- Best overall credit card reader for Android: Square

- Best for customization: Stripe

- Best cheap, basic reader: SumUp

- Best for accepting multiple payment methods: PayPal Zettle

- Best for ecommerce businesses: Shopify

Android devices have made significant technological advancements in recent years. Like iPhones, they can now be used as payment terminals thanks to NFC technology and payment apps available on the Play Store, its app marketplace.

To find the best credit card reader for Android, I considered affordability, payment option flexibility, transaction fees, and, more importantly, reliability and security. I evaluated dozens of Android credit card readers against a 22-point rubric and tested them myself as a payor and payee.

Top credit card readers for Android comparison

Alongside pricing, some important features set the mobile credit card readers for Android apart. The table below illustrates which of the top five Android card readers include these key features.

| Square Reader | |||||

| Stripe M2 | |||||

| SumUp Plus | |||||

| PayPal Zettle Reader 2 | First reader discounted to $29 | ||||

| Shopify Tap & Chip Card Reader |

Square: Best overall credit card reader for Android

Our rating: 4.63 out of 5

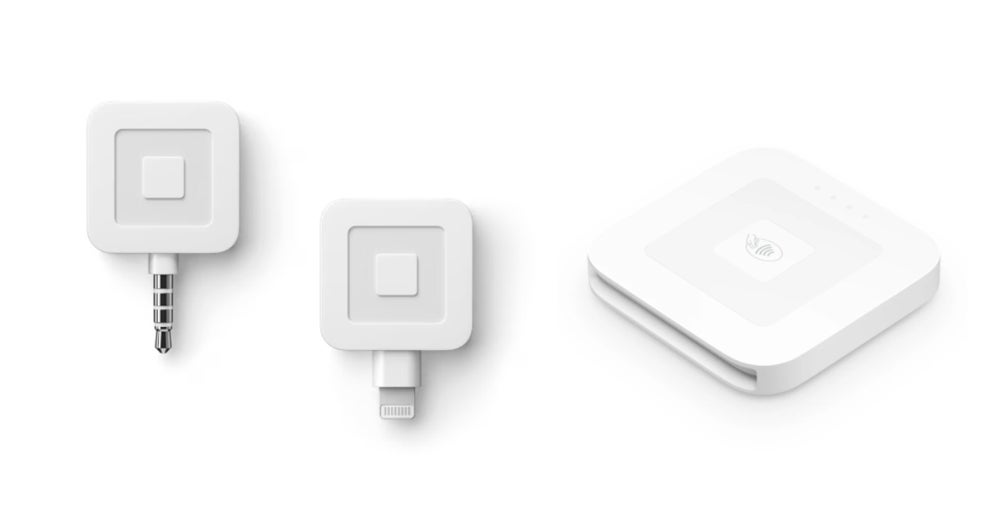

Square Readers consistently rank among our top picks for credit card readers for Android and iPhone devices. They are highly rated by users and experts alike. Their sleek design and handy size make them an excellent choice for accepting payments anywhere, together with the Square POS app.

Square lets you accept payments for free — it doesn’t charge monthly fees or require monthly minimums; you can even get your first magstripe reader for free, making it suitable for the casual user. And yet, it provides a fully-featured POS system ideal for full-time businesses.

Why I chose Square

I like how Square remains affordable and still lets you accept a full range of payment options. You also pay the same transaction rate no matter which card a customer uses — even American Express, which is infamous for having higher fees.

Among the card readers I have evaluated, it’s one of the card readers that got perfect marks for card reader features (free POS app and reader, great aesthetics, and a digital receipts feature) — SumUp being the other one.

Aside from the usual tap, dip, and NFC payments, Square lets you accept gift cards and echecks (with an additional charge). You can also accept international cards, but you must be in the country where you activated your Square account (no cross-border payments).

But what I like best about Square is its active fraud prevention and dispute management feature. It has an excellent chargeback policy — no chargeback fees except for the usual processing fee that the sale incurred. In fact, Square and SumUp are the only providers in this list that do not charge dispute fees.

Pricing

- Monthly processing fee: $0

- Transaction fees:

- Card present: 2.6% + 10 cents

- Keyed-in: 3.5% + 15 cents

- Online, Recurring, and Invoicing: 2.9% + 30 cents

- Card readers:

- First magstripe reader free; additional orders $10 each

- $49-$59 for Square Reader (1st and 2nd generation)

- Accepts tap, dip, Apple Pay, Google Pay, and other NFC payments

- Accepts offline payments; syncing of payments should be done within 24 hours

Features

- 4.7 out of 5 mobile app rating on Google Play based on more than 230,000 user reviews.

- Card reader features:

- Free magstripe reader is available with lightning or audio jack input; can accept payments via magstripe (swiped).

- Square Reader connects via Bluetooth, can work without Internet connectivity, and can accept payments via EMV (chip) or NFC (Apple Pay, Google Pay).

- Transparent and flat-rate processing fees.

- Offline payment processing.

- Free, powerful POS app.

- No chargeback or dispute fees.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Related: Best Free Credit Card Readers for iPhone & Cheap Alternatives

Stripe: Best for customization

Our rating: 4.41 out of 5

Stripe is best known for its highly customizable checkout pages, and that extends to its payment terminals, too. If you have the means to hire a developer (or have the know-how yourself!), you will certainly appreciate Stripe’s flexible terminal tools — you can really customize in-person payment experiences.

Moreover, you can use the Stripe M2 reader with your own POS app or integrate it with other apps for inventory or customer relationship management.

Why I chose Stripe

Given all the high level customization options you get with Stripe, I like that it still offers a low-cost card reader option, allowing you to sell in-person. Stripe is mostly known for online payments, and while its in-person sales features are not as well known as that of Square — it scored above average on most categories during my evaluation.

Stripe and SumUp are the only card readers on this list that accept magstripe (swipe) payments, along with chip and tap. While this technology is not often used anymore, it can come in handy when the connection (NFC or Bluetooth) becomes spotty. Due to its top-notch security and fraud detection, Stripe is the best credit card swiper for Android.

Also worth mentioning is the app’s high user review scores, 4.50 out of 5 — one of the highest scores among the apps I feature in this list. I noticed Stripe actively listens to user feedback — the most recent review as of this writing requested a feature and Stripe added the functionality in the app right away.

Pricing

- Monthly processing fee: $0

- Transaction fees:

- Card present: 2.7% + 5 cents

- Online: 2.9% + 30 cents

- Keyed-in (Manual): 3.4% + 30 cents

- Touchless: 2.9% + 30 cents

- Tap-to-pay on mobile: +10 cents per authorization

- Invoicing: + 0.4%–0.5%

- Recurring Billing: + 0.5%–0.8%

- International payments: + 1.5% fee, 1% spread for currency conversion

- ACH: 0.8%, $5 cap

- Card readers:

- $59.00 for Stripe Reader M2

- $249.00 for BBPOS WisePOS E (smart reader with a touchscreen display)

- $349.00 for Stripe Reader S700 (Android-based smart reader)

- Accepts EMV chip cards, contactless cards, magstripe cards, and digital wallets.

- Chargeback fee: $15 per dispute.

Features

- 4.50 out of 5 mobile app rating in PlayStore based on nearly 25,000 user reviews.

- Card reader features:

- Bluetooth connectivity.

- Offline mode.

- Battery—2 hours charging time, 28 hours active use, 42 hours standby.

- Customizable checkout process.

- Customizable risk management and fraud detection tools.

- Multi currency payment processing.

- End-to-end encryption (E2EE) and point-to-point encryption (P2PE).

- Seamless integration with Stripe Terminal software development kit (SDK).

Pros and cons

| Pros | Cons |

|---|---|

|

|

SumUp: Best cheap, basic reader

Our rating: 4.35 out of 5

SumUp is primarily designed to be an end-to-end mobile payment processing solution. Aside from affordable card readers, you can accept payments via invoicing and virtual terminals. There are no monthly minimums and contract fees. And unlike the Square Reader, SumUp Plus accepts magstripe payments (swipe cards) and includes a screen to show transaction details.

Compared to other feature-rich POS systems like Stripe and Square, SumUp’s functionalities are basic at best. However, for businesses on a budget and only have straightforward payment needs, SumUp is a great option.

Why I chose SumUp

If we are talking exclusively about card readers for mobile app payments, SumUp’s readers are top-notch. Its entry-level card reader (available in black and white versions) is among the cheapest readers I have reviewed.

SumUp is the only card reader, aside from PayPal Zettle, that features a screen to show transactions on its device and has a PIN feature. It is also tied with Square for scoring perfect marks on card features. However, SumUp is the top card reader when it comes to payment options — Zettle doesn’t have an offline mode, and Square Reader can’t do swipe payments. SumUp Plus can do both.

However, SumUp is quite limiting if you need a full-featured POS system and ecommerce integrations. Unlike others on this list, It only offers basic reports like transaction and revenue summaries.

Pricing

- Monthly processing fee: $0

- Transaction fees:

- Card present: 2.6% + 10 cents

- Online and keyed-in: 3.5% + 15 cents

- Invoicing (payment link): 2.9% + 15 cents

- Card readers:

- $54 for SumUp Plus (Connects via Bluetooth to your smartphone or tablet)

- $99 for SumUp Solo (Standalone device with a sleek touchscreen)

- $169 for SumUp Solo printer bundle (Standalone device with printer)

- Accepts swipe, tap, dip, Apple Pay, Google Pay, and other NFC payments

Features

- 3.70 out of 5 mobile app rating in PlayStore based on more than 105,000 user reviews.

- Card reader features:

- 8 hour battery life allows you to accept payments on the go.

- Process over 500 transactions on a single charge.

- Connects via Bluetooth (SumUp Plus).

- Connect via WiFi and with free, unlimited mobile data with the built-in SIM card (SumUp Solo and printer bundle).

- Mobile-first payment processor.

- No add-on fees for international credit cards.

- No extra cost for e-check payments with invoicing.

- No chargeback fees.

Pros and cons

| Pros | Cons |

|---|---|

|

|

PayPal Zettle: Best for accepting multiple payment methods

Our rating: 4.10 out of 5

PayPal Zettle is the best option if you need to accept a variety of payments in person at a low cost and with no commitments. Aside from tap and dip (EMV chip, contactless, and digital wallets), Zettle can accept Venmo and PayPal payments. QR payments are possible with the help of the POS app, too.

If you have a seasonal business or a side hustle, the Zettle Reader is a terrific option. It offers very affordable transaction rates: 2.29% + 9 cents.

Why I chose PayPal Zettle

Aside from the added payment options PayPal Zettle can accept, I like that it provides an added security feature to transactions, having a PIN feature when processing payments. It also has a display screen. Among those on this list, only Zettle Reader and SumUp Plus have these features.

PayPal Zettle also has the lowest card-present (in-person) transaction rate among the card readers featured in this guide. However, note that PayPal Zettle is best for accepting payments on the go and nothing more. It doesn’t offer plan upgrades or integrations for online selling.

Pricing

- Monthly fee: $0

- Transaction fees:

- Card present and QR codes: 2.29% + 9 cents

- Keyed-in: 3.49% + 9 cents

- Invoicing (PayPal payments): 3.49% + 49 cents

- Invoicing (cards and alternative payment methods): 2.99% + 49 cents

- Card reader: $79 (first one, $29)

- Accepts debit and credit EMV cards, NFC payments, gift cards, and Venmo payments

- Chargeback fee: $20

Features

- 3.20 out of 5 mobile app rating in the Play Store based on more than 43,000 reviews.

- Card reader features:

- 8-hour battery life (100 transactions)

- PIN card feature

- Scan QR codes through smartphone

- No long-term contract or termination fees.

- Accepts a variety of payment types — chip and contactless payment methods, including Venmo and PayPal payments.

- Next-day funding, same day with fee.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Shopify: Best for ecommerce businesses

Our rating: 3.99 out of 5

The Shopify Tap & Chip Card Reader is the most suitable and convenient option for accepting payments in person if you have an online business and, more so, use Shopify as your ecommerce platform. You don’t have to pay an additional monthly fee.

Like the Square Reader, the Shopify Tap & Chip Card Reader is exclusive to Shopify’s payments and ecommerce ecosystem. Shopify’s connected ecosystem allows sales and inventory to sync seamlessly across your sales channels.

Why I chose Shopify

I have over a decade of experience working with primarily online-first businesses, and Shopify has been my consistent pick for ecommerce platforms. Even though Shopify is known for ecommerce, I have experienced its equally robust POS platform for mobile and in-store sales — further cementing Shopify as the best solution for multichannel sellers.

The Shopify mobile card reader is no exception. While it has limited offline functionality, I like that it accepts many payment options — credit card, contactless, digital wallets, online payments, gift cards, international/cross-border, and even cryptocurrency — rivaling PayPal Zettle.

Pricing

- Monthly fee: $0–$89 (plus Shopify ecommerce plan ranging from $5-$399 — required)

- Transaction fees:

- In-person: 2.4%–2.7%

- Online: 2.4%–2.9% + 30 cents

- Card reader: $29–$49

- One-year limited warranty (minimum)

- Accepts both chip and contactless payments.

- Chargeback fee: $15

Features

- 3.30 out of 5 mobile app rating in the Play Store based on nearly 2,300 reviews.

- Card reader features:

- Accepts chip and contactless payments

- Standard 1-year warranty or an extended 2-year warranty on POS Pro

- Accepts credit cards (via EMV chip), contactless (via NFC and QR), digital wallets, online payments, gift card, international/cross-border, and cryptocurrency.

- Local payment methods can be accepted for an add-on fee.

- No long-term contract or termination fees.

- Sync online and in-person sales and inventory.

- Extensive integrations for scalability.

- Multiple sales channels, including social channels and online marketplaces like Amazon and Walmart.

- 24/7 customer support.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Related: The 6 Best Mobile POS Systems for 2024

How do I choose the best Android credit card reader for my business?

The best Android credit card reader for your business is one that matches your business needs and is compatible with your Android device’s operating software. Prioritize mobile card readers with high security and minimal reports of downtimes or failed transactions. Connectivity should also not be a problem. It should be easy to connect with your mobile payment app.

Specifically, you should consider:

- Reliability, compatibility, and connectivity: Most card readers connect via Bluetooth to your Android device. There are card readers that include a SIM card to get their own WiFi connection.

- Accepted payment methods: EMV (chip) and NFC (contactless) payments are the most common payment methods for card readers. Your card reader should be able to accept these at the minimum — tap and dip readers are what they are called. If you want to be able to accept other payment methods like QR, invoicing, and Venmo, make sure to check the card reader first before purchasing.

- Easy-to-use mobile app with robust features: Mobile card readers work together with your payment processor’s mobile payment app. Their mobile apps are usually free, so check their features if they fit your business needs before purchasing.

- Hardware pricing: Mobile credit card readers are generally very affordable. Most offer card readers between $50 and $100, and some issue your first reader for free or at a discounted price. If you want a device that provides more sophisticated functions, such as a built-in printer or scanner, prepare to shell out more than $100 per device.

Methodology

Based on my experience helping retail businesses launch their ecommerce stores and streamline their in-store and online sales operations, I looked at the top payment providers and merchant services that have mobile apps and provide card readers for Android.

From my initial list, I graded them using an in-house rubric of 22 data points based on pricing, payment types, card features, security and stability, and user reviews. I prioritized Android card readers with high reviews on security and reliability — minimal failed transactions and downtimes.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

Frequently asked questions (FAQs)

What are the differences between mobile credit card readers for Android?

The main differences between Android credit card readers are the payment methods they accept and their transaction rates.

How do you accept credit card payments on your Android phone?

You can accept credit card payments on your Android phone through Tap to Pay. Your device will serve as a payment terminal through a mobile payment app. You can also accept credit card payments on your Android device with the help of a compatible card reader.

Are there any credit card readers for Android that work offline?

Yes, there are Android credit card readers that work offline. Square, Stripe, and SumUp are a few great examples.

Are there any free credit card readers for Android?

Yes, there are free Android card readers. Square provides your first magnetic stripe reader for free, and PayPal Zettle also offers a discounted rate for your first card reader.

What card readers work with Google Pay?

Most Android card readers can accept NFC payments and mobile wallets such as Google Pay. Square, SumUp, Stripe, PayPal Zettle, and Shopify have great card readers that process Google Pay payments.

Does Samsung Pay still work with any card reader?

Square, PayPal Zettle, and Stripe mobile card readers accept Samsung Pay.