and includes task automations, more thorough accounting reports and double-entry bookkeeping.

- FreshBooks Premium costs $55 per month and includes profit tracking, bill management and additional invoice customizations.

- FreshBooks Select is a custom plan for enterprises that requires a custom quote.

FreshBooks runs frequent sales throughout the year, offering new users discounts as deep as 60% or 70% off for up to six months. Businesses can also take advantage of a 10% discount if they pay annually rather than month to month.

Get more information on FreshBooks by reading our detailed FreshBooks review.

Wave Accounting pricing and plans

[Wave logo. Image: Wave Accounting]

Price: Free forever

Wave Accounting has just one plan and is completely free for life. You don’t have to enter any credit card information when you sign up for Wave, and you won’t pay anything to use the software itself.

The only charges you should expect while using Wave Accounting are standard transaction fees, which accompany all forms of online payment acceptance. In Wave’s case, those fees are as follows:

- 1% for ACH transactions.

- 2.9% + $0.60 for non-AmEx credit card transactions (Visa and MasterCard).

- 3.4% + $0.60 for all AmEx credit card transactions.

Transaction fees and data are accurate as of 6/9/2023.

Wave’s only paid software product is Wave Payroll, which starts at $20/month + $6/employee for self-service payroll or $40/month + $6/employee for full-service payroll.

Learn more about how Wave works by reading our comprehensive Wave Accounting review.

Feature comparison: FreshBooks vs. Wave Accounting

Financial tracking

Winner: Wave Accounting

Both Wave and FreshBooks help you keep a close eye on your finances via income and expense tracking. Once you connect your business bank accounts and credit cards with your preferred software, Wave or FreshBooks automatically pull in transaction data to keep you up to date on your finances.

However, FreshBooks’ cheapest plan relies on the single-entry accounting system, which is less accurate than the more widely accepted double-entry system. And unlike nearly every other accounting competitor, FreshBooks doesn’t include free accountant access with its cheapest plan either.

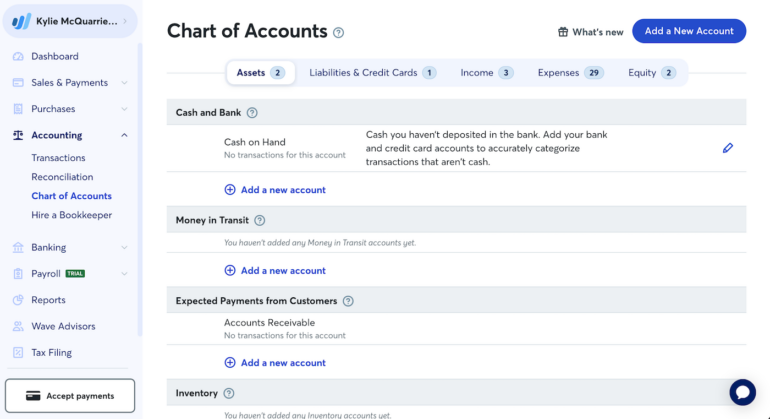

By way of comparison, Wave Accounting, Xero, QuickBooks Online and most other accounting software services automatically default to double-entry accounting. All of these competitors include accountant access with every plan, even plans that otherwise limit you to one user only. (Figure A)

Figure A

Invoicing

Winner: FreshBooks

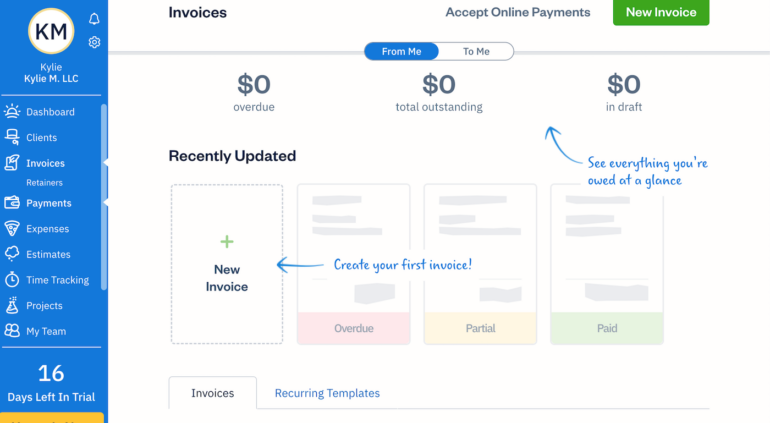

Both Wave and FreshBooks have excellent invoice templates that are easy to customize and send to clients. Both accounting products let you accept payments within the invoice, set up automatic recurring invoices and send payment deadline reminders.

However, FreshBooks has a few more invoicing features than Wave. For instance, with FreshBooks, you can attach expenses to your invoices for reimbursement, sync time-tracking data to each invoice, schedule automatic late payment charges and connect with your customers via FreshBooks’ client self-service portal. (Figure B)

Figure B

Wave Accounting wins big over FreshBooks in one key area: Truly unlimited invoicing. While FreshBooks lets you send an unlimited amount of invoices each month, it limits the number of clients you can send those invoices to.

| Plan name | FreshBooks Lite | FreshBooks Plus | FreshBooks Premium | FreshBooks Select |

|---|---|---|---|---|

| Billable clients per month | Up to 5 | Up to 50 | Unlimited | Unlimited |

Plan data accurate as of 6/9/2023.

User limits

Winner: Wave Accounting

Technically, both Wave Accounting and FreshBooks let you add unlimited users to your account. However, only Wave Accounting lets you do so for free.

Three of FreshBooks’ four plans include access for just one user in the base cost. (The enterprise-level accounting plan includes two users in the base cost.) While you can add as many users as you want, you’ll pay an extra monthly fee of $11 per person — a cost that can add up fast.

For instance, here’s how much you’ll pay for FreshBooks’ cheapest plan, FreshBooks Lite, with extra users.

| Base cost (FreshBooks Lite) | With 1 extra user | With 2 extra users | With 5 extra users | With 10 extra users |

|---|---|---|---|---|

| $17/mo. | $28/mo. | $39/mo. | $72/mo. | $127/mo. |

Plan and pricing data accurate as of 6/9/2023.

If you want multiple eyes on your accounts without paying extra, Xero has unlimited users. Zoho Books charges just $3 per month per extra user, and QuickBooks Online offers access for up to 25 users (depending on which plan you choose).

Time tracking

Winner: FreshBooks

Wave Accounting doesn’t have a built-in time-tracking tool, although you can use Zapier to integrate third-party apps like Timely with Wave. (Note that Wave Payroll doesn’t include built-in time tracking either.)

FreshBooks, in contrast, has an excellent time-tracking feature built into every plan. It’s easy to track time (for yourself or for any 1099 contractors you work with), then sync that time to your client’s invoice so you can be paid accurately for your time. (Figure C)

Figure C

Payroll integration

Winner: FreshBooks

Wave Accounting’s only built-in integration is with its payroll product, Wave Payroll. And while Wave Payroll is perfectly serviceable, that’s about all it is. The software includes only basic payroll features like paycheck calculation, direct deposit, access to one payroll report and end-of-year W-2 form generation.

Additionally, Wave Payroll’s full-service plan, which calculates and remits payroll taxes on your behalf, is limited to 14 states. Clients in all other states must use Wave Payroll’s self-service plan, which costs less but requires you to file payroll taxes on your own.

In contrast, FreshBooks syncs with Gusto and SurePayroll, two of the most fully featured payroll solutions for small businesses in the U.S. (FreshBooks also has built-in payroll integrations for its software users in Canada, the U.K. and Australia.) Gusto is a full-service payroll provider only while SurePayroll has both a self-service and full-service plan.

Unlike Wave Payroll, Gusto and SurePayroll can help you find healthcare and other benefits for your employees (though with Gusto, health insurance is available in only 37 states and D.C.). Both providers also have more HR tools than Wave, including new-hire reporting and basic onboarding features.

Customer service

Winner: FreshBooks

Since Wave Accounting is a free tool, it doesn’t have robust customer support. Users can always access Wave’s resource library online or contact the customer service team via email, but Wave lacks any phone- or chat-based support. (The same thing is true for Wave Payroll as well: Customer service is email-only.)

FreshBooks has a robust online resource library and a basic troubleshooting chatbot. Most importantly, it also has email and phone support. You can request help directly from your FreshBooks dashboard, which includes quick links to the FreshBooks help center.

FreshBooks pros and cons

Pros

- Excellent invoice features, customizations and automations.

- User-friendly interface and mobile app.

- Responsive customer service with multiple methods of contact.

- 100+ third-party integrations, including Gusto and SurePayroll.

- Built-in project management, time tracking and expense tracking.

Cons

- Far fewer third-party integrations than most competitors (especially Xero and QuickBooks).

- High fee for additional users.

- No accountant access or double-entry accounting with basic plan.

- Limited inventory management features.

- Billable clients limited by plan.

Wave Accounting pros and cons

Pros

- Completely free accounting software.

- Double-entry accounting with general ledger and chart of accounts.

- Straightforward Wave Payroll integration.

- Unlimited users, bank account syncing and business management.

- Clear, simple setup instructions with user-friendly interface and app.

Cons

- Third-party app integrations through Zapier only (subscription required).

- Limited email-only customer service.

- One plan (not scalable for growing businesses).

- Limited accounting features.

Our methodology

To compare Wave Accounting vs. FreshBooks, we created free accounts with both services so we could test each tool’s user-friendliness, features, and mobile apps. We viewed demos and product specs on both competitors’ sites. We also considered opinions from verified users on third-party sites (the BBB, the App Store and Google Play, among others) to draw conclusions about overall customer satisfaction, customer service responsiveness and more.

To guide our research, we focused specifically on how each software solution excelled or fell short in the following areas:

- Overall accounting and bookkeeping features.

- Pricing and plans.

- Overall customer satisfaction and company reputation.

- User-friendliness and accessibility, including ease of setup and access to mobile apps.

- Integration with other software, especially third-party payroll providers.

Should your business use FreshBooks or Wave Accounting?

While you should always take your business’s unique needs into account when choosing an accounting software provider, we recommend following these general guidelines.

Consider FreshBooks over Wave Accounting if:

- You run a service-based freelancing business and charge clients by time or project.

- You want an easy way to collaborate with clients on project costs.

- You want accounting software that offers slightly more than the basics without getting bogged down in overly complex features.

- Your company is growing but you don’t plan to become a midsize business or large corporation.

Consider Wave Accounting over FreshBooks if:

- You’re a freelancer, solopreneur, self-employed contractor or a small-business owner with a handful of employees.

- You want user-friendly software that lets you charge customers and manage your finances at no cost.

- You need basic accounting tools only, such as income tracking, online payment acceptance, expense tracking and invoicing.

- You don’t rely on many third-party apps to manage your business.

If you don’t think either Wave or FreshBooks will work for you, there are dozens more accounting software options to choose from, starting with these:

- QuickBooks Online starts at $30 a month and has more accounting features than either FreshBooks or Wave.

- Xero starts at $13 a month and includes unlimited users and inventory tracking with every plan.

- Zoho Books costs nothing for businesses with an annual revenue >$50K USD. Its plans include at least as many features as QuickBooks Online, if not more.

Finally, even if you’re pretty sure you’ve found the right accounting product for your business, we recommend taking it out for a test-drive first. All the products on this list are free (like Wave Accounting), offer a free plan (Zoho Books) or include a 30-day free trial (QuickBooks, Xero and FreshBooks).

Setting up a free account is the ideal first step toward finding accounting software that will help you meet — and even exceed — your financial goals.

Read next: Vendor comparison: Small business financial accounting software