Both services provide similar offerings but with notable differences — like how Deel offers a free plan while Papaya uses AI for valuable payroll automation. We’ll pick apart the two so you can decide which is best for your business.

Deel and Papaya are global payroll and HR companies that offer international contractor and Employer of Record (EOR) services. While they have some similarities, there are some key differences that set them apart from each other. In this guide, we will compare Deel vs. Papaya in depth to help you decide on the right choice for your business.

Jump to:

Deel vs. Papaya: Comparison table

| Features | Deel | Papaya |

|---|---|---|

| Global payroll | Yes | Yes |

| Contractor management | Yes | Yes |

| Employer of record (EOR) | Yes | Yes |

| Mobile app | No | Yes |

Deel vs. Papaya: Pricing

Deel pricing

Deel offers three types of pricing plans: contractor payroll, EOR payroll and direct employee payroll.

- The contractor payroll plan starts at $49 a month.

- Deel’s EOR services for paying international employees starts at $599 a month.

- Businesses with 200 or less direct employees — hired through their own entities — can use Deel for free.

- Businesses with more than 200 direct employees need to contact Deel for a pricing quote for the enterprise plan.

For more information, see the full Deel review.

Papaya pricing

Papaya offers multiple services that you can mix and match to suit your needs.

- Full-service payroll starts at $12 per employee per month.

- Payroll platform license starts at $3 per employee per month.

- Data and insights platform license starts at $150 per location per month.

- Payments as a service starts at $3 per employee per month.

- Employer of Record starts at $650 per employee per month.

- Contractor management starts at $2 per contractor per month.

- Global expertise services start at $190 per employee per month.

Unlike Deel, Papaya does not offer a free trial or a forever free plan so you can extensively test the product before committing to it. However, it is one of our favorites for enterprise payroll with its more tailored pricing options, so if you have more complex enterprise needs, it’s worth looking into.

For more information, see the full Papaya Global review.

Deel vs. Papaya: Feature comparison

Global payroll and HR

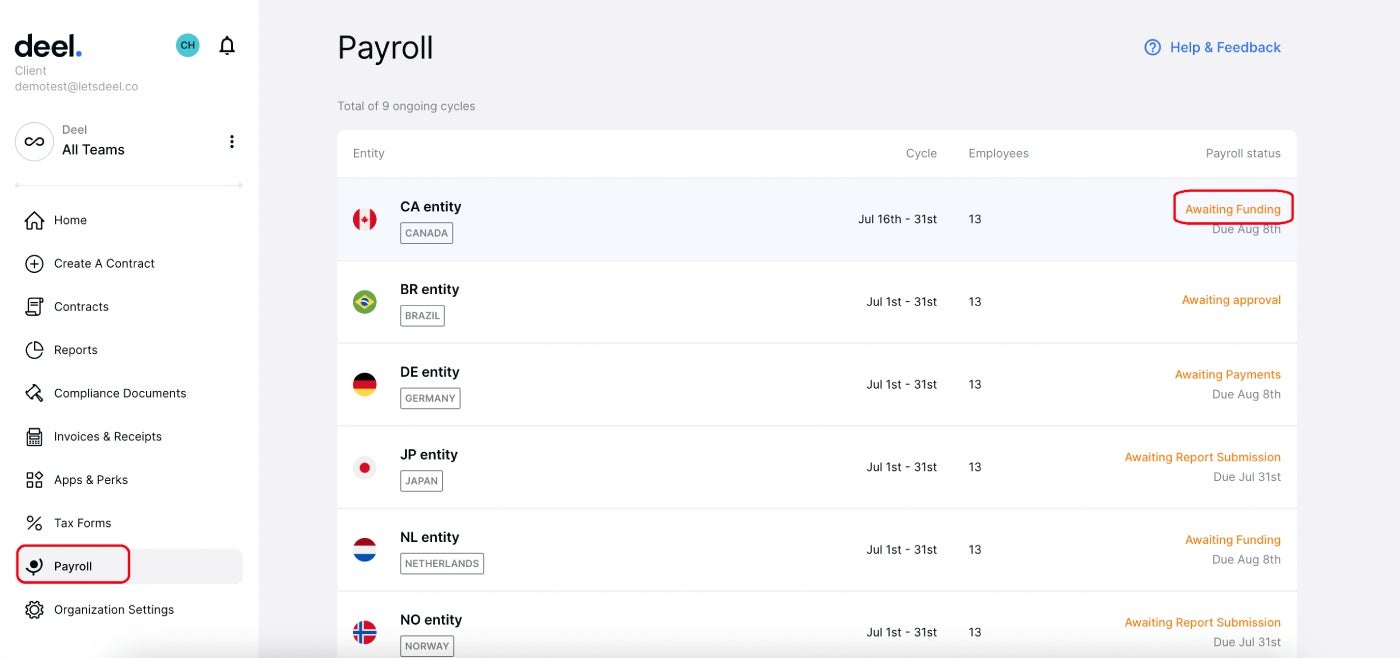

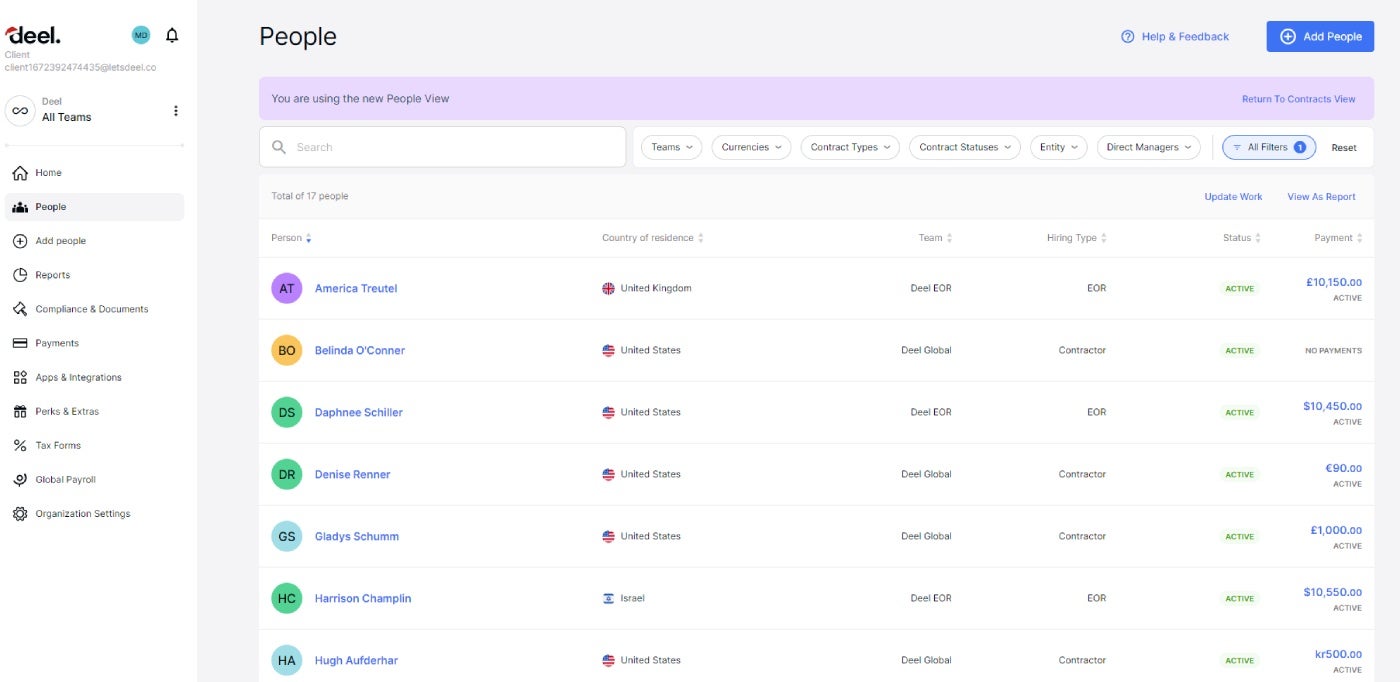

Deel lets you run payroll in 100+ countries on a single platform, which allows you to streamline compliance, taxes, benefits and more. Deel’s payroll experts can help you navigate compliance issues or set up an entity. You can also manage visa support and PTO admin within the same system, and Deel includes other HR tools besides just payroll, such as a people database, onboarding and offboarding tools and employee engagement surveys.

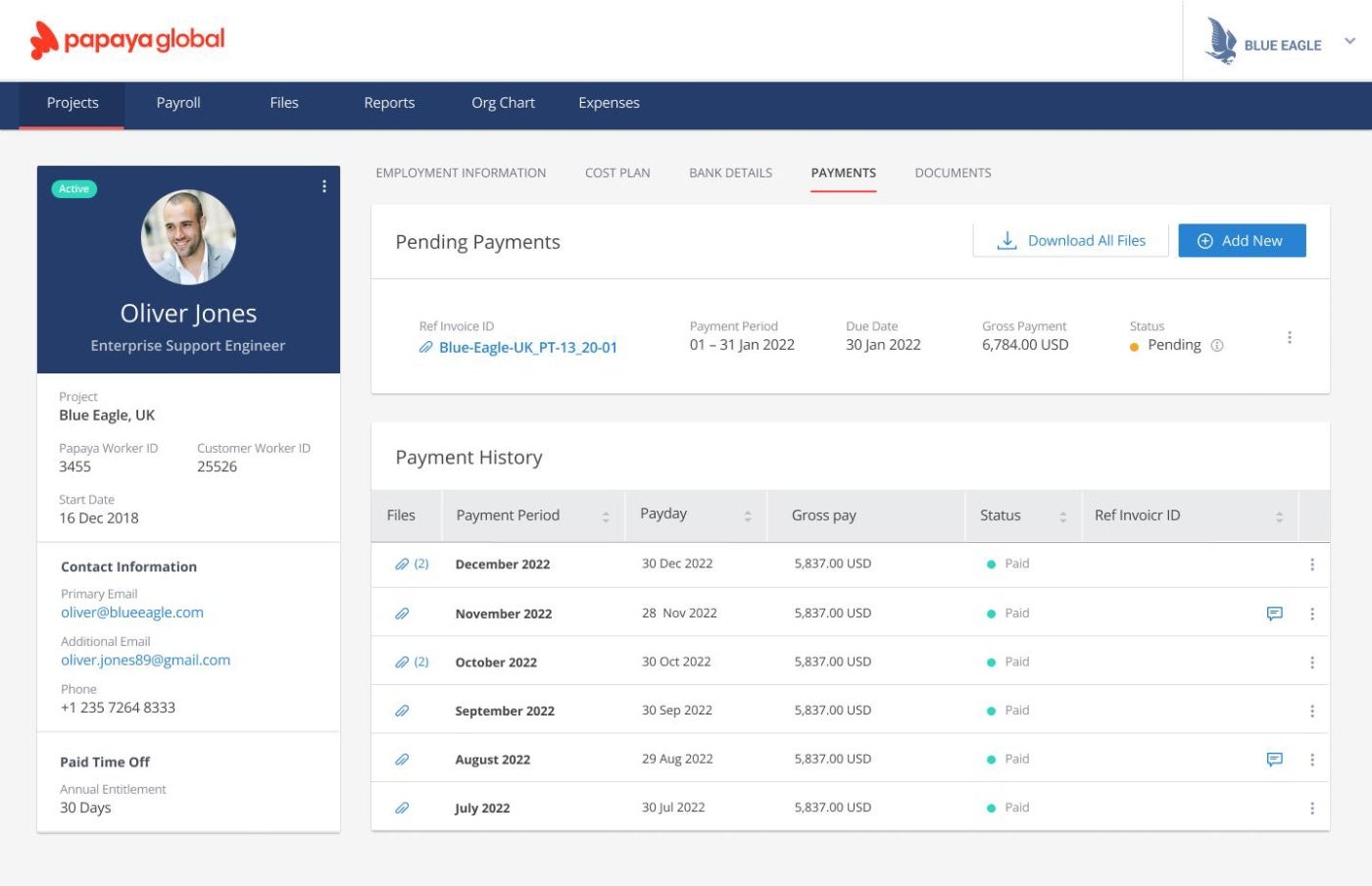

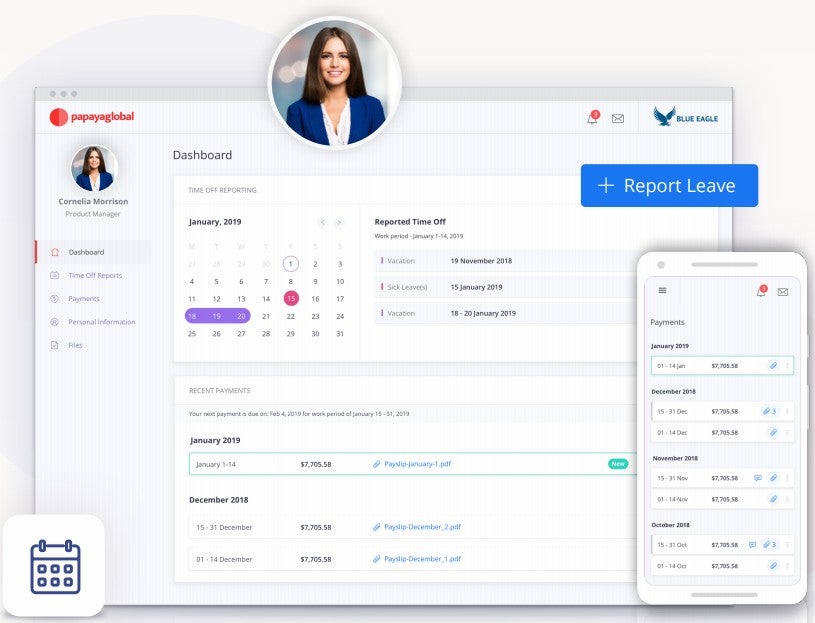

Papaya’s global platform lets business owners run payroll in 160+ countries. It’s powered by artificial intelligence to help automate the payroll process, detecting anomalies and speeding up processing. The payroll platform supports all types of employment and includes benefits and equity as well. To streamline payments, Papaya utilizes a virtual “wallet” that allows you to find a single bank account and then use it to pay employees in multiple currencies. Papaya also offers a self-serve mobile app for employees. Papaya does include some onboarding tools, though it doesn’t have as many HR capabilities as Deel.

Contractor management

When it comes to paying contractors, Deel offers 15 payment methods as well as a Deel card — a debit card that contractors can use to make payments straight from their Deel account using a stable currency. The system lets you generate W-9s for U.S. team members and file 1099s with a single click. The service also offers additional misclassification protections for employers who pay for the upgraded Deel Shield and Deel Premium plans.

Papaya, on the other hand, offers a dedicated portal so contractors can submit invoices directly into the system. Plus, it has country-specific tax forms and agreement templates to help you avoid costly misclassification mistakes. Automatic notifications and calculations speed up the payment process, and a bulk payment feature lets you pay the whole team at once. You can also transition a contractor to full-time or EOR within the same system.

Employer of Record

Both Deel and Papaya Global offer EOR services, in which they act as a third-party go-between that assumes all the hassle and compliance risks of hiring and paying employees internationally. (If you’re interested in EOR services specifically, check out our article on Papaya Global competitors, which lists some more options.)

Deel currently offers EOR services in 90+ countries and owns all of its international hiring entities except for China, which means you’ll have a seamless experience no matter what country you plan to hire in. Deel also provides localized benefits for each country and allows you to edit and sign contracts directly in the app with document management tools.

Papaya offers EOR services in 160+ countries. Instead of owning local entities, Papaya partners with organizations that are already working there to hire international employees. The EOR solution provides both mandatory and non-mandatory benefits to ensure compliance and a competitive compensation package.

Deel pros and cons

Pros of Deel

- Free plan for businesses under 200 employees.

- Good selection of HR tools.

- Easy-to-use payroll system.

- Dedicated customer success manager for enterprise clients.

Cons of Deel

- No mobile app available.

- Contractor plan which is more expensive than some competitors.

- Must pay extra for contract misclassification protection.

- Not as comprehensive as dedicated HR software.

Papaya pros and cons

Pros of Papaya

- Great international payroll service.

- Excellent data analytics tools.

- Contractor plan which is more affordable than Deel’s.

- Newly launched employee mobile app.

Cons of Papaya

- Limited HR capabilities.

- EOR plan which is more expensive than Deel’s.

- No free trial or plan.

Review methodology

To compare Deel and Papaya Global, we looked at their global payroll and HR tools, and considered their Employer of Record (EOR) services and contractor management plans. We also weighed other factors such as pricing, user experience and ease of use. Furthermore, we consulted user reviews, product documentation and demo videos to more thoroughly compare the two.

Should your organization use Deel or Papaya?

Both Deel and Papaya offer a similar set of features when it comes to running global payroll, managing international contractors and engaging an EOR service. The differences come down to details, so when comparing these two services, be specific about what exact features you need and how much you are willing to pay for them.

For instance, Deel’s contractor plan is much more expensive than Papaya’s, but it offers the Deel debit card option. Deel also has its own EOR entities while Papaya does not, which may or may not matter to your company. Additionally, Deel has more HR tools included in its main plans, whereas Papaya offers more robust reporting capabilities but charges extra for them.

On the other hand, Papaya Global’s $3 payroll platform licensing fee, global benefits, comparatively fast setup time and new employee-facing app are all solid reasons to schedule a free demo before committing to either global payroll option.

Deel’s free plan, which covers companies with less than 200 people, is also a big differentiator. Even if your company has more than 200 people, this free plan still allows you to test the software for an extended period of time without financial commitment. Papaya does not offer a free trial or plan, so you’ll have to make your decision based on the demo alone.

Still not sure if Deel or Papaya is right for your needs? Check out our list of the best international payroll services and the best payroll software for 2023 to see what other options are out there.

1

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

3

Justworks

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.