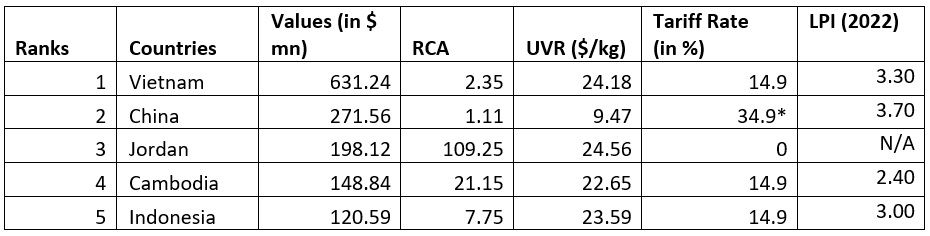

Table 1: Top 5 countries exporting women’s synthetic trousers (HS code-610463) to the US and trade statistics of CY 2024

US market for women’s synthetic trousers is highly competitive, with Vietnam, China, Jordan, Cambodia, and Indonesia leading exports.

Vietnam dominates due to strong specialisation and pricing balance, while Jordan benefits from tariff-free access.

China’s cost efficiency offsets tariff burdens, though its competitiveness may decline.

Cambodia and Indonesia hold mid-range positions.

Source: TradeMap and F2F Analysis, *Effective March 4, 2025

Note: LPI (Logistic Performance Index)

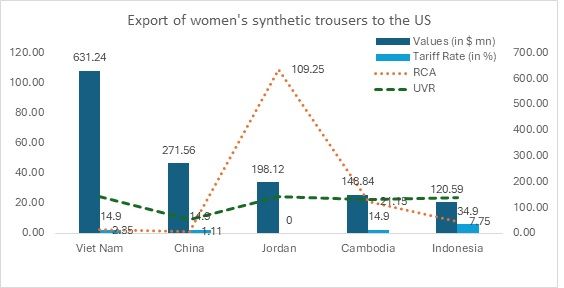

Figure 1: Top 5 countries exporting women’s synthetic trousers to the US and trade statistics of CY 2024

Source: TradeMap, F2F Analysis

Trade Overview

Vietnam: Market leader with strong RCA and competitive UVR

Vietnam leads the US market for women’s synthetic trousers, boasting an impressive export value of $631.24 million. With an RCA of 2.35, Vietnam demonstrates a strong specialisation in this product category, reinforcing its dominance in global trade.

Vietnam’s UVR of $24.18/kg positions its exports in the mid-range price segment, striking a balance between affordability and quality. This competitive pricing strategy enables Vietnam to cater to both value-conscious buyers and those seeking reliable quality at a reasonable cost.

Despite facing a 14.9 per cent tariff rate, Vietnam remains highly competitive due to its efficient production capabilities, economies of scale, and well-integrated supply chains. The country’s ability to produce cost-effective, high-quality trousers has solidified its status as a key supplier to the US market, allowing it to maintain a significant edge over competitors.

China: Strong exporter facing high tariffs

China ranks second with an export value of $271.56 million. Its RCA of 1.11 reflects a moderate comparative advantage, while its UVR of $9.47/kg places its products in the lower price range. However, China faces a high tariff rate of 34.9 per cent, which slightly impacts its pricing competitiveness in the US market.

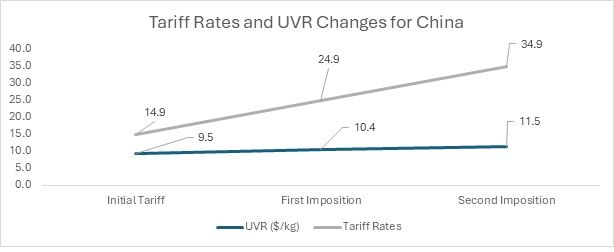

Figure 2: Tariff rates (%) and UVR ($/kg) for China

Source: F2F Analysis

Tariff Impact: With the first tariff imposition on February 4, 2025, the tariff rate increased to 24.9 per cent. This rise in the tariff burden would lead to an increase in the UVR as production and export costs rise. As a result, the UVR would likely increase to around $10.40/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR indicates that the product is becoming more expensive, which could make it less attractive for price-sensitive US consumers.

In the second tariff imposition, effective from March 4, 2025, the tariff rate rose further to 34.9 per cent. This substantial increase would push the UVR to approximately $11.50/kg or higher. The higher tariff burden will continue to raise costs, further diminishing the cost-effectiveness of women’s synthetic trousers.

However, China might continue to dominate in the segment despite the tariff imposition. This is because China has been able to produce women’s synthetic trousers at much lower prices compared to its competitors. The tariffs are unlikely to affect the key strength of China’s women’s trousers—cost-effectiveness.

Jordan: Tariff-free advantage with high RCA and competitive UVR

Jordan is a strong competitor with an export value of $198.12 million and an impressive RCA of 109.25, indicating a dominant comparative advantage in producing synthetic trousers. With a UVR of $24.56/kg, Jordan’s products are positioned in the mid-to-high price range, making them highly attractive to quality-conscious US consumers. The biggest advantage for Jordan is its tariff-free access to the US market, which enables it to offer competitive pricing while maintaining high-quality standards. Jordan’s tariff-free status gives it a significant edge over countries facing higher tariffs.

Jordan also benefits from its relative proximity to the US, which helps reduce trade costs. It avoids higher logistics expenses while benefitting from zero-tariff access.

Cambodia: Competitive player with strong RCA and moderate UVR

Cambodia ranks as the fourth-largest exporter of women’s synthetic trousers to the US, with an export value of $148.84 million. Its exceptionally high RCA of 21.15 underscores its strong specialisation in this product category, making it a key player in global trade.

With a UVR of $22.65/kg, Cambodia positions itself in the mid-price segment, offering a balance between affordability and quality. While its 14.9 per cent tariff rate is moderate, it poses a challenge in competing with tariff-exempt exporters like Jordan, which enjoys a pricing advantage.

Despite tariff pressures, Cambodia maintains a strong market presence due to its lower production costs, skilled workforce, and well-integrated supply chains. Its competitive pricing allows it to challenge lower-cost exporters like China while offering a quality alternative to higher-priced suppliers. As trade dynamics shift, Cambodia’s ability to sustain cost efficiency and capitalise on its strong RCA will be crucial in maintaining and expanding its share in the US market.

Indonesia: Emerging competitor with moderate RCA and UVR

Indonesia ranks as the fifth-largest exporter of women’s synthetic trousers to the US, with an export value of $120.59 million. Its RCA of 7.75 reflects a moderate specialisation in this category, while its UVR of $23.59/kg places it in the mid-to-high price range.

Like Cambodia and Vietnam, Indonesia faces a 14.9 per cent tariff rate, which, while moderate, presents challenges in a market historically dominated by China’s cost-efficient exports.

Despite its strong RCA, Indonesia struggles to gain a significant foothold due to pricing constraints. Its higher UVR makes it less competitive against China’s lower-priced offerings, which continue to dominate the segment despite tariff hikes. Additionally, established supply chains and buyer preferences for Chinese products make it difficult for Indonesia to capture a larger share of the market.

To strengthen its position, Indonesia may need to focus on product differentiation, value-added features, or trade agreements that could provide a tariff advantage over competitors.

Competitive summary & outlook

- Vietnam will likely sustain its leadership due to its balanced pricing, strong RCA, and moderate tariffs.

- Jordan will capitalise on its tariff-free advantage, strengthening its position in higher-value segments.

- Cambodia and Indonesia will continue competing for mid-range buyers, but Cambodia’s cost-effectiveness may give it a slight edge.

- China’s dominance will weaken but not disappear, as its cost-efficiency and logistical strength will offset some of the tariff impact.

Looking ahead, trade policies, tariff shifts, and evolving buyer preferences will be critical in shaping market dynamics. Countries that combine production efficiency with strategic pricing and trade advantages are likely to capture greater share in the US women’s synthetic trousers market.

Fibre2Fashion News Desk (NS)