- Best overall Stripe alternative: Square

- Cheapest Stripe alternative: Helcim

- Best Stripe alternative for ease of use: PayPal

- Best Stripe alternative for integrations and fraud protection: Authorize.net

- Best Stripe alternative for account stability: Adyen

- Best Stripe alternative for Shopify merchants: Shopify Payments

- Best Stripe alternative for high-risk businesses: PaymentCloud

Stripe is a highly-rated and popular payment processor by users and experts alike because of its customizable tools, security features, and ability to accept many payment methods. However, there are some situations when Stripe isn’t the best option, such as the need for strong omnichannel sales, an easy-to-use setup, and reduced or discounted processing fees.

Top Stripe alternatives comparison

The best alternatives to Stripe are providers that surpass Stripe in certain criteria during my evaluation or offer a feature that Stripe lacks. The table compares these payment processors like Stripe based on ease of use, platform compatibility, and associated costs.

| Starting price (per month) | Online transaction fee | Same-day payouts | Ease of use | Platform compatibility | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Square | $0 | 2.9% + $0. 30 | 1.75% | Excellent | Exclusive | |||||||

| Helcim | $0 | Interchange plus 0.15% + $0.15 | N/A | Good | Limited | |||||||

| PayPal | $0-$30 | 2.99% + $0.49 | 1.5% | Excellent | Excellent | |||||||

| Authorize.net | $25 | 2.9% + $0.30 or $0.10 | No fees | Good | Excellent | |||||||

| Adyen | $0 | Interchange + $0.13 | Undisclosed fee, if any | Good | Excellent | |||||||

| Shopify Payments | $0 | 2.4% + $0.30 | N/A | Excellent | Exclusive | |||||||

| PaymentCloud | $10-$45 | 2%-4.3% | N/A | Good | Excellent | |||||||

Square: Best overall Stripe alternative

Square is an all-in-one POS solution that facilitates in-person, online, and mobile payments. When it comes to Stripe vs Square, the latter provides merchants with a payment gateway to accept payments through point-of-sale hardware (that they also provide) and online (that they also provide an avenue for through an e-commerce website builder). Even better, Square offers these at zero cost, making it a very attractive option for all business sizes.

Square’s free offerings are also not limiting — they are robust enough to be a completely viable option for startups and businesses primed for growth.

Why I chose Square

While both Stripe and Square do not charge monthly fees and offer flat-rate pricing, Square has these advantages: it has lower processing fees for card-present or in-person transactions, offers free POS and e-commerce tools, and more card reader options that are less expensive.

Stripe has higher fees for in-person transactions and requires integrations for POS and e-commerce builders. It also has limited card reader options for in-person selling as it’s primarily an online payment processor.

Square is the best Stripe alternative if budget, ease of use, and quick installation are priorities. It has no monthly fees and offers free omnichannel selling tools (POS, card reader, and e-commerce builder). Square can get you set up and started in a few simple steps, with no coding knowledge required. It also comes with scalable features that can support business growth. Custom pricing is available upon request for enterprises.

Pricing

- Subscription fee: $0.

- Online transaction: 2.9% + 30 cents.

- Invoice processing: 2.9% + 30 cents or 3.5% + 15 cents if processed using Card on File.

- ACH transaction fee: 1% processing fee, minimum $1.

- Recurring billing: 3.5% + 15 cents.

- Chargeback fee: $0 (waived up to $250 per month).

Features

- Flexible POS system that grows with your business.

- Omnichannel payment processing.

- Deposit speed — standard 1–2 days, 1.75% fee for instant funding.

- Inclusion of a free e-commerce website builder.

- Customer support — Monday-Friday phone support, 24/7 automated chat support.

Pros and cons

| Pros | Cons |

|---|---|

| Free user-friendly POS and online store. | Not suited for high-risk businesses. |

| No monthly fees or minimums. | Exclusive to Square. |

| Omnichannel payment processing tools. | Developer-based solutions only for enterprise accounts. |

Helcim: Cheapest Stripe alternative

Helcim is a merchant account provider offering robust payment processing solutions — including support for online, in-person, invoicing, recurring billing, virtual terminal, and ACH payments. Its biggest advantage over Stripe is its interchange-plus pricing structure with automatic volume discounts, making it the cheapest Stripe alternative for business owners.

B2B businesses and those with large sales volumes, particularly above $50,000 a month, will especially benefit from Helcim’s pricing, as that is where Helcim’s volume discount starts.

Why I chose Helcim

I chose Helcim as my top pick for the best B2B payment processor and Stripe alternative primarily because of its cost-effectiveness. Helcim provides competitive pricing (interchange plus) and automatic volume discounts for those handling more than $50,000 in monthly sales. With Stripe, you only get flat-rate and custom pricing, which can get costly as you increase sales.

Helcim also offers zero-cost processing (automatic compliant surcharging), which lets you legally pass on credit card charges to customers, saving on fees. Stripe only has manual surcharging. Lastly, Helcim has free invoicing and recurring billing, which you must pay extra for in Stripe. Helcim also includes level 2 and 3 data optimization programs (to qualify for low B2B interchange rates) at no extra cost.

Overall, Helcim beats Stripe when it comes to saving on costs and fees and provides free tools that are suitable for B2B payments. Its limited integrations can be the dealbreaker for some, although Stripe has an extensive list. But for those wanting to save on fees and maximize profits based on sales volumes, Helcim is the best Stripe alternative.

Pricing

- Monthly fee: $0.

- Payment gateway fee: $0.

- Payment processing fees:

- Interchange plus 0.15-0.4% and 6-8 cents per card-present transactions.

- Interchange plus 0.15%-0.50% and 15-25 cents per card-not-present transaction.

- Plus 1% international sales (Helcim specified this fee is bank-imposed and not a markup on its end.)

- Interchange plus 0.15%–0.5% + 15–25 cents for invoicing.

- Interchange plus 0.15%–0.5% + 15–25 cents for recurring billing.

- 0.5% + 25 cents per transaction for domestic ACH transfers.

- Plus 0.10% + 10 cents for American Express (AmEx) transactions.

- Chargeback fee: $15, refundable.

- Deposit speed: 2 business days.

Features

- Interchange plus pricing with automated volume discounts.

- Free international credit card payment processing. (Note: An international service fee (1%-3%) may be charged by your bank.)

- Fee Saver Program, which is a zero-cost processing program that automatically detects the free credit card processing program available to use based on the card type/network and business location.

- Built-in Level 2 and 3 data processing.

- Support for common B2B payments — virtual terminal, invoicing, recurring billing.

- Customer self-service portal.

- Guided chargeback dispute resolution.

- Credit Card Vault — store and protect customers’ credit cards on file.

- Fraud Defender — risk estimation done for each transaction for fraud and chargeback reduction.

Pros and cons

| Pros | Cons |

|---|---|

| Automatic volume discount. | Limited integrations. |

| Free access to all payment tools. | Strict approval process for merchant accounts. |

| Built-in compliant surcharging and Level 2 and 3 data optimization. | Slow deposit speed; no instant payouts. |

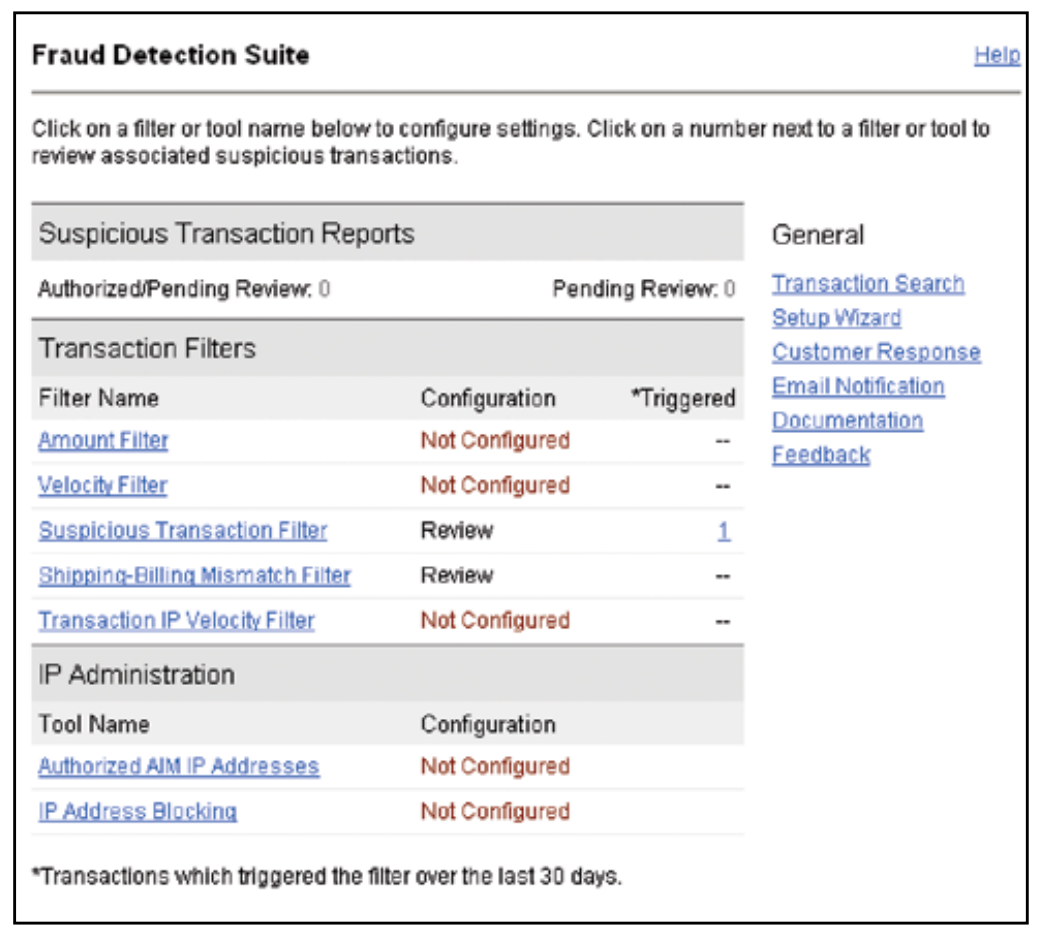

PayPal: Best Stripe alternative for ease of use

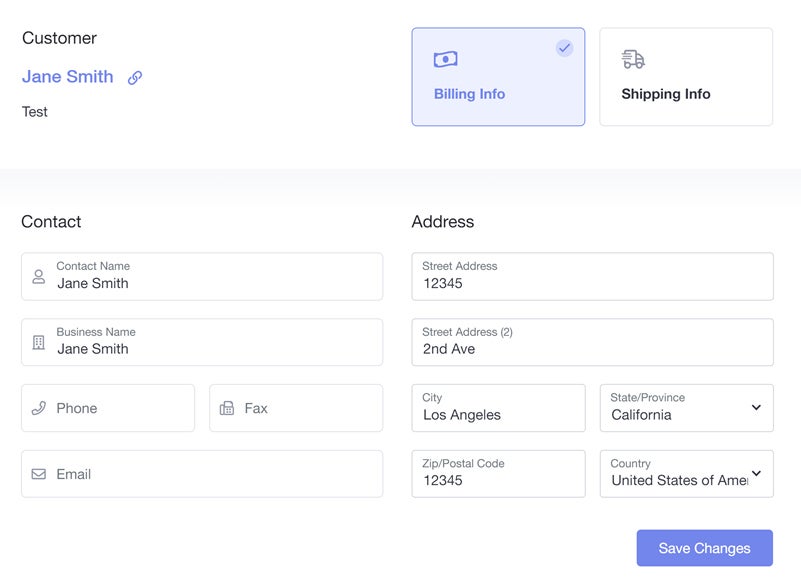

PayPal is a household name when it comes to online payments, used by millions of consumers around the world. Merchants can use PayPal business to accept global payments from customers through various channels (online and in-person) and methods (credit cards, cryptocurrencies, QR codes, BNPL, and more).

PayPal’s easy integration process also streamlines the online payment setup across various platforms. It even provides a hosted and customizable checkout page you can easily embed in other platforms, such as social media.

Why I chose PayPal

While PayPal has a complicated pricing structure and faces the same user reports of frozen funds and accounts held by Stripe, it has advantages over Stripe, such as support for cryptocurrency and BNPL payments. In fact, PayPal is the only one featured in this list that has a native BNPL payment option; the rest only offers the option through integrations with partners.

The presence of a PayPal button in a checkout button amplifies consumer trust right away, earning itself a spot in my recommended e-commerce payment solutions. Ultimately, PayPal earned a spot as a good Stripe alternative because of its ease of use for both businesses and customers. I also recommend adding PayPal as a secondary or alternative online payment option because of the high consumer trust in the brand.

Pricing

PayPal has the most complex fee structure of the companies on our list, with special rates for different currencies and countries of origin. Below are some fees for U.S.-based businesses for comparison. See PayPal’s website for more information.

- Monthly account fee: $0.

- Payment gateway fee: $0–$25 per month.

- Recurring billing: $10 per month.

- Online card processing fees: 2.59%–2.99% + 49 cents.

- International processing fees: Plus 1.5%.

- Currency conversion fees: Plus 4%.

- Virtual terminal: $0 to $30 per month.

- Cryptocurrency conversion fee: 1%.

- Chargeback fee: $0–$20.

- Dispute fees: $15 for standard transactions; $30 for high-volume transactions.

- Instant withdrawal: 1.50% of payout volume.

Features

- Accepts Venmo and cryptocurrency payments.

- Native Buy Now, Pay Later (BNPL) payment options.

- In-person payments via PayPal Zettle.

- Prebuild and custom-hosted checkout pages.

- Embeddable “Buy Now” or “Pay Now” button with PayPal’s payment button generator.

- Chargeback protection.

- Deposit speed — same-day deposits to own PayPal account, two to three days to a regular bank account.

- Customer support — extended business hours for live customer and technical support. Its phone support is available from 6:00 a.m. to 6:00 p.m. Pacific Time, Monday through Sunday.

Pros and cons

| Pros | Cons |

|---|---|

| Highly trusted and widely popular platform. | Complex and high fee structure. |

| Seamless and widely available online checkout integration. | Reports of unpredictable account holds and freezing of funds. |

| No monthly fees or minimums. | Virtual terminals cost extra. |

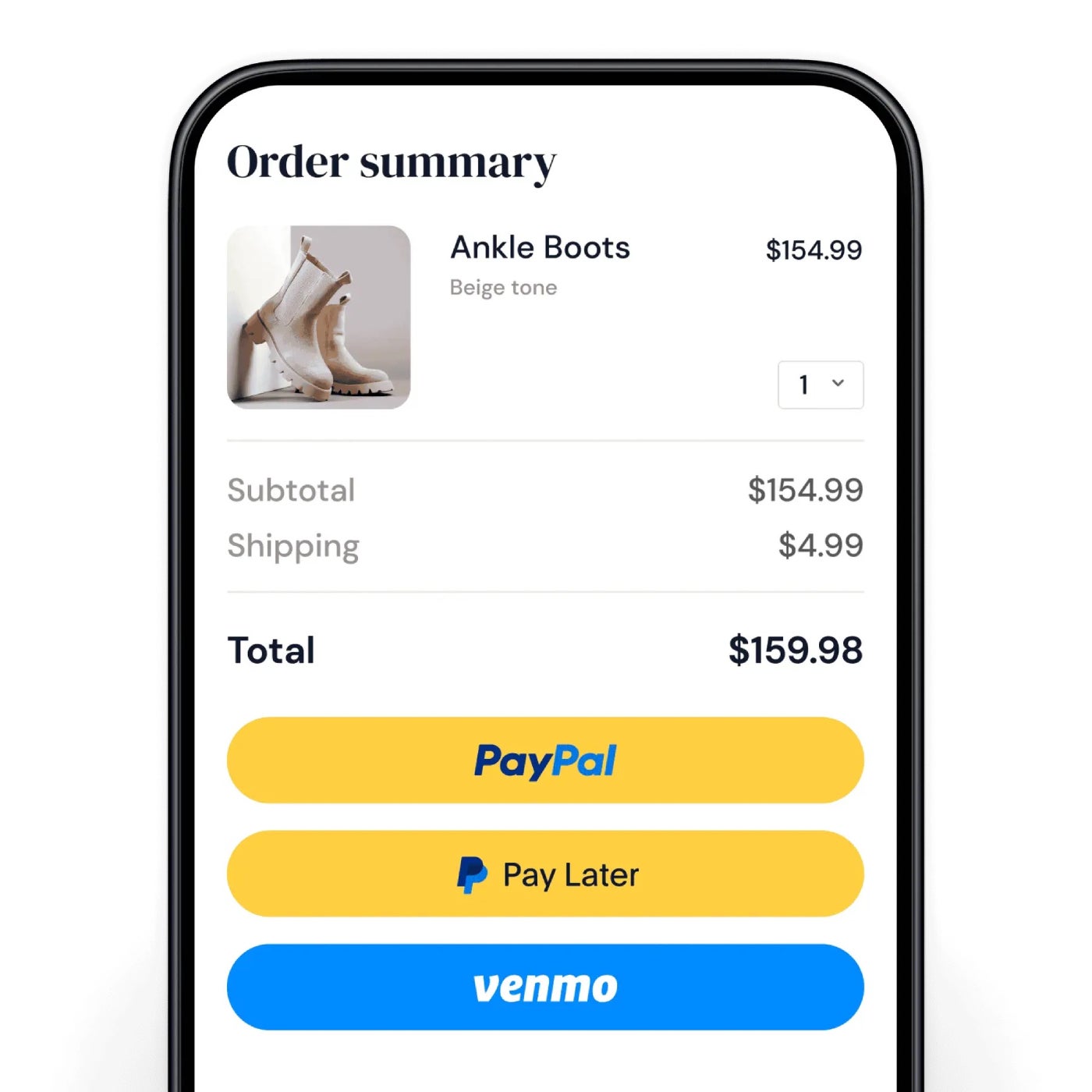

Authorize.net: Best Stripe alternative for integrations and fraud protection

Authorize.net is one of the oldest and most trusted payment gateways. It is a highly flexible solution that lets businesses use their existing or preferred merchant accounts or subscribe to an all-in-one solution, which sets them up with Authorize.net’s partner merchant account providers.

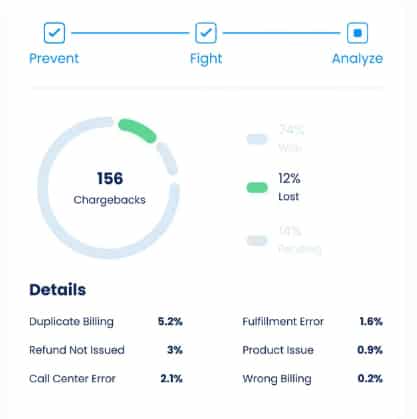

Authorize.net rivals Stripe with its extensive list of integrations, too. However, what sets Authorize.net apart is its highly reputable fraud detection tool, Advanced Fraud Detection Suite, which has more than a dozen customizable fraud filters that help protect against suspicious transactions.

Why I chose Authorize.net

As one of the best payment gateways, Authorize.net does not charge extra fees for using its invoicing and recurring payment service, though Stripe does. It is also one of the two solutions featured in this list that can service high-risk merchants, which is something Stripe cannot do. I like that it is similar to Stripe in terms of extensive integrations and API extensions and also provides built-in level 2 and 3 data optimization programs like Helcim, which you need to do via integrations with Stripe.

Pricing

- Monthly fee: $25.

- Payment processing fees: 2.9% + 30 cents.

- International payments: 1.5% per transaction.

- ACH: 0.75% per transaction.

- Verbal authorization: $1.20 per transaction.

- Payment service fees: $0 for recurring billing service, fraud detection, and customer management.

Features

- Choose between a payment gateway-only plan or an all-in-one plan that comes with a merchant account.

- Full Level 2 and Level 3 payment processing.

- Open API for custom integrations.

- Integrations for 145 software from POS hardware to accounting systems.

- 160 software development platform partners.

- Advanced Fraud Detection Suite (AFDS) tool.

- Customer Information Management (CIM) tool can save cards on file and up to 10 payments and 100 shipping details.

- Account updater, virtual terminal, invoicing tools, recurring payments.

- Payout within 24 hours (no fees).

- 24/7 customer support.

Pros and cons

| Pros | Cons |

|---|---|

| More than 900 integrations and more than 400 certified technology partners. | Limited reporting features. |

| Works as a payment gateway and payment processor. | Limited in-person payment features. |

| Works with existing merchant accounts. | Outdated user interface (dashboard). |

| Highly reliable. | Monthly fees make it expensive for small businesses. |

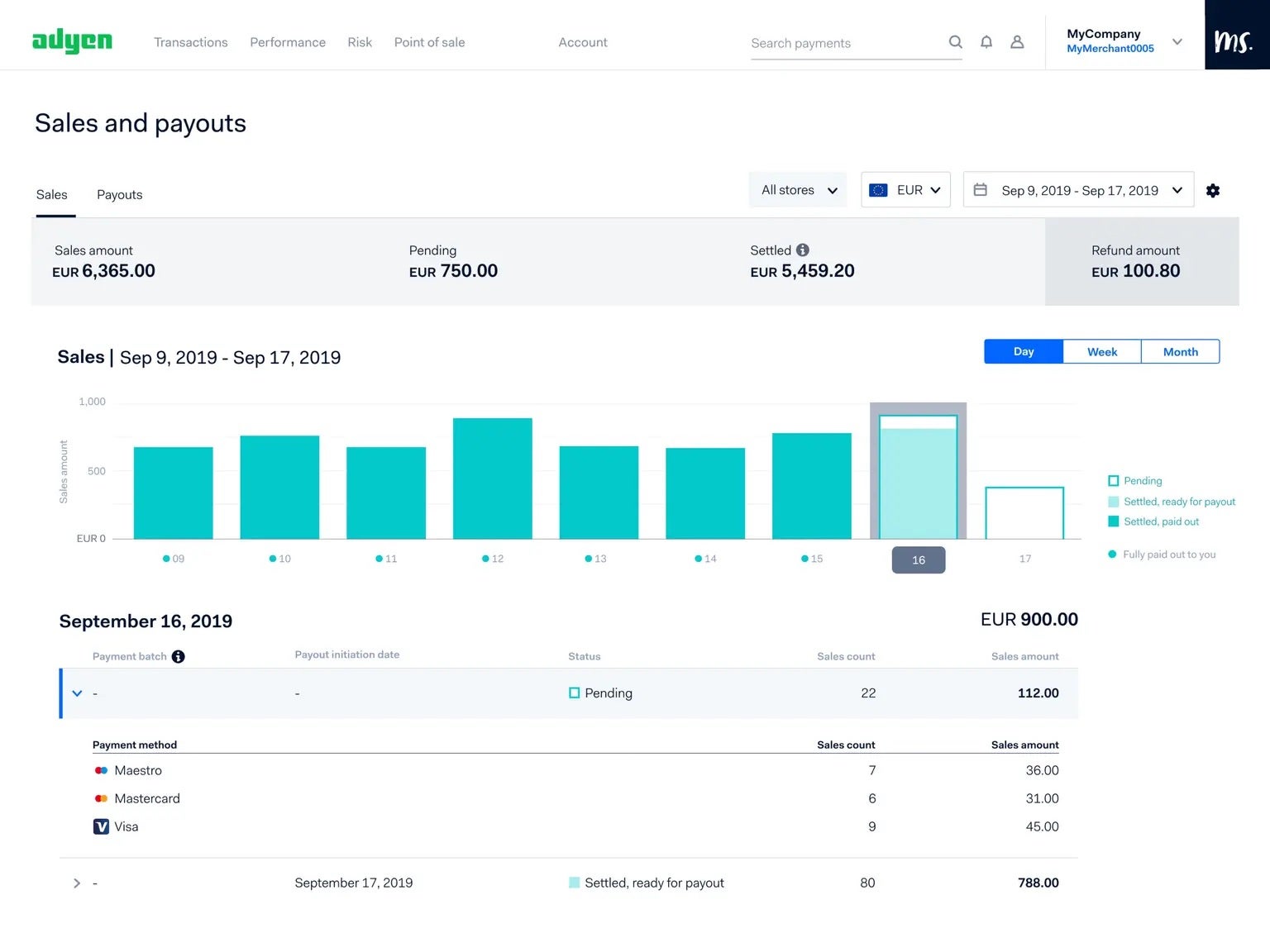

Adyen: Best Stripe alternative for account stability

Adyen is a global dedicated merchant account provider and direct payment processor with top-notch security tools, extensive partnerships with local banks, interchange plus pricing, and out-of-the-box and custom API solutions.

Adyen is a great Stripe alternative because it isn’t a payment aggregation platform like Stripe; merchants have their own dedicated merchant accounts, giving them control over their payment infrastructure and reducing their risk of frozen funds.

Why I chose Adyen

I chose Adyen because of its affordability and out-of-the-box solutions, which make it a solid alternative to Stripe, in addition to its being a dedicated merchant account. Adyen comes a close second to Stripe in my evaluation of best international payment gateways and is particularly the cheapest option for global high-volume and B2B businesses.

Adyen has better ACH processing fees than Stripe (40 cents markup per transaction vs 0.8% with a $5 cap) and offers interchange plus pricing. It lets merchants save even with its $120 monthly sales minimum.

Another feature that makes it a good alternative to Stripe and even PayPal is its user-friendly design. While developers can still customize Adyen using APIs, it also gives out-of-the-box software options, making it easy to use for non-technical users.

Pricing

- Monthly fee: $0.

- Monthly minimum sales: $120.

- Processing fees:

- Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for other card brands for in-person transactions.

- Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for other card brands for online transactions.

- Payment services fees:

- Invoicing: $0.

- ACH: 13 cents plus 27 cents markup per transaction.

- Chargeback fee: $5-$100, non-refundable.

- Deposit speed: Per programmed schedule or immediate (manually).

Features

- Dedicated merchant account.

- Advanced fraud detection and prevention tools.

- Unified commerce — multiplatform and omnichannel payment integration.

- Support for 37 currencies and nearly 100 countries with dynamic currency conversion (DCC) — customers can accept DCC or decline and pay in local currency.

- Local and cross-border payouts.

- Risk management tool you can customize depending on your business’ acceptable risk levels.

- Business hours include phone support, in-person training, support via ticket, and dedicated account managers.

Pros and cons

| Pros | Cons |

|---|---|

| Global payment options available. | Complex pricing model. |

| Robust omnichannel features. | Limited invoicing features. |

| Dedicated merchant account so there are fewer chances of frozen accounts or account holds. | Extensive underwriting process. |

Shopify Payments: Best Stripe alternative for Shopify merchants

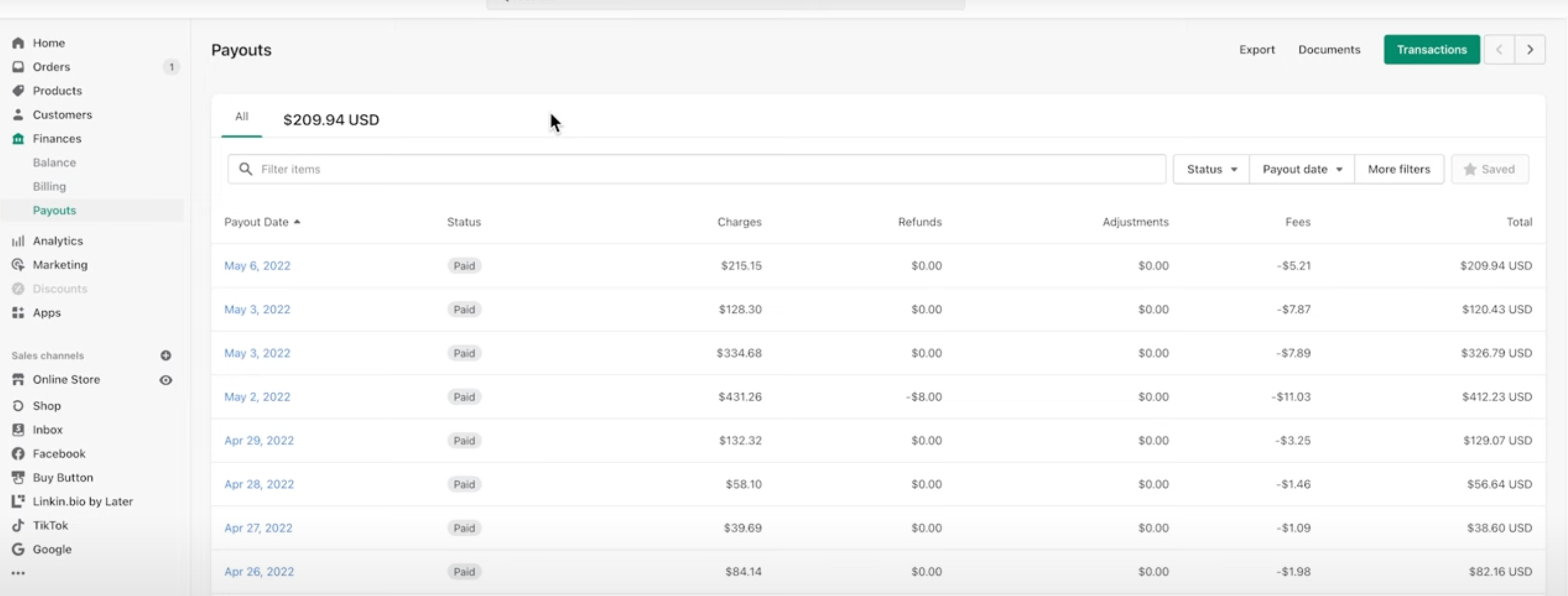

Shopify Payments is the built-in payment processing solution of Shopify, a highly-rated and widely popular e-commerce platform that small business owners and B2B alike use. Shopify merchants can easily accept payments online through their Shopify stores and in-person through the Shopify POS without setting up a separate payment gateway.

With Shopify Payments, Shopify merchants can easily manage their payments, payouts, and refunds from within their dashboards. If you are a Shopify store owner, Shopify Payments is the best Stripe alternative for an easy installation and all-in-one setup.

Why I chose Shopify Payments

Shopify Payments is a great Stripe alternative for Shopify businesses because of its easy setup and seamless integration with the rest of Shopify’s tools. I like that using Shopify Payments waives the transaction fees that Shopify otherwise charges to use a third-party payment provider. Merchants can save on processing costs while still benefiting from Stripe’s reliable infrastructure since Shopify Payments is powered by Stripe.

However, Shopify Payments is exclusive to the platform and doesn’t support instant payouts, so this will be limiting for some. However, it is still the best Stripe alternative for Shopify merchants or those considering Shopify as an e-commerce platform.

Pricing

Shopify Payments is built into Shopify merchant accounts and has a flat-rate transaction fee structure. While it does not have monthly or setup fees, you must subscribe to a paid monthly subscription to Shopify’s e-commerce platform. Shopify e-commerce plans range from $5 per month (for social selling) to $399 per month. Note that the $5 per month plan has a higher transaction fee of 5% for in-person transactions and 5% plus 30 cents for online transactions.

- Subscription fee: $0.

- Online transaction: 2.4% + 30 cents to 2.9% + 30 cents.

- Invoice processing: 2.4% + 30 cents to 2.9% + 30 cents.

- Currency conversion fee: 1.5% (U.S.) and 2% (all other supported countries and regions).

- Chargeback fee: $15.

Features

- Waived transaction fees if you are using the Shopify e-commerce platform (0.5% to 2% for third-party payment processors).

- POS hardware for in-person selling.

- Deposit speed — next business day for Shopify Balance (in-house balance account) or up to five business days for external bank accounts; no instant payouts.

- Stored payments and one-click checkout (Shop Pay).

- Relatively low chargeback fees.

- Built-in fraud analysis tool.

- Excellent customer support — 24/7 live chat, email, and phone.

Pros and cons

| Pros | Cons |

|---|---|

| Full integration with Shopify platform. | Exclusive to Shopify. |

| Accelerated checkout (Shop Pay). | No instant payouts, long deposit transfer (up to five business days). |

| Built-in fraud analysis tool. | Requires at least a $39 ecommerce plan to waive transaction fees. |

PaymentCloud: Best Stripe alternative for high-risk businesses

PaymentCloud is the best Stripe alternative for businesses operating in industries such as CBD, vape, adult entertainment, and others, which are usually tagged as high-risk by traditional payment processors. Stripe doesn’t support such industries, and PaymentCloud offers services you would find in Stripe, such as credit card processing, ACH processing, and e-check processing.

Known for its high approval rate and hands-on approach to clients, PaymentCloud is a lifeline for high-risk merchants when other processors, including Stripe, are likely to decline their applications.

SEE: Stripe’s list of prohibited and restricted businesses

Why I chose PaymentCloud

PaymentCloud is my top recommendation for the best high-risk merchant account. It has partnerships with more than 10 banks and assigns you a dedicated account manager who will work with you from your application to onboarding. Plus, you get 24/7 customer support thereafter.

As a merchant account, it can work with all payment gateways, including Stripe, to get the best of both worlds. Pricing remains undisclosed, but user reviews say it is still competitive. A longer application process is expected due to the nature of the merchant’s industry. PaymentCloud is still the best Stripe alternative if you sell high-risk products or run a mid- or high-risk business.

Pricing

PaymentCloud only provides custom pricing to merchants. Interchange plus pricing is available depending on the use case; merchants are advised to inquire for more information. Large volume discounts are available, and PaymentCloud does not have application, setup, or annual fees.

The rates below are estimates provided by the provider:

- Monthly fee: $10-$45.

- Payment processing fees:

- 2%-3.1% for low-risk transactions.

- 2.3%-3.4% for medium-risk transactions.

- 2.7%-4.3% for high-risk transactions.

- Payment gateway fee: $15/month.

- Chargeback fee: $25-$50.

Features

- High-risk merchant support; PaymentCloud has a full list of compatible industries.

- Works with all payment gateways.

- Compliant credit card surcharging.

- Cryptocurrency payments.

- Fraud and chargeback protection.

- Chargeback management.

- Next-day funding.

- Dedicated and hands-on onboarding support.

Pros and cons

| Pros | Cons |

|---|---|

| Good customer reviews. | Payment gateway charges. |

| Competitive rates. | Longer application and approval process. |

| High approval rate for high-risk merchants. | Undisclosed pricing. |

Do you need an alternative to Stripe?

Even with Stripe leading the pack in most of TechRepublic’s recommendations regarding merchant accounts and payment processors, there are reasons why Stripe may not be the best option for your business; I list the reasons below.

- Yes, if you need strong omnichannel payment tools, particularly for in-person sales.

- Yes, if you need an easy-to-use, simple, and straightforward solution that does not need coding knowledge.

- Yes, if you need built-in or native integrations or all-in-one packages or solutions.

- Yes, if you need discounted or reduced rates for high volume business or government sales

Methodology

To come up with my recommended Stripe alternatives, I took a look at more than a dozen Stripe competitors, mostly those that are top picks on other buyer guides for merchant accounts and payment processing.

Then, I evaluated the providers based on pricing and contract (20%), payment types (30%), sales and account management features (25%), and expert score (25%). I also zeroed in on specific features that Stripe lacks and areas where other solutions perform better. After thorough research and review, I narrowed my top picks to seven, focusing on platforms that are easy to use and compatible with most platforms.

Frequently Asked Questions (FAQs)

Is there a better alternative to Stripe?

Depending on your business needs, there are other companies that are better suited than Stripe. For example, Square is a good alternative for omnichannel or in-person selling, PaymentCloud for high-risk businesses, Shopify Payments for Shopify merchants, and PayPal for ease of use.

What is the disadvantage of Stripe?

Stripe’s high level of customization is a double-edged sword; it can be limiting for businesses that do not need the developer option and may find it too overwhelming and difficult to use.

Is using Stripe payments worth it?

Yes, while there are certain situations in which you may want an alternative, overall Stripe can’t be beat with its high level of customization and extensive developer toolkit. There are also a variety of Stripe alternative payment methods that support international currencies.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.