The second quarter (July-September) is usually the least profitable time for airlines, with the average Q2 profit contribution for leading Indian carrier IndiGo being only 13 per cent during FY16-18. As expected, July 23 saw a significant decrease in passenger load factor (PLF) for most airlines. Despite this, ICICI Securities holds a positive outlook on the supply-demand balance of the Indian aviation industry in the medium term, which is the basis of their investment strategy for IndiGo.

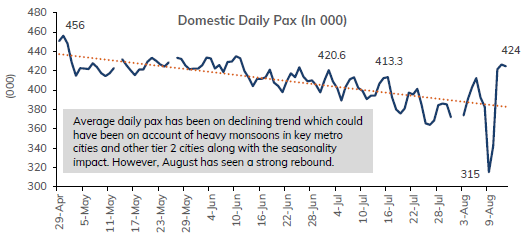

Domestic traffic experienced a seasonal decline in July 23, with a total of 12.1 million passengers compared to 12.5 million in June 23 and 13.2 million in May 23. However, there has been a strong recovery in August 23, with a daily average of 389,000 passengers due to holiday travel.

IndiGo continues to increase its market share, which stood at 63.4 per cent in July 23, up by 20 basis points (bps) from the previous month, while the Tata group’s combined market share was 26.8 per cent in the same period.

Most airlines experienced a sequential decline in PLF, as is typical of Q2. IndiGo’s PLF dropped by 720 bps to 83.7 in July 23 from 90.9 in June 23. In July 2017 and July 2019, PLF also decreased by 416/393 bps, while July 2016 and July 2018 saw an increase of 574/40 bps, respectively. In terms of international traffic, Indian airlines saw a marginal 2 per cent MoM decline in July 23, carrying a total of 23 million passengers, while IndiGo experienced a 1.6 per cent MoM increase in its international passengers, resulting in an increase of 140 bps in its international market share to 40.9 per cent among Indian airlines.