Employment growth eased in June, taking some steam out of what had been a stunningly strong labor market.

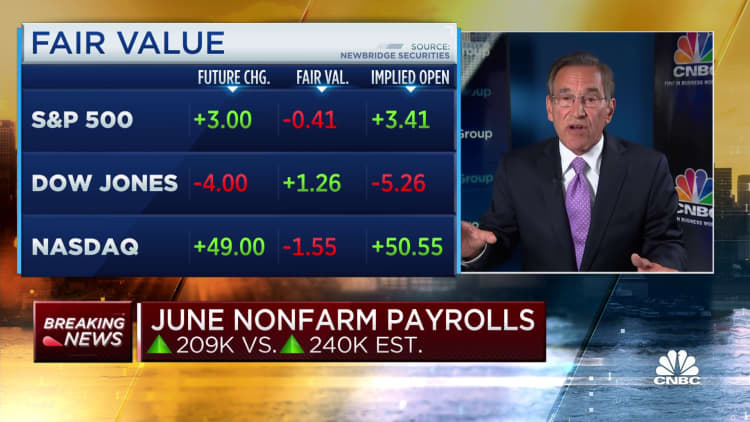

Nonfarm payrolls increased 209,000 in June and the unemployment rate was 3.6%, the Labor Department reported Friday. That compared with the Dow Jones consensus estimates for growth of 240,000 and a jobless level of 3.6%.

The total, while still solid from a historical perspective, marked a considerable drop from May’s downwardly revised total of 306,000 and was the slowest month for job creation since payrolls fell by 268,000 in December 2020. The unemployment rate declined 0.1 percentage point.

Closely watched wages numbers were slightly stronger than expected. Average hourly earnings increased by 0.4% for the month and 4.4% from a year ago. The average work week also increased, up 0.1 hour to 34.4 hours.

“Overall, the job market is outstanding and is getting back to a balanced, sustainable level,” Chicago Federal Reserve President Austan Goolsbee said on CNBC’s “Squawk on the Street.”

Job growth would have been even lighter without a boost in government jobs, which increased by 60,000, almost all of which came from the state and local levels.

Other sectors showing strong gains were health care (41,000), social assistance (24,000) and construction (23,000).

Leisure and hospitality, which had been the strongest job growth engine over the past three years, added just 21,000 jobs for the month. The sector has cooled off considerably, showing only muted gains for the past three months.

The retail sector lost 11,000 jobs in June, while transportation and warehousing saw a decline of 7,000.

There had been some anticipation that the Labor Department report could show a much higher-than-anticipated number after payrolls processing firm ADP on Thursday reported growth in private sector jobs of 497,000.

Markets moved lower following the release of the jobs report, with futures tied to the Dow Jones Industrial Average off nearly 90 points. Longer-dated Treasury yields were slightly higher.

“A 209,000 increase in payrolls can hardly be described as weak,” said Seema Shah, chief global strategist at Principal Asset Management. “But after yesterday’s ADP wrongfooted investors into expecting another bumper jobs number, the market may be disappointed.”

The labor force participation rate, considered a key metric for resolving a sharp divide between worker demand and supply, held steady at 62.6% for the fourth consecutive month and is still below its pre-Covid pandemic level. However, the prime-age participation rate — measuring those between 25 and 54 years of age — rose to 83.5%, its highest in 21 years.

A more encompassing unemployment rate that includes discouraged workers and those holding part-time jobs for economic reasons rose to 6.9%, the highest since August 2022. At the same time, the unemployment rate for Blacks jumped to 6%, a 0.4 percentage point increase, and rose to 3.2% for Asians, a 0.3 percentage point rise.

In addition to a downward revision of 33,000 for the May count, the Bureau of Labor Statistics sliced April’s total by 77,000 to 217,000. That brought the six-month average to 278,000, down sharply from 399,000 in 2022.

“This is a strong labor market where demand for higher paying jobs is clearly the trend,” said Joseph Brusuelas, chief economist at RSM. “So, I think it’s no longer appropriate to talk about an imminent recession, given those strong gains in jobs and wages.”

The jobs numbers are considered a key in determining where Federal Reserve monetary policy is headed.

Policymakers see the strong employment market and the supply-demand imbalance as helping propel inflation that around this time in 2022 was running at its highest level in 41 years.

They are using interest rate increases to try to cool the economy, but the labor market thus far has defied the central bank’s tightening efforts.

In recent days, Fed officials have provided indication that more rate hikes are likely even though they decided against moving at the June meeting.

Markets widely expect a quarter percentage point increase in July that would take the Fed’s benchmark borrowing rate to a targeted range between 5.25%-5.5%. The outlook was little changed following the jobs data release, with traders pricing in a 92.4% chance of a hike at the July 25-26 meeting.

The June report “suggests labor market conditions are finally beginning to ease more markedly,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics. “That said, it is unlikely to stop the Fed from hiking rates again later this month, particularly when the downward trend in wage growth appears to be stalling.”