The Federal Reserve may have paused its aggressive interest rate hikes for now, but that offers little relief for anyone with credit card debt.

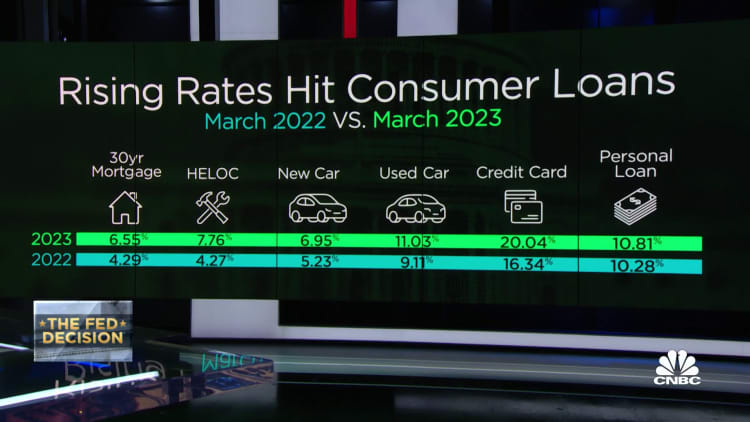

The central bank raised interest rates 10 times since last year — the fastest pace of tightening since the early 1980s — and that has caused credit card rates to hit an all-time high.

“Even though the Fed has hit the pause button on its rate-hiking campaign, the cumulative effect is significant,” said Ted Rossman, senior industry analyst at Bankrate.

More from Personal Finance:

3 financial risk areas for consumers to watch

Americans are saving far less than normal

A recession may be coming — here’s how long it could last

Since most credit cards have a variable rate, there’s a direct connection to the Fed’s benchmark. As the federal funds rate rose, the prime rate did, as well, and credit card rates followed suit.

The average credit card now charges a record 20.69%, nearly five percentage points higher than the beginning of last year, according to Rossman.

“While the skip means interest rates may not rise again this month, the high credit card interest rates consumers are currently seeing are going nowhere anytime soon,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

Tackling credit card debt ‘is an urgent priority’

Sky-high APRs make credit cards one of the most expensive ways to borrow money from month to month and yet, many Americans continue to take on ever-increasing amounts of debt. While balances are higher, nearly half of credit card holders carry credit card debt from month to month, according to a Bankrate report.

“Paying down high-cost, variable-rate debt is an urgent priority for households,” said Greg McBride, chief financial analyst at Bankrate.

Experts often recommend moving that balance from a high-rate credit card to one with a no-interest or low-interest balance transfer offer to reduce the amount of interest you’re paying.

Balance transfers are ‘the best weapon’

“My top tip is to sign up for a 0% balance transfer card. These allow you to avoid interest for up to 21 months,” Rossman said.

While the offers may be a little harder to find than they were one year ago, “the good news is that you can still get balance transfer credit cards, assuming you have good credit, and they can save you a ton of money,” said Matt Schulz, chief credit analyst at LendingTree.

“They are still about the best weapon you can have in your arsenal.”

To make the most of a balance transfer, aggressively pay down the balance during the introductory period.

Otherwise, there could be a catch: If you don’t pay the balance off during the initial period, the remaining balance will have a new annual percentage rate applied to it, which is generally about 23%, on average, slightly higher than the rates for new credit.

Further, there can be limits on how much you can transfer as well as fees attached. Most cards have a one-time balance transfer fee, which is usually about 3% of the tab, but there can be an annual fee as well.

One late payment can negate your no-interest offer.

For more on balance transfer credit cards, check out CNBC Select’s recent ranking on the best balance transfer credit cards.