“Everybody’s lookin’ for somethin’,” as the song says. And you are looking for a way to accept payments that isn’t bolted to the floor. But if you’re here, that might mean you haven’t quite found it yet.

We can help you with that search. In fact, you might find that picking the right processor for taking mobile payments is almost as easy as pinning down what you mean by “mobile.”

Top mobile credit card processing comparison

As we discuss in deeper detail further down in the article, there are a number of key reasons you might be looking for mobile credit card processing specifically.

Whether it’s just the added convenience of being able to carry your POS solution around your place of business or your line of work necessitates something that gets the job done far from the comforts of civilization, one thing is clear: a standard checkstand isn’t what you’re looking for.

Now, with all that in mind, we highlight the most critical points — i.e., the ones that will most likely signal if a solution won’t be the right fit for you. Peruse said table, then jump down to the list to learn more about the ones that meet your standards at a glance.

| Our rating (out of 5) | Starting subscription cost | Lowest transaction fee | Lowest-price POS hardware | Offline mode? | |

|---|---|---|---|---|---|

| Square | 4.83 | Starting at $0 per month | 2.6% + $0.10 | Square Reader (free) | Yes |

| SumUp | 4.56 | Starting at $0 per month | 2.6% + $0.10 | SumUp Plus ($54) | Depends on POS hardware |

| Payment Depot | 4.43 | By quote | “Interchange Plus”, as low as 0.2% | None (3rd-party only) | Depends on POS hardware |

| Helcim | 4.16 | No subscription fee | Base interchange, plus 0.15% + $0.06 | Helcim Card Reader ($99) | No; mobile or wifi connection required |

| Payanywhere | 4.16 | Starting at $0 per month | 2.69% | Payanywhere 3-in-1 Reader (free) | Yes |

| GoDaddy | 4.06 | No subscription fee | 2.5% + 0¢ | Tap to Pay via mobile | No; mobile or wifi connection required |

| Clover | 4.06 | Starting at $0 per month | 2.3% + 10¢ | Clover Go ($199) | Yes |

| PayPal | 4.03 | No subscription fee | 2.29% + $0.09 | PayPal Card reader ($29) | Yes |

Square: Best overall

Our rating: 4.83

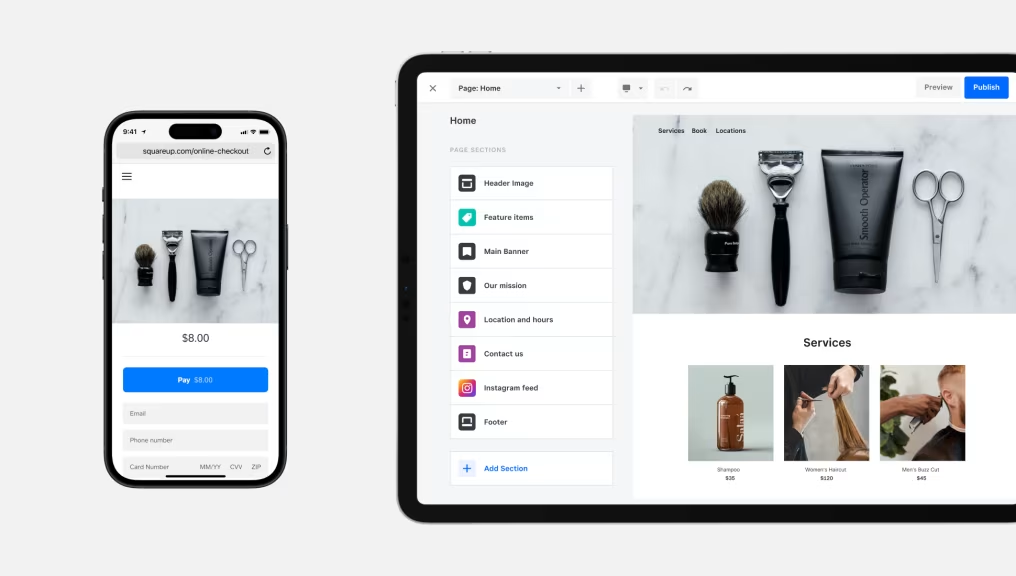

Square tops a lot of our POS and payment best-of lists. And, it’s not without good reason. In many ways, Square birthed the entire category of financial solutions it now dominates. Their flagship product, a square-shaped phone peripheral enabling card-present payments, was the first of its kind.

To this day, the freebie card reader they send to newly signed accounts lowers barriers to entry and empowers small businesses to turn their passions into professions.

Why I chose Square

As you may have noticed above, Square checks all the major boxes for this list. Reasonable transaction fees, no subscription fees, free card reader on signup, and offline functionality — you could do a lot worse than Square as both a POS and a merchant services provider. On the contrary, the majority of new and growing businesses will likely find Square offers all they need, and then some.

Pricing

- Free: pay only the transaction fees, starting at 2.6% + $0.10 per transaction.

- Plus: starting at $29 per month, plus processing fees.

- Premium: custom pricing (plus processing fees).

Features

- Free Square Reader with every account (and signing up is free, too).

- Reliable service from a trusted brand; take nearly every possible payment method, from virtually anywhere (even offline).

- Plenty of POS hardware to choose from.

Pros and cons

| Pros | Cons |

|---|---|

| Affordable transaction fees for in-person payments. | Fees scale up quickly for card-not-present transactions. |

| Offline mode for when the Wifi Spirits fail you. | Square POS hardware and payment processing go hand-in-hand; if you’re using one, you’re using both. |

| Free card reader, and free subscription tier, with room to upgrade both if you need it. | Free card reader only takes swipes. |

SumUp: Best budget option

Our rating: 4.56

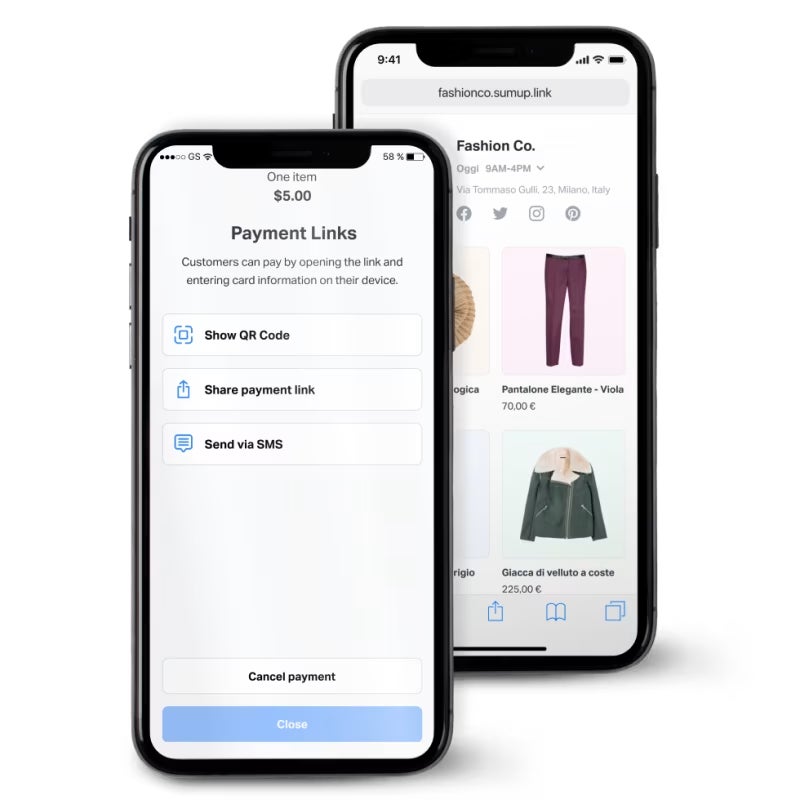

SumUp is comparable in many ways to Square in both pricing and functionality. With no starting fees and plenty of low-cost options, it’s a budget-friendly solution to many problems smaller businesses face. What sets them apart, though, is what’s included in the upgrades.

Though you can start using SumUp for free, and can pick up a mobile card reader for as little as $54, SumUp offers upgrades in both their hardware and their services, both of which come at lower costs than what competitors charge for comparable features.

Everything from mobile POS with receipt printing to customer loyalty features and marketing automation, SumUp offers room to grow with minimal financial strain.

Why I chose SumUp

It’s not uncommon for more advanced hardware and features to quickly exceed the budget of new and growing businesses. Some POS hardware goes for thousands just for a single station. And business services like SMS/email marketing, customer loyalty programs, and similar B2B solutions are often an entire business model unto themselves (with a price tag to match).

SumUp is a little different. With affordable transaction fees and flat subscription pricing, you’re never guessing how much you’ll have to pay. And with their upgraded offerings less expensive than many of their peers in the space, it’s easier to opt for more advanced tools if you need them.

Pricing

Transaction fees:

- In person: 2.6% + $0.10.

- Online/manual entry: 3.5% + $0.15.

- Invoicing: 2.9% + $0.15.

Subscription fees:

- POS Lite: Free.

- SumUp POS with Connect Lite: $99 per month.

- SumUp POS with Connect Plus: $199 per month.

- SumUp POS with Connect Pro: $289 per month.

Features

- Dedicated installation and training.

- Free and low-cost options for those who need them.

- Upgraded subscriptions include marketing automation and customer loyalty features.

- Advanced hardware capable of inventory management and more.

Pros and cons

| Pros | Cons |

|---|---|

| Affordable solution. | Offline mode only available on stationary hardware. |

| Also great as an inexpensive “upgraded” solution, both in hardware and software. | Not as good a fit for larger teams or more complex businesses. |

| More offerings to choose from than even other competitors in this list. | There are less expensive solutions if you plan to do a lot of online selling. |

Payment Depot: Best for wholesale transaction rates

Our rating: 4.43

Our only processor-only entry on the list, Payment Depot is compatible with plenty of 3rd-party POS hardware options, but doesn’t have any branded gear of their own.

Instead, Payment Depot’s whole value proposition is basically “Costco, but for processing card transactions.”

By paying a flat subscription fee (determined by your sales volume), you get access to “Interchange Plus” pricing — a model where instead of paying a uniform transaction fee, the processor adds a flat, unchanging margin on top of every interchange fee. In other words, your price per swipe will be variable, but you’ll be paying the lowest possible fee each time.

Why I chose Payment Depot

Interchange rates are…kind of all over the place. The fees that banks and card issuers charge for a given transaction vary by location, card type, what color of socks you’re wearing that day, and a host of other things (ok, one of those might be hyperbole, but not by much).

Most of the time, providers deal with this by leveling things out, and charging you a flat fee. That’s easier to understand and easier to calculate for you, but it means that if you get a lot of business with lower interchange rates, you’re paying more than you have to.

Payment Depot does the opposite. Rather than simplify to the detriment of savings, they prioritize savings, even if it means the pricing gets a little more confusing. Of the options on the market, those offering interchange plus are the least expensive per transaction. And since Payment Depot doesn’t make its own POS hardware, you’re free to bring your own device rather than buy an expensive branded product.

Pricing

Subscription costs with Payment Depot are by quote only, and their rates are variable, so you’ll have to contact them for specifics. However, interchange plus is widely accepted as the most affordable transaction fee structure.

Features

- Low-cost interchange plus pricing.

- Compatible with a number of POS hardware/service brands, like Clover (see further down in the list).

- Support is available 24/7.

Pros and cons

| Pros | Cons |

|---|---|

| Save just about as much as possible with every transaction. | Doesn’s support high-risk businesses. |

| Pick a POS provider based on your preference and needs, rather than being stuck with the processor’s proprietary stuff. | Not as beneficial for low-volume use (like we said—Costco for processors). |

| No setup fees. | Between quote-based pricing and variable rates, cost structure is less transparent than we would like. |

Helcim: Best for low fees and surcharging

Our rating: 4.16

Helcim is another interchange plus processor, like Payment Depot. That means they boast many of the same benefits and advantages. However, unlike Payment Depot, Helcim does not come with a monthly fee. And, they do have their own POS hardware, though their selection is very limited (just two mobile options, actually). They offer some additional perks, like recurring payment subscription support, so that you can set a customer’s payments on a cycle.

What sets Helcim apart, however, is how you can pass through processing fees to customers via Helcim’s surcharging feature, which can be toggled on or off for each transaction.

Why I chose Helcim

Helcim has plenty of advantages comparable to its peers on this list, but its pass-through option for fees is a must if you’re running a nonprofit or charity, or just simply looking to minimize transaction fees. And with Helcim using Interchange Plus pricing, those fees are already comparatively low.

Pricing

Helcim doesn’t charge monthly fees or lock you into contracts. They charge interchange plus fees, meaning the cost is highly variable, but Helcim’s cut isn’t:

- For volumes up to $50,000: Interchange+ 0.40% + $0.08.

- For volumes from $50k to $100k: Interchange+ 0.35% + $0.07.

- For volumes from $100k to $500k: Interchange+ 0.25% + $0.07.

- For volumes from $500k to $1 million: Interchange+ 0.20% + $0.06.

- For volumes above $1 million: Interchange+ 0.15% + $0.06.

As for Helcim’s POS hardware, you have two branded options:

- Helcim Card Reader: $99.

- Helcim Smart Terminal: $329, or $30/month for 12 months.

Features

- Payment gateway, invoicing, virtual terminal functionality, and more.

- Subscription manager so that you can set up recurring payments from customers/patrons/donors/etc.

- Inventory management for those who need it.

- Interchange Plus pricing, with pass-through fee options.

Pros and cons

| Pros | Cons |

|---|---|

| Lower transaction costs than almost any competing options. | Slower deposit speeds than others in this list. |

| Pass-through fees benefit donations and charity payments. | Fewer POS hardware options. |

| Discounts for operating at higher volume. | |

| No monthly fees. |

Payanywhere: Best for rapid payouts

Our rating: 4.16

Let’s face it: we’d all prefer to have our money faster, wouldn’t we? Unfortunately, most payment processing and other financial services have built-in delays that stall and slow a process that otherwise seems instantaneous. And while expedited payments are sometimes available as options, they usually cost extra.

Payanywhere presents an alternative. With free next-day payouts and the potential to qualify for free same-day payouts, Payanywhere makes rapid payouts easier and less expensive than almost anyone else.

Why I chose Payanywhere

Do you want faster payouts? ‘Cause this is how you get faster payouts. Jokes aside, Payanywhere brings all the usual suspects to the lineup — reliable payment processing with a variety of mobile payment options. Affordable, pay-as-you-go pricing. Invoicing, reporting, tap-to-pay on mobile, the works. Beyond that, you get paid faster at less expense. And they even have options for inventory and employee management.

Pricing

Pay as you go:

- Swipe/dip/tap: 2.69%.

- Keyed: 3.49% + $0.19.

Custom pricing: call for quote.

Monthly software fee:

- Mobile 3-in-1 card reader: None.

- All others: From $14.95/month to $44.95/month.

Features

- Inexpensive or even free next-day and same-day funding.

- Employee management.

- Inventory management.

- In-person, virtual, online, and digital storefront payment processing.

Pros and cons

| Pros | Cons |

|---|---|

| Do everything most other payment processors let you do, but get paid faster while doing it. | Added fees for inactivity and early termination. |

| Plenty of hardware to choose from to meet your needs. | Smaller integration library than others. |

| Offline mode for those who work on the go. | Doesn’t accept some business types. |

GoDaddy: Best in-person/ecommerce combo

Our rating: 4.06

So far, we’ve been heavily focused on in-person payment interactions. But let’s be honest — ecommerce businesses aren’t exactly a small demographic. Even when just considering solo outfits and small teams. And not every processor is as conducive to a bilateral sales channel.

Square, for example, is less than stellar with ecommerce. It has ecommerce tools, but it gives the lion’s share of its features to in-person sellers. Great, if that’s all you do. Not so much if 50% or more of your business comes from digital traffic.

GoDaddy helps combat this problem. The brand is far more famous for its domain services and web hosting because that’s where they started. Where Square moved from card-present transactions to online channels, GoDaddy did the reverse, and their ecommerce pricing reflects that.

Why I chose GoDaddy

It’s no fun seeing a killer rate on all your in-person card transactions, only to choke on the size of the fees gouging your online profits. GoDaddy’s service isn’t like that. Their ecommerce price is closer to their in-person charges than any other option on this list.

Their broader POS and payment features can certainly go toe-to-toe with their peers in this list. But they take the cake for anyone who wants to sell face-to-face and through web-based channels.

Pricing

GoDaddy lists transparent pricing for their transaction fee structure, making it easy to identify if your most common processing types will be well served by the platform:

- In-person: 2.5% + $0.00.

- Ecommerce: 2.7% + $0.30.

- Invoicing: 2.9% + $0.30.

- Online Pay Links: 2.9% + $0.30.

- Keyed-in: 3.5% + $0.00.

However, they’re a bit less transparent about explaining their subscription fees. They do list some pricing, such as their managed WooCommerce stores (starting at $24.99/month). And they explicitly mention how you can get started using their POS services for free. As of this writing, however, the links on their site for specifics on premium plans, like Point of Sale Plus, just route you back to pages that don’t list a price.

Beyond that, it’s not entirely clear which subscription you’ll need to cover the range of functions you need, be that a full Woocommerce plan, or something else.

**Disclaimer** In GoDaddy’s defense, POS, mobile payments, and other in-person offerings are recent additions to their portfolio. So some of this confusion is likely due to fine-tuning and frequent adjustments being done on their end as they roll it out in full. There’s even a banner flagging this very detail on their Point of Sale Plan documentation page.

Features

- Inexpensive in-person payments. Similarly priced ecommerce transactions.

- Rapid payouts, as fast as next-day.

- They’re well-versed in helping businesses run their operations online, and make money through digital channels — in fact, their whole platform is designed around it.

- A boatload of other features and functionality to boot, many of which revolve around integrations, automations, and web hosting.

Pros and cons

| Pros | Cons |

|---|---|

| Get payment processing, POS solutions, and website hosting, all in one. | Reportedly, some of the affordable pricing that’s offered to new merchants gives way to less favorable fee structures after introductory periods end. |

| You’ll be hard-pressed to find a vendor that offers both in-person and online processing that’s so close in price. | They offer a free trial, but it’s limited in scope. |

| It’s a widely known and well-used platform, so there are numerous avenues to find the help and assistance you need. | The POS/in-person features are newer, and thus both the functionality and the information is still “under construction,” as they say. |

Clover: Best for choice of processor

Our rating: 4.06

Clover is a widely used, and widely supported, POS brand. Offering both robust software and a wide variety of hardware, they cater to half a dozen unique industry verticals, from dining, to retail, to professional services, and beyond.

With Clover, you have the option to bring your own processor. Clover is owned by Fiserv, and, while you can purchase hardware directly from the Clover website with Fiserv processing and rates, you can also purchase Clover hardware from any processor that operates on the Fiserv network.

Luckily, Clover is one of the most popular options on the market, so most processors are compatible (even in cases where those vendors have their own POS hardware options).

Why I chose Clover

It’s surprisingly difficult to find a matching POS option if you’ve already got your merchant account in place.

That makes Clover somewhat of an oddity; they’re not new to the space, but they’ve continued to hold the line as one of the best point-of-sale tools on the market. There’s plenty to love about Clover before you even start digging into some of their more advanced features and services.

Pricing

Pricing for Clover is clearly stated on their website, but it’s also highly variable based on a few factors:

- The industry you work in.

- The type of POS hardware you’re using.

- The subscription tier.

Each industry offers three tiers: Starter, Standard, and Advanced. The baseline monthly fee is $14.95 per month, though you can also add monthly payments for hardware via a three-year payment agreement (so you don’t have to cash out for an expensive POS station all at once). Some starter plans have no monthly fee, though.

And finally, Clover advertises transaction fees as low as 2.3% + $0.10.

However, note that the pricing will vary if you purchase your mobile Clover reader from a different processor.

Features

- Low transaction pricing, to pair with your current processor savings.

- Plentiful POS hardware options, from mobile readers and devices, to full register stations.

- Robust software capable of supporting a variety of very specific use cases.

Pros and cons

| Pros | Cons |

|---|---|

| Bring your own merchant account. | Buying hardware via payment plan locks you into a three-year contract. |

| Some of the best POS hardware and software in the business. | Fees can add up if you do a lot of online selling. |

| Advanced features are tailor-made for restaurants and retail businesses, like online meal orders, online store integration, and more. | Some common, and very important, integrations (such as with accounting applications) require additional setup and 3rd-party apps. |

PayPal: Best dedicated mobile POS device

Our rating: 4.03

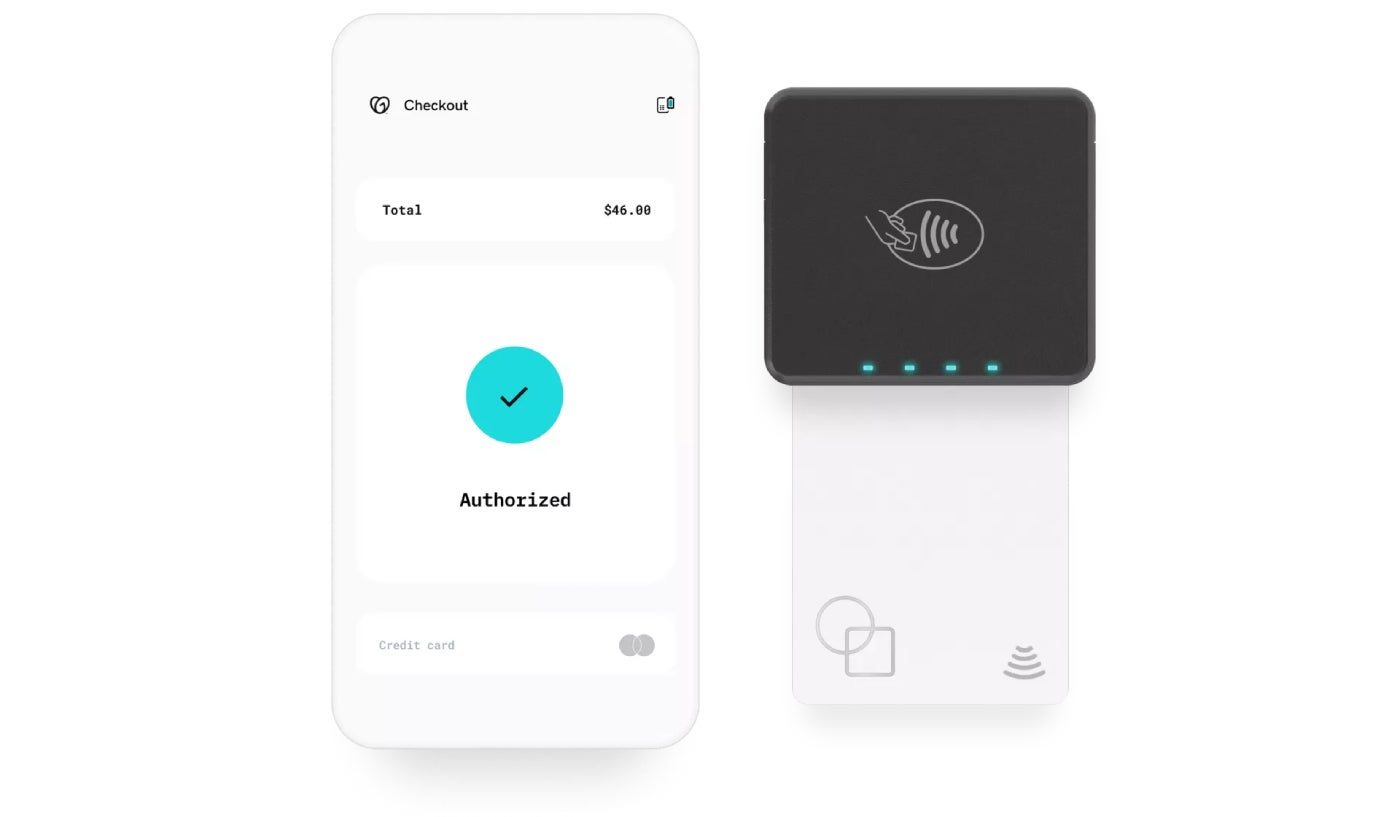

Another widely recognized player in the payments space, PayPal is usually known for its online processing and payment portals. But that’s not to say it doesn’t have a horse in the race, so to speak. In fact, PayPal Zettle is our pick for those who need a dedicated mobile POS (as opposed to just using their phone via Tap to Pay or with a card reader).

PayPal offers one of the least expensive options on the market for using a dedicated handheld, with mobile data connection. Transaction fees are lower than average with the handheld, and there’s no monthly subscription fee to use it. And if you’re willing to use your PayPal account in the process, you can get your money in minutes. If a simple smartphone won’t cut it for your business, this probably will.

Why I chose PayPal

While smartphones can handle quite a bit in the realm of accepting and processing payments, there are a few things they can’t do. It can’t print a receipt on its own. It struggles to handle barcodes without additional software or hardware. And you’re probably using it for things other than just payments, so logistics and battery life become concerns.

Oh, and no one likes sharing their phone, so using your personal device can get iffy if there are multiple people or locations involved.

But getting a dedicated device from most vendors tends to come with some pretty hefty added costs. With PayPal, you can go full smartphone if that’s what works. You can opt for stationary POS setups if needed. Their Zettle mobile POS, though, is a level of budget-friendly convenience that’s hard to compete with.

Pricing

PayPal doesn’t require any subscription fees. As for their transaction fees, PayPal’s pricing structure breaks down similarly to some of their peers, though they offer better rates than most in some key areas:

- Card-present: 2.29% + $0.09.

- Manual entry: 3.49% + $0.09.

- QR code transactions: 2.29% + $0.09.

- Invoicing through PayPal: 3.49% + $0.49.

- Invoicing via alternatives: 2.99% + $0.49.

Finally, it’s worth mentioning the costs of PayPal’s mobile devices:

- Mobile card reader: $29 for your first card reader ($79 per reader after that).

- Zettle mobile POS terminal: $199 for the standalone terminal. Built in barcode scanner upgrade and receipt printer upgrade are both extra.

Features

- Low transaction fees for in-person payments.

- Affordable mobile devices for doing business on the go.

- Mobile data usage is covered in the Zettle purchase price.

Pros and cons

| Pros | Cons |

|---|---|

| Some of the most affordable options for mobile payments. | If you want to add online payments, things get a bit pricier. |

| No contracts, no subscription fees, no monthly payments (and hardware inexpensive enough to make it worth it). | Some of PayPal’s offerings support offline payments, but as of this writing, their mobile POS solutions do not. |

| Get your money in minutes if using your PayPal account. |

How do I choose the best mobile credit card processor for my business?

Ok, full disclosure, we cover quite a bit of overlapping material in some of our other articles. The lines between point-of-sale systems and payment processors can get kind of blurry, and “mobile” can be a rather broad and nebulous category.

Had we been able to chat with you in person on this subject, we would definitely have asked you a follow-up question:

Exactly how far do you need to wander off the beaten path when taking a payment?

“Just trying to get my steps in”

Maybe this dates us a bit, but those cordless landlines were a real game-changer back in the day. Not having to stand in the kitchen awkwardly, while everyone walked around you, just to take a phone call? It was great. Of course, you couldn’t go very far before the reception was more static-y than your grandparents’ black-and-white TV. But at least you could move around a bit.

Some businesses are looking for something in this ballpark, mobility-wise. You probably have a dedicated place of business — a restaurant, a retail store, a kiosk at the local mall. Whatever the case, you’ll have reliable access to both internet and power, though you may not be plugged in 100% of the time.

You might need additional POS hardware, like a receipt printer, a cash drawer, or similar. Or you might be tethered to certain proximity limitations, for whatever reason. You might even be in a position where simply using smartphones isn’t an ideal solution (don’t want those sprouting feet and running off, you know?).

Whatever the case, you still need (or at least benefit from) a cordless experience, and even a short amount of wireless range will do you some good.

“I’m not one to ‘settle down’”

If the previous category didn’t sound like you, then how about this one? Maybe you don’t have a dedicated office or retail space. Perhaps you work somewhere that doesn’t provide reliable Wifi, or where you have to plan for long stretches without access to a power outlet.

Or, it could be that you just don’t need or want anything other than your own smartphone to handle business transactions (dedicated hardware can be pricey, after all).

With contactless card payments becoming more and more common, and even mobile wallets proving fairly standard at this point, some businesses can function almost frictionlessly without even needing a magstripe or chip reader peripheral. And, should you in fact need one, those are the easiest and least expensive POS tools to come by.

Just be sure you’re doing business somewhere with cell service. Otherwise, you’ll end up in the next group.

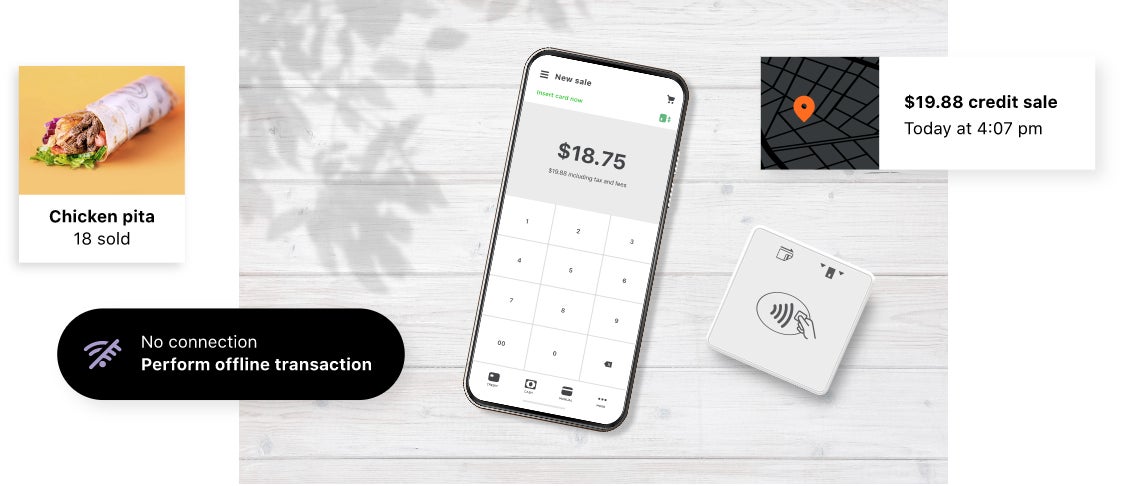

“I sell off the beaten path”

Internet access is painfully easy to take for granted at this point in society, and those unpleasant “no service” surprises happen to the best of us. In most situations, we just put our phone back in our pocket, grumble under our breath, and deal with it. But if it’s a business transaction, there’s a bit more on the line than just an interruption to your Spotify stream.

POS and payment processing vendors know this, and some of them have built offerings to address issues like these. Colossal battery life for POS handhelds. Offline functionality for processing software. Whatever your biggest concern, odds are there’s a brand with a value prop aimed squarely at it. You want to do business wherever you need to, and they want to help (for a small fee, of course).

Honorary mention: the “why not both?” crowd

Lest we forget, this isn’t merely a point-of-sale discussion. It’s also a payment processing discussion. And payments come in…just so many forms these days. So the final point of consideration here (of those that are unique to this particular niche of the broader topic, of course) is whether you need POS tools to match your processor, a processor to go with the POS device you’re using, or a little of both.

If you’re manually typing in card information via a desktop app and just need a vendor to facilitate the actual transaction, a lot of the other details don’t really matter much. Similarly yet inversely, if you’re all set with a merchant account but really need a way to take those magstripe payments, that will affect your list of candidates (as many vendors expect you to use their branded or partnered processing solution).

While you’ll always want to vet a tech vendor for the standard values, like customer support, price, security, etc., the “right pick” for you will ultimately be decided by these more practical details, most likely. So be sure to let them shape your buying journey.

Methodology

In our search for mobile-friendly card readers, payment processors, and the like, we built a list of candidates and graded said candidates based on critical core factors, including pricing, software features, hardware options, user experience, and reliability. We consulted branded marketing, review aggregator sites like G2, hands-on demos, and free trials, as well as feedback and reviews from current and past users.

We paid particular attention to areas of functionality that were non-standard, if they were mentioned in the brand’s marketing as an available feature and whether or not reviews indicated it worked as described.

Here are the specific criteria used in our evaluation:

- Pricing: 20%

- We examined processing fees, contract terms, cancellation fees, chargeback fees, and the costs of mobile card readers themselves.

- Payment types: 25%

- We checked whether each mobile processor can accept card-present transactions, invoicing, all types of contactless payments, split tender options, SMS text-to-pay, Tap to Pay, and more.

- Features: 25%

- We checked for offline processing, free POS tools, product libraries, the ability to send digital receipts, and deposit or payout speeds.

- UX: 20%

- We evaluated its overall ease of use, app or mobile interface, and its ability to integrate with other popular business software like QuickBooks for accounting.

- User reviews: 10%

- Finally, we assessed each processor’s Google Play app rating, iOS app rating, and overall popularity.

It’s always difficult to get a comprehensive picture of what a tech solution has to offer, especially when you’re not in a position to field test it directly or explore how it performs in different niche use cases. We’ve done our best to close that gap here and “fumble in the dark” on your behalf, to help you avoid doing the same at much greater opportunity cost.