To make evidence-based decisions for your business, you need financial reporting software that makes it possible to import and analyze your financial data and accounting statistics. However, the financial reports of a small business are very different from that of a large enterprise, which can make it tough to find the best financial reporting software for your needs.

To help you narrow down your search, we’ve rounded up the best financial reporting software for businesses of all sizes.

Top accounting software comparison

Besides price, there are many other features to consider when choosing a financial reporting software platform. This chart summarizes some of the main things to look for:

| Starting price | Pre-built reports | Custom templates | Forever free account | Free trial | ||

|---|---|---|---|---|---|---|

| QuickBooks Online | $30 per month | 60+ | Yes | No | Yes | Visit QuickBooks |

| Sage Intacct | Contact for quote | 150+ | Yes | No | No | Visit Sage |

| NetSuite | Contact for quote | Not disclosed | Yes | No | No | Visit NetSuite |

| Xero | $15 per month | 22 | Yes | No | Yes | Visit Xero |

| Spotlight Reporting | $35 per month | 17+ | Yes | No | Yes | Visit Spotlight |

| Zoho Books | $15 per month | 24 | Yes | Yes | Yes | Visit Zoho |

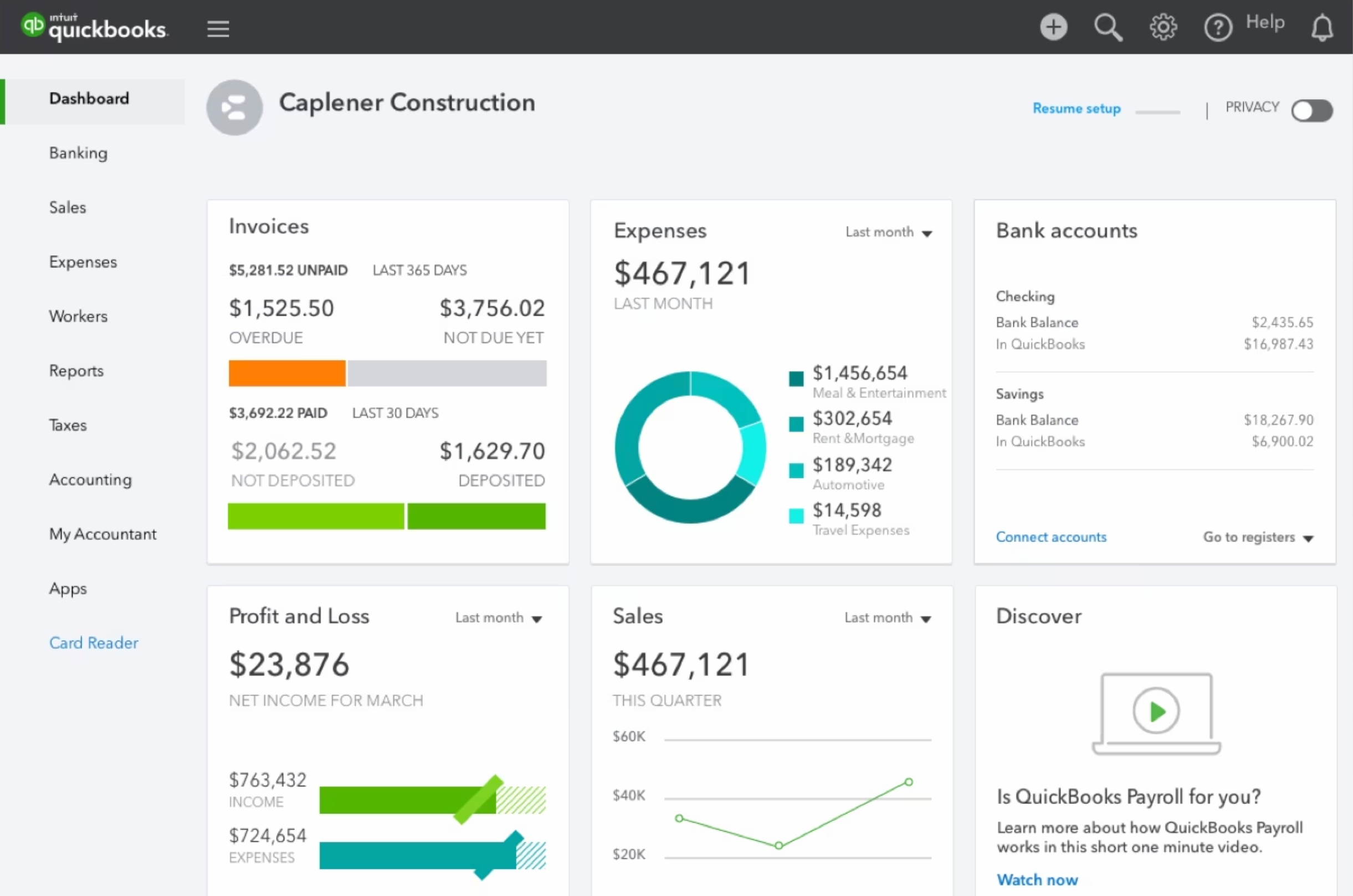

QuickBooks Online: Best overall financial reporting software

QuickBooks is known for its accounting and bookkeeping software, but it actually offers a very robust library of financial reports as well. The entry-level Simple Start plan already comes with dozens of reports, and the Plus plan provides access to more than 60 different reports to choose from. QuickBooks also comes with plenty of other advanced features, including time tracking and inventory management, depending on what plan you decide on.

Pricing

QuickBooks Online offers four different pricing tiers to choose from:

- QuickBooks Simple Start: $30 per month with access for one user.

- QuickBooks Essentials: $60 per month with access for up to three users.

- QuickBooks Plus: $90 per month with access for up to five users.

- QuickBooks Advanced: $200 per month with access for up to 25 users.

First-time QuickBooks customers can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

Features

- Automatic sales tax calculations are included.

- Bookkeeping automation cuts down on tedious manual work.

- Share your books and reports with your accountant easily.

- Automatically track mileage for reimbursement using the mobile app.

Pros

- More than 60 financial reports to choose from.

- Unlimited invoices and bills on each plan.

- Mobile receipt capture on each plan.

- Multiple pricing plans offer scalability as your business grows.

Cons

- More expensive than some competitors.

- Each pricing plan limits the number of users.

- Customer support is not well reviewed.

For more information, read our full QuickBooks Online review.

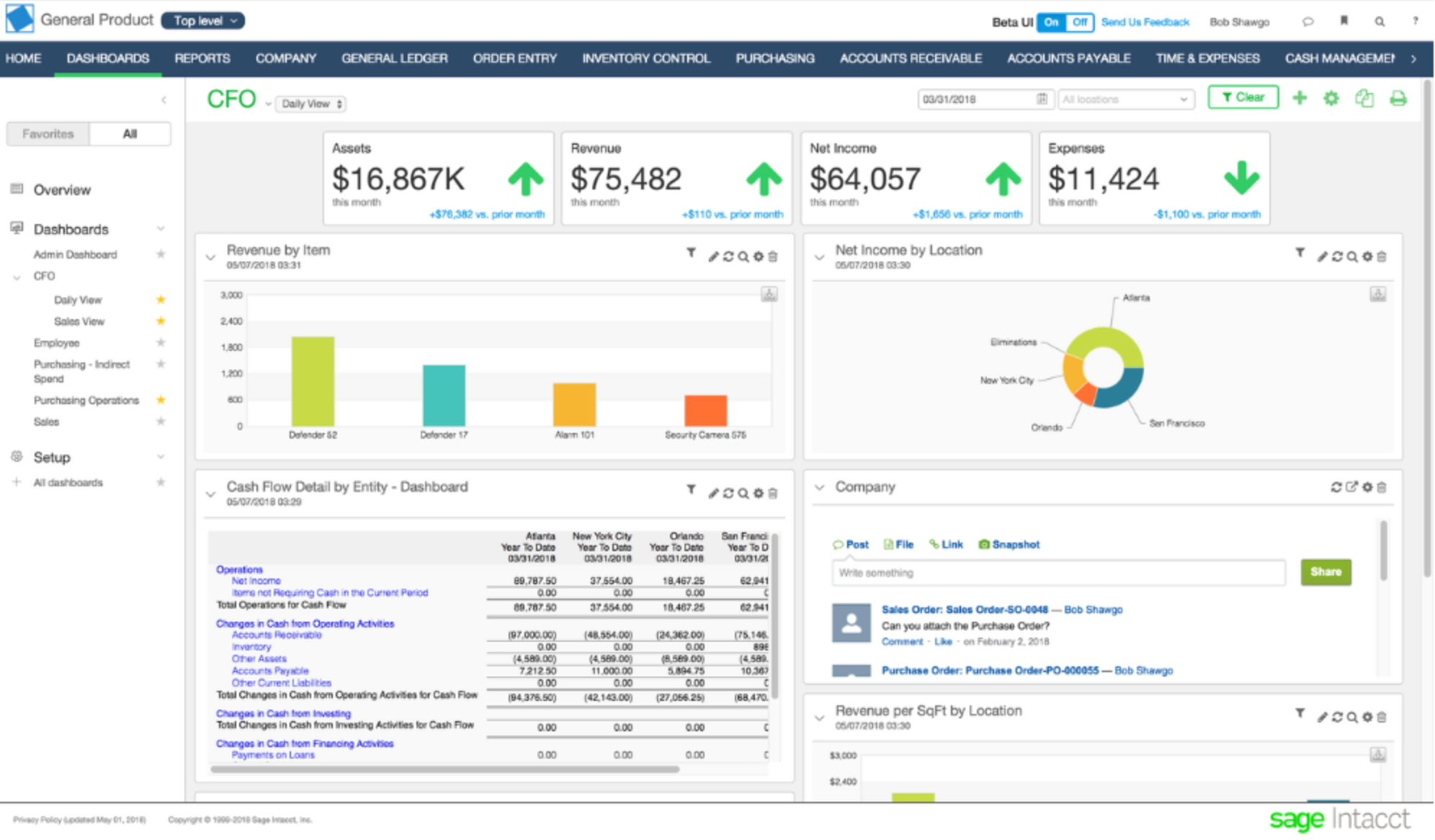

Sage Intacct: Most comprehensive reporting

Sage Intacct offers more than 150 pre-built financial reports to choose from, plus the ability to generate custom reports. This comprehensive financial reporting software tracks both financial and operational data and even allows you to combine data from multiple entities so you can look at the high-level numbers. You can also slice and dice data according to 10 pre-built dimensions or define your own to get granular and enhance your financial reports.

Pricing

Sage Intacct does not publicly disclose its pricing information. You’ll have to contact their sales team for a custom quote.

Features

- Create reports, graphs, dashboards and visualizations.

- Multi-entity analytics for complex businesses.

- Intelligent general ledger uses AI to scan for anomalies.

- Add user-dimensions for greater reporting detail.

Pros

- Designed for large, multi-entity businesses.

- AI and machine learning features help to automate work.

- Choose from more than 150 pre-built accounting and financial reports.

- Drag-and-drop dashboard creator.

Cons

- Pricing is not transparent.

- Learning curve can be steep due to the number of features.

- Too complicated for small businesses.

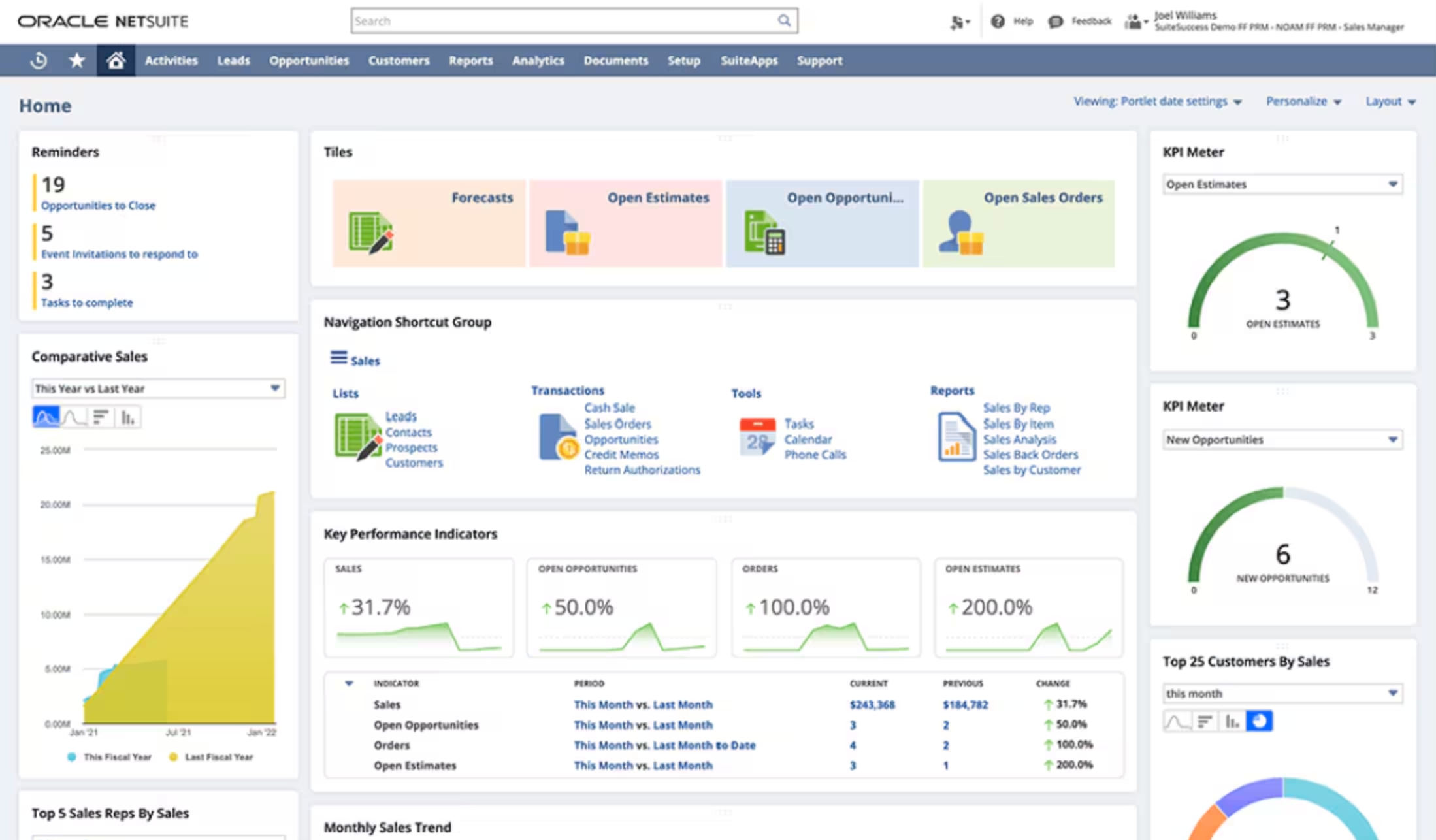

NetSuite: Best for large enterprises

NetSuite is a full business software stack solution that includes robust options for financial reporting. Since NetSuite was specifically designed for large enterprises, it includes reporting features that support their needs, such as combining financial, operational and statistical data into one report. You can also create custom versions of the same report to present to different audience, so you can highlight different aspects of the same data set.

Pricing

NetSuite does not publicly disclose its pricing information. You’ll have to contact their sales team for a custom quote.

Features

- Create multiple versions of custom reports to show to different audiences.

- Combine financial, operational and statistical data into one report.

- Identify trends as they happen with real-time analytics.

- Gain meaningful insights with industry standard KPIs.

Pros

- Comprehensive, complex financial reporting.

- Designed with enterprise needs in mind.

- Many different integrations available.

- Consolidate multiple types of data in one report.

Cons

- Pricing is not transparent.

- Higher learning curve.

- Interface can feel outdated compared to competitors.

For more information, read the full NetSuite review.

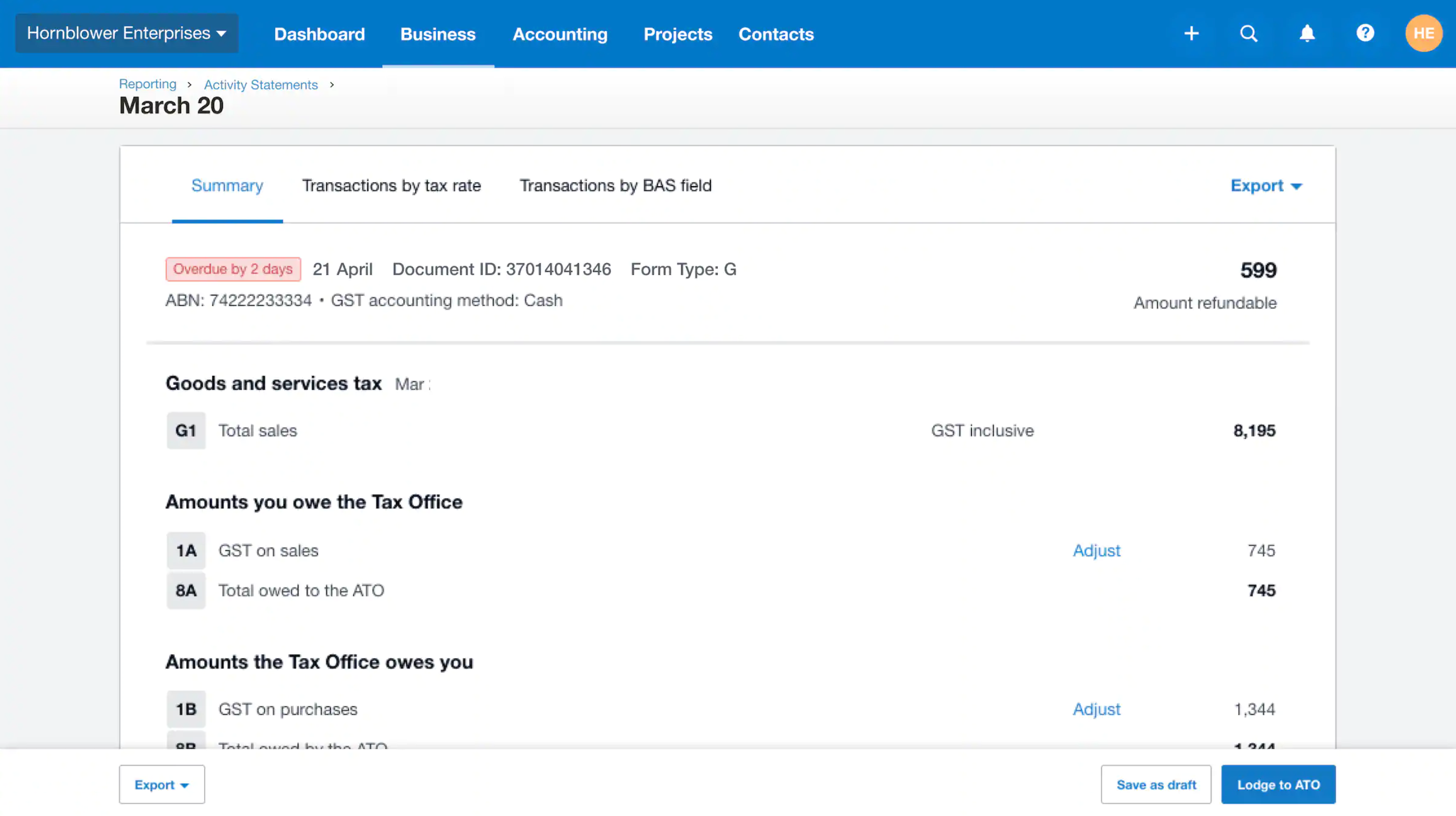

Xero: Best for small businesses

If you’re a small-business owner looking for simple financial reporting software, Xero is a great option to consider. This accounting software offers a limited selection of default reporting templates, such as profit and loss statements, assets and liabilities, and budget variances.

You can also create your own custom reporting templates and save them for later to make it easy to generate future reports. Xero also provides a good selection of other accounting features, such as invoice creation and expense management.

Pricing

Xero accounting also three different pricing tiers to choose from:

- Xero Early: $15 per month.

- Xero Growing: $42 per month.

- Xero Established: $78 per month.

Xero also offers a 30-day free trial so that you can test drive the software before committing to a paid plan.

Features

- Expense and mileage tracking available.

- Inventory management available on all pricing plans.

- Create quotes, send invoices and enter bills.

- Sync your bank accounts for automatic tracking and reconciliation.

Pros

- Unlimited users on all accounts.

- Affordable pricing plans.

- Low learning curve for beginners.

- Easy to navigate interface.

Cons

- Not as many financial reports as some other competitors.

- Must upgrade to Established plan to get many features.

- Invoices and bills are limited on the Early plan.

For more information, read the full Xero review.

Zoho Books: Best automations

Zoho Books currently offers 24 accounting and financial reports to choose from, making it a worthy contender for your financial reporting software pick. The reports can be scheduled to automatically sent at specific time intervals and you can also configure role-based access to the reports. Zoho Books also offers four more ways to automate work — workflows, webhooks, email alerts and custom functions — to cut down on repetitive manual tasks.

Pricing

Zoho Books offers six different pricing plans, which are billed per organization instead of per user. The base pricing plans are:

- Free: $0 for businesses with less than $50K USD per calendar year.

- Standard: $15 per organization per month billed annually, or $20 per organization per month billed monthly.

- Professional: $40 per organization per month billed annually, or $50 per organization per month billed monthly.

- Premium: $60 per organization per month billed annually, or $70 per organization per month billed monthly. A 14-day free trial is available for this plan.

- Elite: $120 per organization per month billed annually, or $150 per organization per month billed monthly.

- Ultimate: $240 per organization per month billed annually, or $275 per organization per month billed monthly.

Zoho Books also offers the following add-ons:

- Additional users: $2.50 per user per month billed annually, or $3 per user per month billed monthly.

- Advanced autoscans: $8 per month for 50 scans per month billed annually, or $10 per more billed monthly.

Features

- Double-entry accounting software.

- Generate quotes, invoices and sales orders.

- Simple expense tracking included.

- Client port login makes it easy for them to manage payments.

Pros

- Six pricing plans offer excellent scalability.

- Multiple automations to choose from.

- More affordable than many competitors.

- Forever free plan available.

Cons

- Requires an outside integration for automatic sales tax calculations.

- Payroll add-on only available in 21 states currently (though access is expanding).

- Must set up free invoicing and inventory add-ons to get full functionality.

For more information, read our full Zoho Books review.

Key features of financial reporting software

Pre-built reports

The best financial reporting software should already come with a library stocked full of common financial reports, such as profit and loss statements. These pre-built templates make it possible to generate a new report in just a few minutes.

Custom templates

In addition to the pre-built templates, the financial reporting software should also let you create and save your own reporting templates. You should be able to build your own from scratch as well as edit and save existing templates.

Data import

Financial reporting software should integrate with all your data sources, and most come with pre-built connectors to do just that. The software should also give you the option to manually upload data via an Excel sheet or another file format.

Report export

Once the final report is ready, you should be able to share it through multiple avenues. Some of the most common are downloading a PDF and emailing it to colleagues, but some financial reporting software also allows you to publish to the web or present it online.

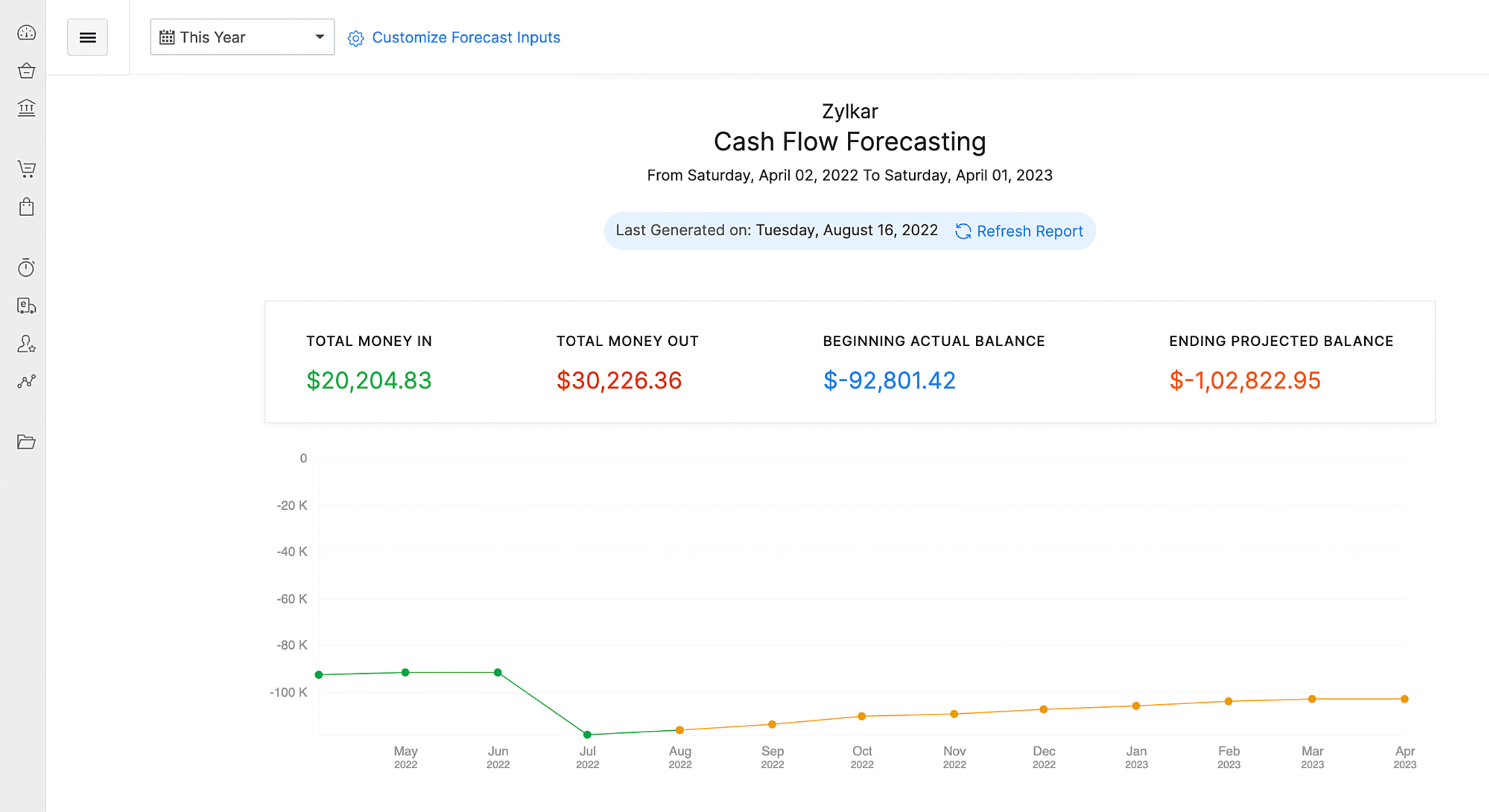

Forecasting

In addition to generating reports for past data, the best financial reporting software will also be able to create forecasts for the future based on data-driven trends. This helps your business to make evidence-based decisions grounded in data.

How do I choose the best financial reporting software for my business?

To choose the best financial reporting software for your business, consider your needs as well as your budget. A small business will likely be satisfied with a handful of basic reporting templates at a lower price, while enterprises will be willing to pay more for advanced features like multi-entity reporting.

Make a list of your must-have features and prioritize those during your search. If you have a strict budget, you might have to be willing to compromise on some of them to keep costs low. Ask yourself if the lower costs are worth skipping the missing features or having to do time-consuming manual workarounds.

During your search for the best financial reporting software, take advantage of free trials, free accounts and free software demos. For the demo calls, come prepared with specific questions and requirements so you can confirm the software will integrate with the rest of your business software stack.

Methodology

To choose the best ecommerce accounting software, we consulted product documentation, demo videos and user reviews. We evaluated products based on pricing, customer service, user interface design and scalability. We also considered features such as reporting templates, data import, forecasting and integrations.